Fundamental Analysis

The ECB will announce its rate decision today, with expectations of a 25 basis point cut, bringing the deposit rate to 3.25%. This follows October’s cut and reflects a disinflationary process and weakening growth. Christine Lagarde’s press conference will be critical in setting the Euro’s policy direction, as the currency remains vulnerable due to accumulated short positions and recent economic deterioration.

This contrasts with the Bank of Japan’s stance, which appears more inclined to raise rates in the short term.

Technical Analysis

EURJPY, H1

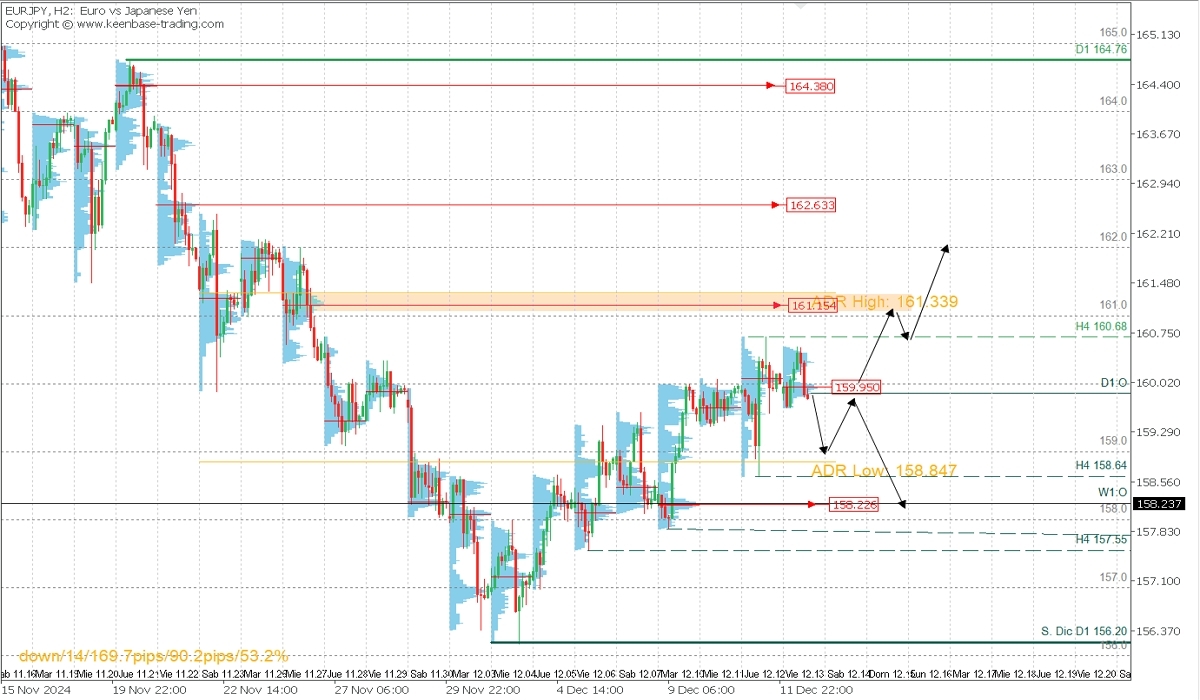

- Supply Zones (Sell): 161.15

- Demand Zones (Buy): 158.22

The pair has been bullish since last week, reaching resistance at 160.68. However, given the aforementioned fundamental outlook, sustained buying is unlikely if the ECB effectively cuts its benchmark rate.

The price has struggled to surpass the last resistance, with volume concentrations around 160.31 and now at 159.95, suggesting the accumulation of sell orders.

Bearish Expectations: Sales are anticipated to be below 160.00, with a target of 159.00, and the average bearish range is at 158.84. From there, buying liquidity may be recovered, aiming for a rebound to 160.00, whose breakout could allow for a new bullish attempt targeting the next supply zone between 161.15 and the upper range at 161.33.

Alternatively: If the current volume concentration at 160.00 halts the price's rise, a bearish reversal targeting the last validated intraday support at 158.64 and demand zone around 158.22 could initiate.

Technical Summary

- Bearish Scenario: Sell below 160.00 with TP at 159.00, and only after a decisive break, consider targets at 158.64 and 158.22.

- Corrective Bullish Scenario: Buy after retracement above 159.00 (with prior formation and confirmation of a bullish PAR*), targeting 160.00, 160.68, and 161.15 intraday. Use a 1% capital risk SL with a low lot size to allow for price movement.

Always wait for the formation and confirmation of a Reversal/Exhaustion Pattern (PAR) on M5, as taught here https://t.me/spanishfbs/2258, before entering trades at the indicated key zones.

Key Term: Point of Control (POC)

POC represents the level or area with the highest volume concentration. If it previously led to a bearish move, it’s considered a sell zone and forms resistance. Conversely, if it triggered a bullish impulse, it’s a buy zone, often near lows, forming support zones.

@2x.png?quality=90)