Fundamental Analysis

The USDJPY pair maintains a bullish bias, supported by strong U.S. economic data and expectations that the Federal Reserve will adopt a less dovish stance. The U.S. 10-year bond yield remains firm above 4.40%, widening the spread with Japanese bonds and pressuring the yen. Additionally, uncertainty surrounding the Bank of Japan's (BoJ) policy, which is likely to keep rates unchanged this week, reinforces JPY's weakness.

However, investors remain cautious ahead of key monetary policy events: the Fed's decision on Wednesday and the BoJ's on Thursday. In the short term, U.S. Retail Sales data and bond market sentiment could provide additional support to the dollar, limiting any downward corrections. Overall, the fundamental backdrop suggests significant obstacles for the yen, keeping USDJPY on the path of least resistance to the upside.

Technical Analysis

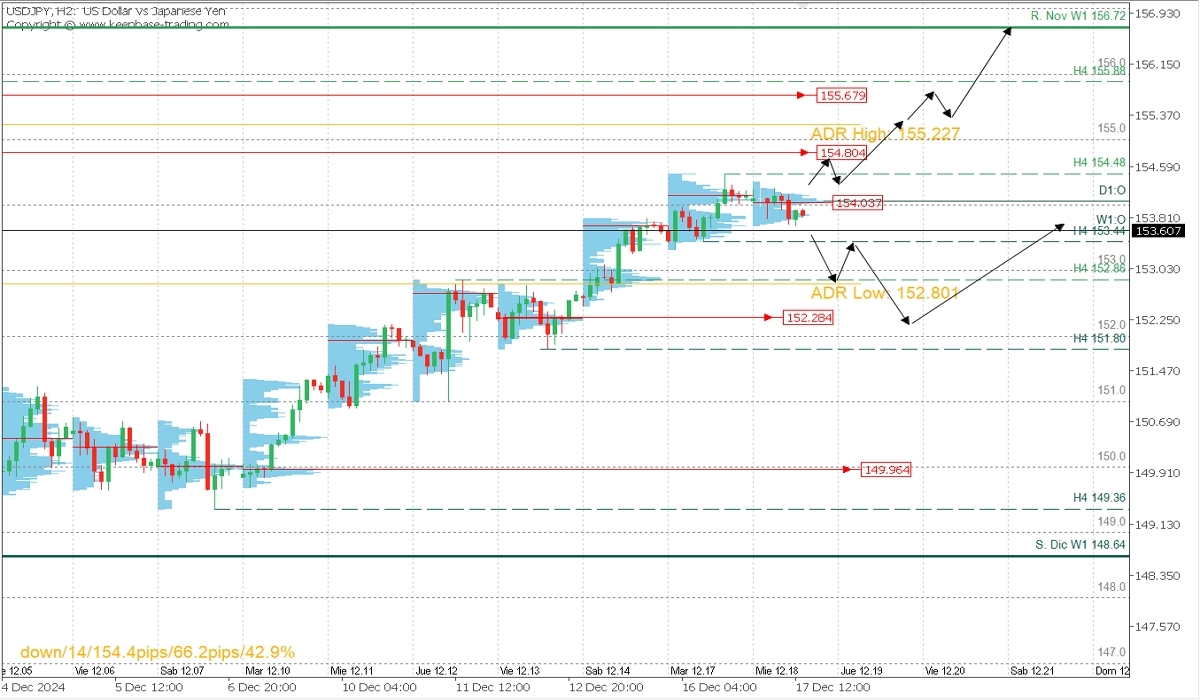

USDJPY, H2

- Supply Zones (Sell): 154.03, 154.80, and 155.67

- Demand Zones (Buy): 152.28

The pair remains in an uptrend, aiming to extend further above the November resistance at 156.72. For this to happen, the price must decisively surpass today’s Asian volume cluster at 154.03 and yesterday’s resistance at 154.48. This would pave the way towards the nearest supply zones at 154.80, the bullish range (ADR High) at 155.22, and the next uncovered POC* at 155.67. Moderate bearish reactions from these levels will likely allow the continuation of the uptrend through the week, potentially reaching and surpassing the November resistance.

On the other hand, a short-term correction scenario will be triggered if the price breaks the local support at 153.44, targeting 152.86 intraday and continuing the move towards the uncovered POC at 152.28 (demand zone). A potential bullish reaction from this area could aim for the weekly opening (W1:O) at 153.60.

Technical Summary

- Anticipated Bullish Continuation: Buy above 154.30/48 with targets at 154.80, 155.22, 155.67, 156.00, and 156.72.

- Bearish Scenario: Sell below 153.70 with targets at 153.44, 152.86, and 152.28.

- Bullish Scenario After Correction: Buy above 152.80 (if a PAR* forms and confirms); otherwise, wait for a PAR* formation around 152.30 with targets at 153.60, 154.50, 155.00, 156.00, and 156.72.

Always wait for the formation and confirmation of a *Pattern of Exhaustion/Reversal (PAR) on M5, as taught here: https://t.me/spanishfbs/2258, before entering trades at the key levels indicated.

Glossary:

- Uncovered POC: POC = Point of Control: The level or zone where the highest volume concentration occurred. If a bearish move follows from this level, it is considered a selling zone and forms resistance. Conversely, a bullish move is seen as a buying zone, usually near lows, thus forming support levels.

@2x.png?quality=90)