In the Elliott Wave Theory, there are rules, and there are guidelines. You must follow all the rules we went through in the previous articles, but the guidelines are not written in stone. Guidelines don’t always appear, but they do in a sufficient number of cases, so we shouldn’t ignore them.

What is alternation?

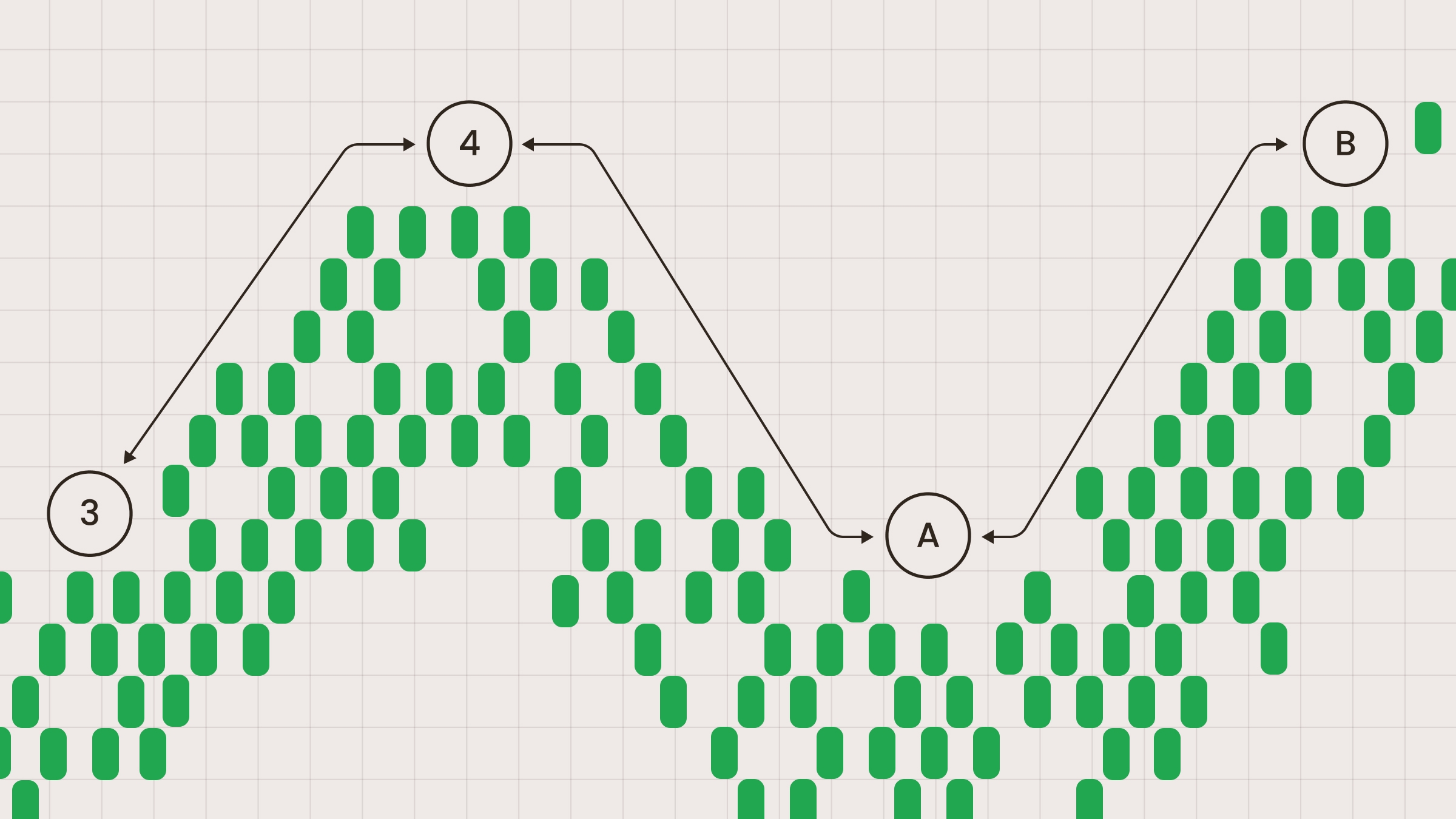

Simply put, alternation is the expectation that similar waves will display some differences inside a pattern. These differences are expressed in depth, complexity, and duration. Alternation happens inside impulses and corrections. Let’s see some examples.

