Coinbase: your ultimate guide for trading on the biggest crypto IPO

If 2021 had a name, we would call it the “year of crypto”. Indeed, the year started on an utterly optimistic note for the overall crypto community. While Bitcoin has breached several important milestones since the start of the year, big platforms such as Robinhood and PayPal permitted their customers to buy and sell BTC and other digital assets. Even DOGE – the famous meme coin rose above 30 cents. Following these fortunate happenings, there was another big event that conjoined the worlds of digital and real finance. We are talking about the Coinbase IPO that happened in April. This is big news: Coinbase becomes the first cryptocurrency-related startup that goes public on the US Stock Exchange. Now, trading Coinbase stocks is also available in FBS Trader! In this article, we are going to introduce you to this stock and explain why you need to consider it for your investment decisions.

What is Coinbase?

Coinbase Global or simply Coinbase is a large American cryptocurrency exchange platform founded in 2012. It does not have official headquarters, as all activities are conducted remotely. As of March 2021, the crypto exchange had 56 million verified users that held $223 billion worth of assets. The platform provides trading of 108 digital assets. Coinbase’s crypto list includes but is not limited to Bitcoin with a trading volume of 41%, Ethereum (15%), and Litecoin. This year, the exchange platform became the largest one in the United States by crypto trading volume.

The company makes money by charging around 1.5% commission on trades in its retail platform and lower (approximately 0.5%) commissions for larger amounts on Coinbase Pro.

COIN: the boom is born

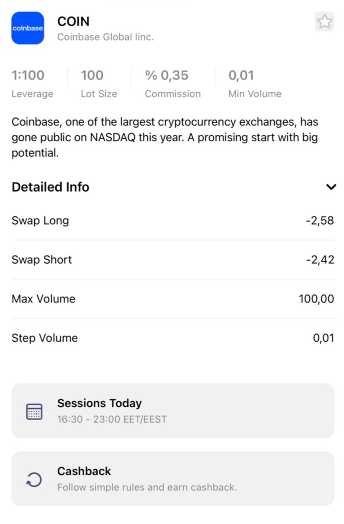

On April 1, 2021, the US Security and Exchange Commission (SEC) gave a green light to a proposed public direct listing of Coinbase’s common stock named COIN on the NASDAQ stock exchange. Direct listing (or direct public offering) allows a company to raise capital directly without a "firm underwriting" from an investment bank. This way, the company became the first crypto exchange platform on NASDAQ on April 14.

The public offering of Coinbase marked an important step towards cryptocurrencies’ widespread acceptance. The price of Bitcoin spiked above $64000 right after the listing. As for the COIN stock itself, it opened at $381, twice higher than a reference price of $250. In the first minutes of trading, it managed to surge to $429 but then cooled down below $320. Still, analysts see the great potential of this stock in the future based on its underlying fundamentals.

Why should I consider the COIN stock for trading?

After you’ve read all the facts above, you may still have a question: “Why should I care about this stock?” To begin with, let’s talk numbers.

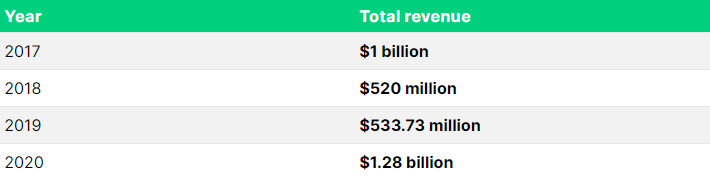

According to the data provided by the company ahead of listing, the company has reached outstanding financial results. Coinbase expects to make a profit of $730-$800 million in the first quarter of 2021. As for the total revenue generated this quarter, it is said to be $1.8 billion. This is almost $500 million more than during 2020. By the way, from the table below you can notice a correlation between a trend of the crypto market and the company's revenue.

The trading volume of an exchange platform has reached an impressive milestone of $335 billion. This means that the platform is constantly growing and has set ambitious goals.

Now, let’s return to fundamentals once again. The crypto exchange platform has been approved by US SEC and has never been hacked. Thus, Coinbase proves to be reputable and secure. Another interesting thing we want to draw your attention to is its market share. Reportedly, it has more than 10% of all BTC and other cryptocurrencies circulating there.

Another “tip” for your “to-buy” basket is connected with Coinbase’s business model. As the crypto market is expanding and dragging the attention of more and more regular people, the newcomers will likely choose an SEC-approved famous company to buy and sell cryptocurrencies, such as Coinbase. That is, the number of clients, as well as the number of transactions in the platform, will grow day by day.

What drives the COIN stock?

If you don’t know how to buy stocks, here's your brief guide. Stocks of companies tend to move on to the earnings data, risk sentiment in the market, and company-related news. Better news, as well as better financial results, push the stock of a company up. Vice versa, negative news, and lower-than-expected financial data pull the stock down. While all of these factors work the same for the COIN stock, there are some specific ones we’d like to highlight. You can find them below.

- Crypto prices. If virtual money rise, the number of transactions will increase, so will the commission. It will result in better revenue and profit data.

- Trading volumes. Again, if the crypto boom continues, more speculators will join the game. As a result, the trading activity on the Coinbase platform will be higher. This is another positive factor for the COIN stock.

- The bid/ask spreads for novice traders remain high. Experts pay a quite high commission as well. For now, these tools work in favor of Coinbase.

All in all, we recommend you to focus on the company's news, as it may have a great impact on the company's stock.

Ok, you got me. I need the COIN stock. How can I trade it?

If you trade with FBS you don’t have to worry about anything! FBS allows you to trade the stock of Coinbase in FBS Trader without actually owning it. Just imagine, how much money you can make on its growing popularity! To trade the Coinbase stock in FBS Trader, follow the steps below.

- Download FBS Trader – an all-in-one trading app from Google Play or App Store.

- Open an account in FBS Trader. It’s as easy as a pie!

- Find the COIN stock in the list.

- Decide whether you want to buy or sell this stock. The stock market news and FBS analytical materials may help you with that.

- Trade!

Bottom line

As the crypto market is rapidly expanding, traders may find an interesting way to diversify their investments with the stock of Coinbase. Its potential is visible even to an unprepared trader, so be among the first who trades it!