The Bank of England (BoE) faces a tricky balancing act as it prepares for its next policy decision. While the British economy has shown signs of contraction—shrinking by 0.1% for the second consecutive month—the latest BoE/Ipsos inflation expectations survey highlights a rise in public inflation concerns. Average inflation expectations for the coming year have increased to 3%, up from 2.7% in August 2024, while long-term expectations (over five years) have climbed to 3.4%, compared to 3.2% in the previous survey.

Rising inflation expectations are critical for policymakers because public perception of future inflation can influence current spending behavior. If people believe prices will rise, they may spend more now, driving up demand and fueling actual inflation further—a self-reinforcing cycle.

Despite these inflation concerns, the BoE faces mounting pressure to cut interest rates in 2025, with markets anticipating three to four rate reductions. The move aims to stimulate economic growth in a slowing economy, but inflation risks limit how aggressively the central bank can act.

The BoE's announcement this week will need to carefully balance these conflicting dynamics—addressing inflation concerns without further stifling economic recovery.

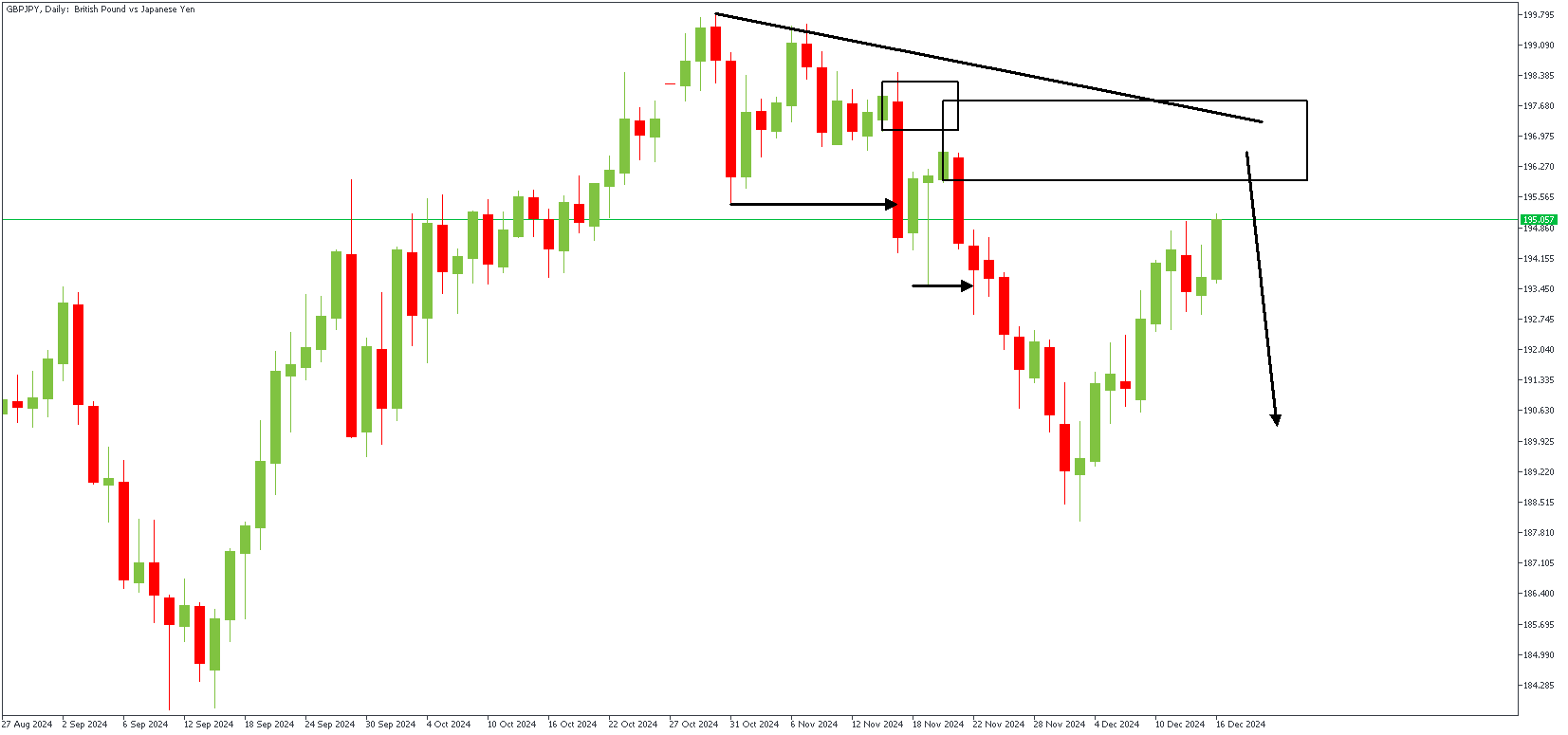

GBPJPY – D1 Timeframe

The downward slope of the resistance trendline on the daily timeframe chart of GBPJPY indicates that the current trend is bearish. Following the market structure, the price recently broke below the previous low, with the supply zone a few pips from the current price. Now, we can check if the lower timeframe aligns with the bearish sentiment.

GBPJPY – H4 Timeframe

.png)

Plotting a Fibonacci retracement of the recent bearish impulse, we see that the critical zone rests between 196.110 and 197.390. Considering the SBR pattern formed, the 76% Fibonacci retracement level, trendline resistance, and the rally-base drop supply zone, the sentiment leans heavily towards a bearish outcome.

Analyst's Expectations:

Direction: Bearish

Target: 189.971

Invalidation: 198.700

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.