Alternation in Impulses

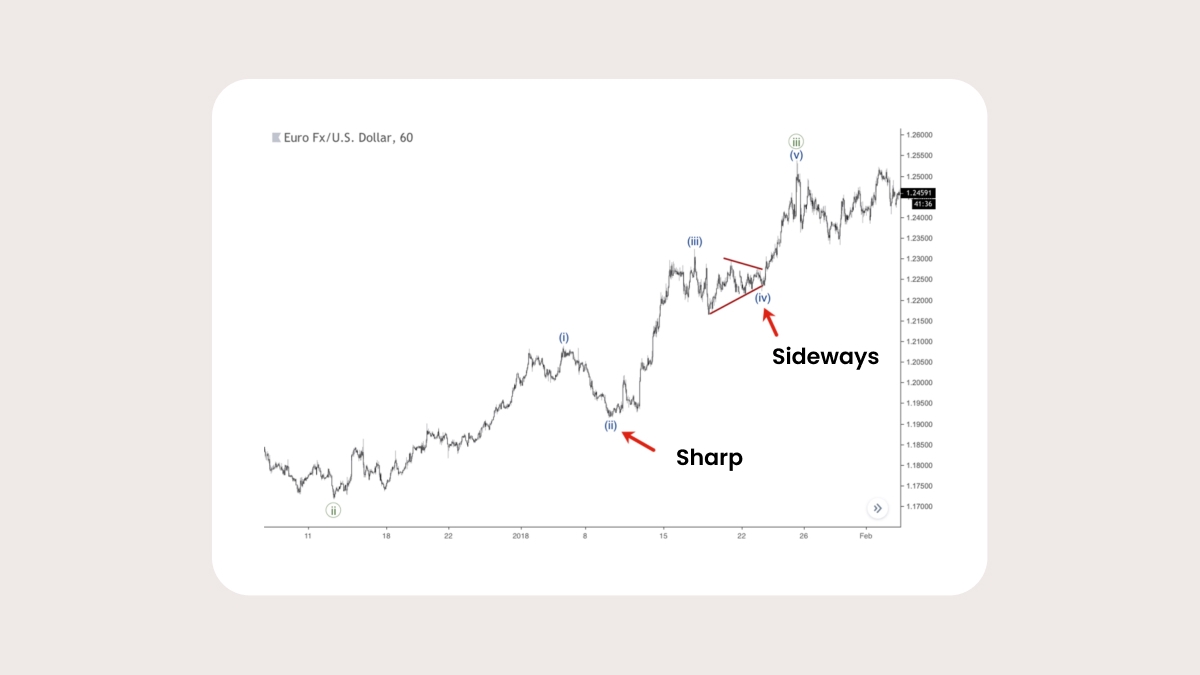

Usually, there’s a relation between waves two and four in an impulse. There’s an upward impulse on the next chart. Wave (ii) of this impulse is sharp, but wave (iv) moves sideways. That’s how alternations work in impulses, which have two corrections inside – waves two and four. If an alternation occurs, one correction will have a direction, while the other won’t.

Also, wave (ii) is pretty easy here, but wave (iv) has more waves inside: there’s another alternation by complexity.

