Trader Vic's false breakout method

Tribute

Victor Sperandeo is a famous trader who suggested a methodology to identify trend reversal based on false breakouts. We will examine this methodology below and bring some examples to demonstrate its use.

Theory

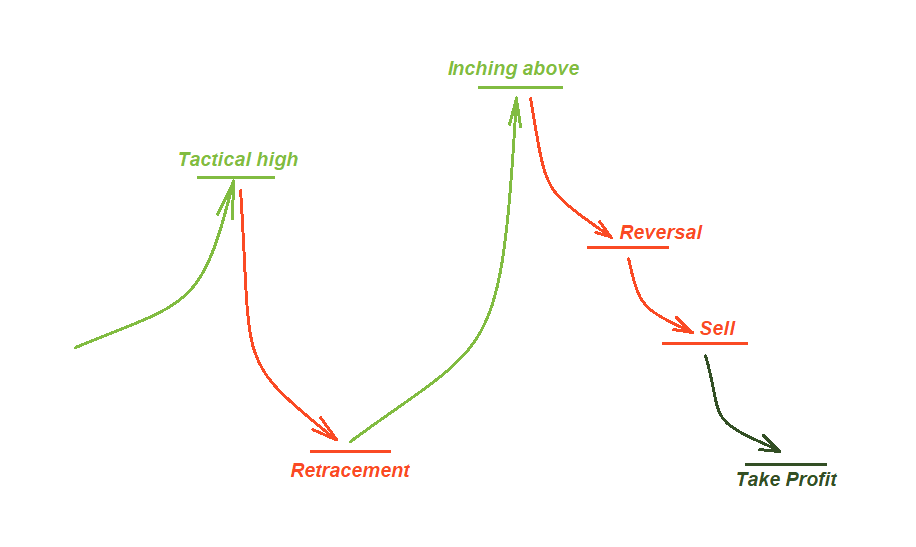

The methodology suggests that you can take any trend (be it bullish or bearish) on any timeframe. Essentially, you will be looking for a spot where the price inches beyond a recently formed high or low. If it does so and then quickly reverses, it is taken as an indication that a larger correction is about to take place – that is what you will use to make your profit.

The inner logic behind this approach is the hypothesis that if the market does not have the momentum to beat a recently formed high or low and just inches beyond it, it is likely to go into correction against the trend it was in when it made that high or low. Here is how it works.

- You wait for a tactical high or low to be formed. To have that, you see that a 20-bar high/low appears.

- After that, you wait to see if the price steps back several bars, bouncing from that recently formed tactical high.

- Then, you check if the price gets back again into the trend it was in when it made the tactical high or low.

- Now, if the price just inches beyond that recently formed high or low and then bounces back again, that should be an indication for a bigger correction.

- You open your trade as soon as the reversal is confirmed.

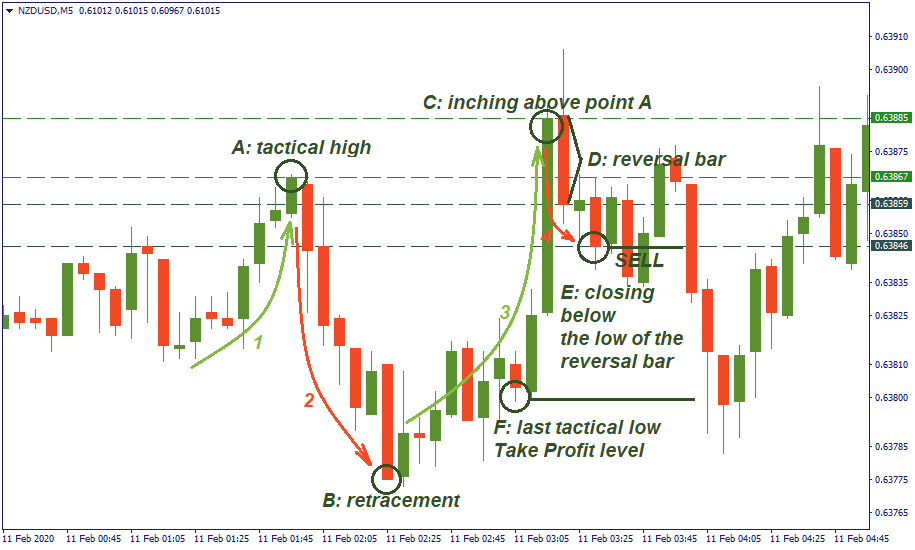

Example 1: sell

- You see the new high formed in point A.

- You see a significant retracement down to point B.

- You see the price went up again reaching point A just a bit higher than point A.

- You see bar D reversing down and note its low.

- You see the price close below the low of bar D – you sell here aiming to close at point F.

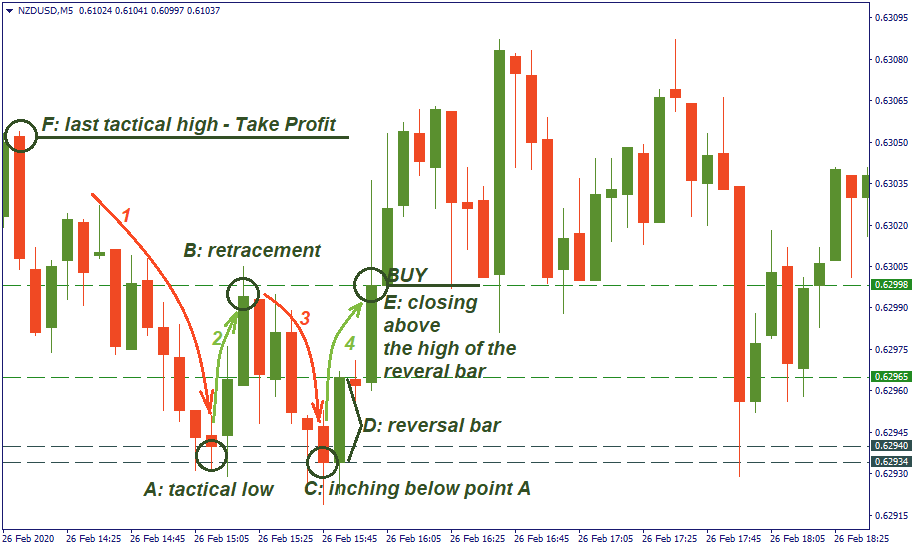

Example 2: buy

- You see the new low formed in point A.

- You see a significant retracement up to point B.

- You see the price went down again reaching point C just a bit lower than point A.

- You see bar D reversing up and note its low high.

- You see the price close above the high bar D – you buy here aiming to close at point F.