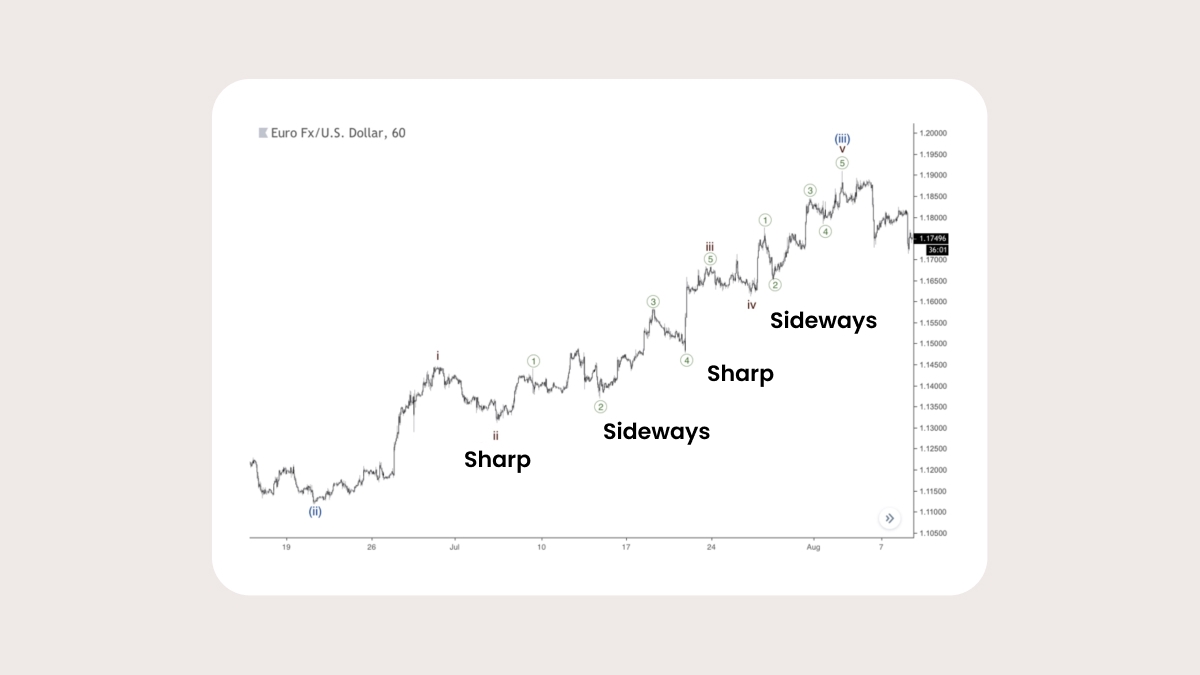

The chart below shows two alternations. Inside wave (iii), we have a sharp wave 2, so wave (iv) is sideways. Another example is seen in wave (iii): its wave 2 moves sideways and its wave 4 is sharp, so the order has changed. When you see that kind of successive change in waves 2 and 4, that is also considered a kind of alternation.

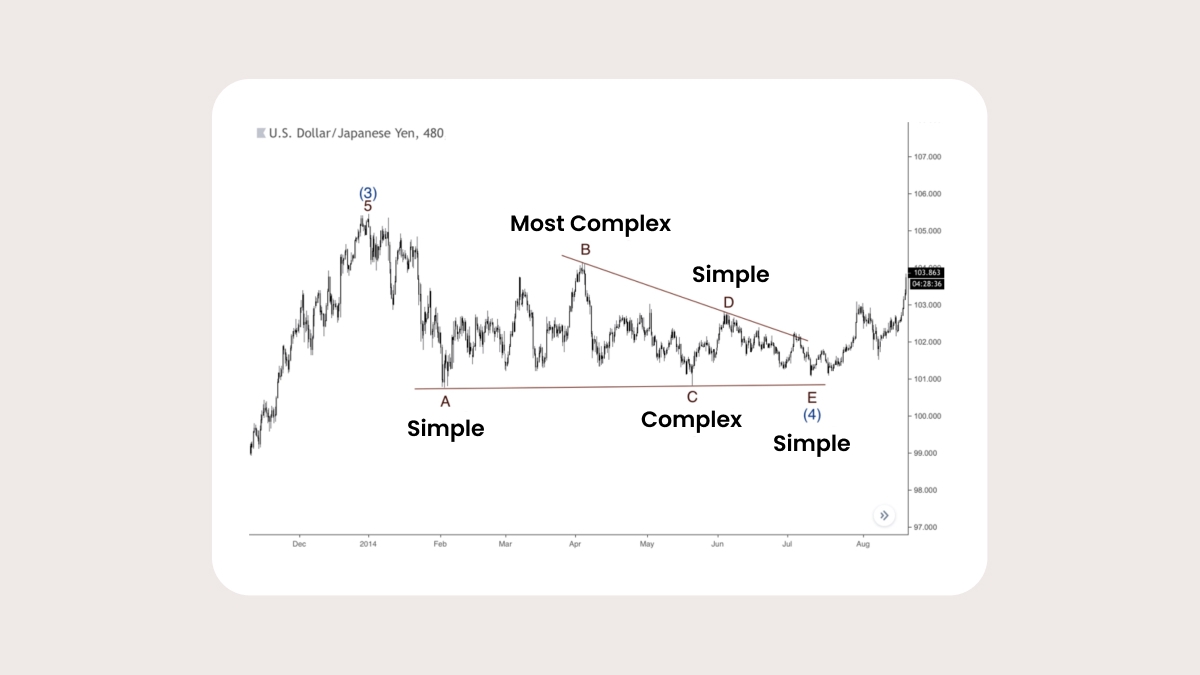

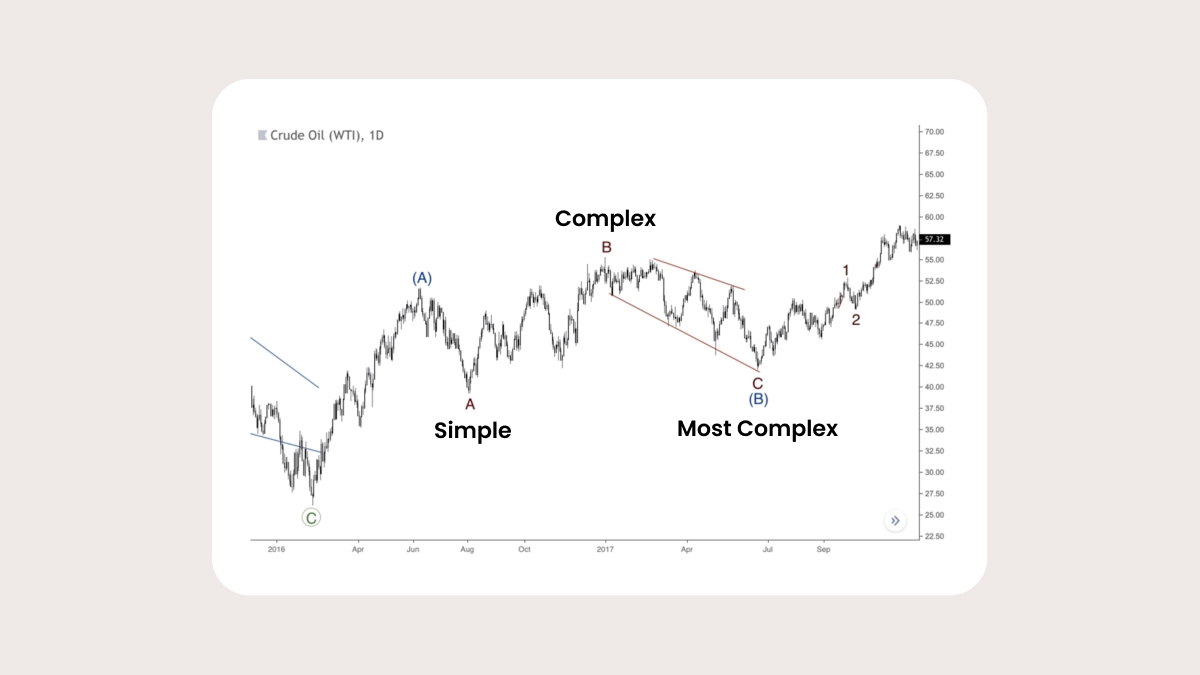

Alternation in Triangles

Waves inside corrections subdivide into Simple, Complex and Most Complex. Inside triangles, one of the waves tends to be the Most Complex. As you can see on the chart below, wave B has the Most Complex structure, while other waves are Simple or Complex.

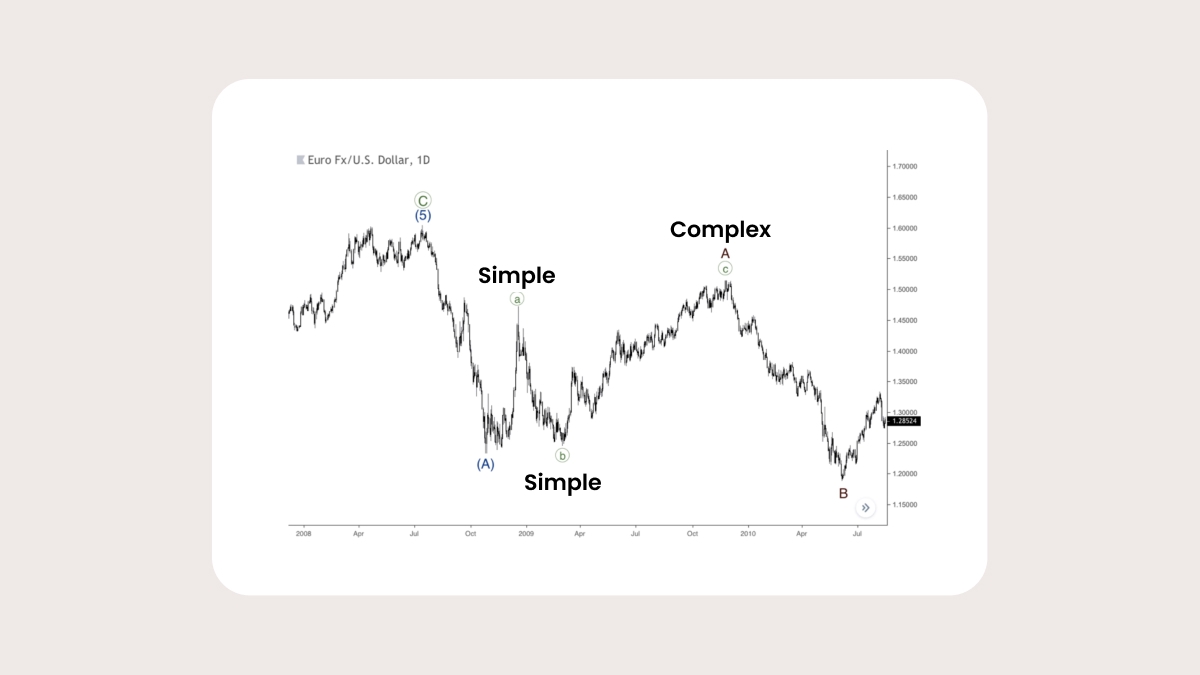

Alternation in Zigzags

Sometimes one of a Zigzag’s waves has a more complex structure than others. The next chart represents a case with a complex wave ((c)) in relation to waves ((a)) and ((b)). However, if you encounter a simple wave A and a complex wave B, then likely wave C will be a simple one as well as wave A.

Alternation in Double Zigzags

Waves of a Double Zigzag could also express some differences from each other. Let’s have a look at the chart below. The wave (w) is Simple, wave (x) is Complex, and wave (y) is the Most Complex. Thus, if we have relatively easy waves W and X in a Double Zigzag, we shouldn’t rule out the possibility that wave Y will be complex.

Alternation in Flats

The ‘Simple-Complex-Most Complex’ principle could also apply to flats. The next chart shows a case with Most Complex wave C. At the same time, wave B could be the Most Complex, while a massive rally in wave C expresses itself as a Simple wave.

Summary

Alternation is one of the most useful guidelines helping us to understand which style of wave we could face in the market’s next stages. It’s not a hard-and-fast rule, but a very powerful additional tool to improve your wave counts.