All about pips in Forex: a comprehensive guide

Discover what pips are in Forex trading and how to calculate their value. Learn about their impact on risk management and trading strategies.

What is a pip?

A pip is a Forex market convention, and it used to be the smallest unit of price movement that an exchange rate could make. A pip equals one-hundredth of 1% (1/100 × 0.01), and appears in the fourth decimal place (0.0001). Although there are now more precise methods for pricing (with more decimal places), the pip remains a standard value for brokers and trading platforms.

In most currency pairs, the quotation is made to four decimal places, and a pip is found in the fourth decimal (i.e., 1/10,000). For example, the smallest movement that the USDCAD currency pair can make is $0.0001, or one pip. The term "pip" is an acronym of "percentage in point", or "price interest point". It is important to note that a pip should not be confused with a basis point (bps), as the latter is used in interest rate markets and represents 0.01% or one-hundredth of 1%.

What is a pip in Forex?

A pip is a fundamental concept in the Forex market. It is a standard unit used in the Forex market to measure the change of an asset’s price. People engaged in Forex trading buy and sell a currency whose value is expressed in relation to another currency. The quotes for these currency pairs are shown in the form of bid and ask spreads, which are accurate up to four decimal places.

This unit of measurement is small enough to capture fluctuations in exchange rates, without resorting to fractions or more complex numbers. The value of a pip varies depending on the size of the traded lot. For example, if a standard lot of 100 000 units of the base currency is traded, each pip is worth about 10 units of the counter currency in the quote.

This standardization makes it easier to understand and compare price changes in currency pairs, and is a great help in developing safe trading plans.

How much is a pip worth in trading?

The value of a pip depends on three factors: the currency pair, the exchange rate, and the trade value. If your Forex account is funded in US dollars(USD), and the USD is the second currency in the pair (or the quote currency), as in the EURUSD pair, the pip is fixed at 0.0001.

In this case, to calculate the pip value, you must multiply the trade value (or lot size) by 0.0001.

Let’s see an example. Imagine you are making a trade with EURUSD of 10 000 euros. Multiply the trade value by 0.0001. The pip is worth $1.

The formula is:

Trade value × quote currency pip = pip value

10 000 × 0.0001 = 1

Why calculate pips in Forex?

Pips are used to assess market volatility. When a currency pair moves by many pips, this can be a sign of volatility. Since the movement of the exchange rate is the factor that determines whether a trader profits or loses, some use this information to determine their trading strategies, whether to take advantage of volatility, or to manage risk. The pip measurement is used to calculate risk exposure. Understanding and calculating pip value is crucial for setting profit goals and loss limits. The information provided by pips can help configure stop-loss and take-profit orders. Proper configuration of these orders maximizes profit opportunities and minimizes potential losses.

Exceptions to the pip rule

Sometimes, you need more precision. Like when you’re trading really high volumes. That’s why pipettes were created. For most pairs, they’re the hundred-thousandth (fifth decimal place). These are especially applicable when robots are doing your trading for you at computer speeds.

When the Japanese yen is half of a pair, a pip is 0.1 instead of the usual 0.0001. The same applies to pipettes. Since a pipette is one-tenth of a pip, a normal pipette for most currency pairs is 0.00001, but for pairs involving the yen, it will be the third decimal place: 0.001. This is because the value of the yen is lower in relation to other major currencies.

Metals and scalping require a little more control than your standard pip, so people often use 0.01

How to calculate pip value in Forex and position size

Calculating pip value

Lot size

Lot size directly affects pip value. The most common lot sizes are:

Formula for pip value

The pip value will differ depending on the currency pair and lot size. The general formula is:

Pip Value = (One Pip / Exchange Rate) × Lot Size

Example for EURUSD with a standard lot:

Pip Value = (0.0001 / 1.1200) × 100 000 = $8.93

Position Size = (Risk Capital / (Pip Value × Stop-Loss in Pips))

Example:

Using the previously calculated pip value:

Position size = ($100 / ($8.93 × 50)) = 0.224 standard lots

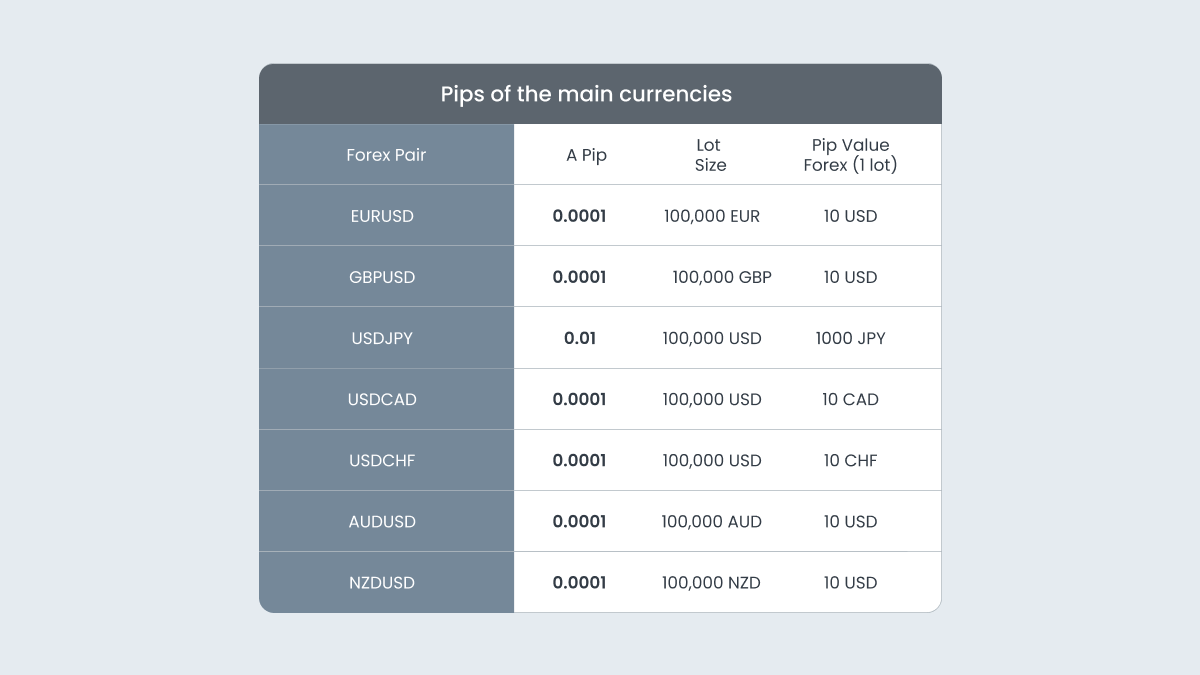

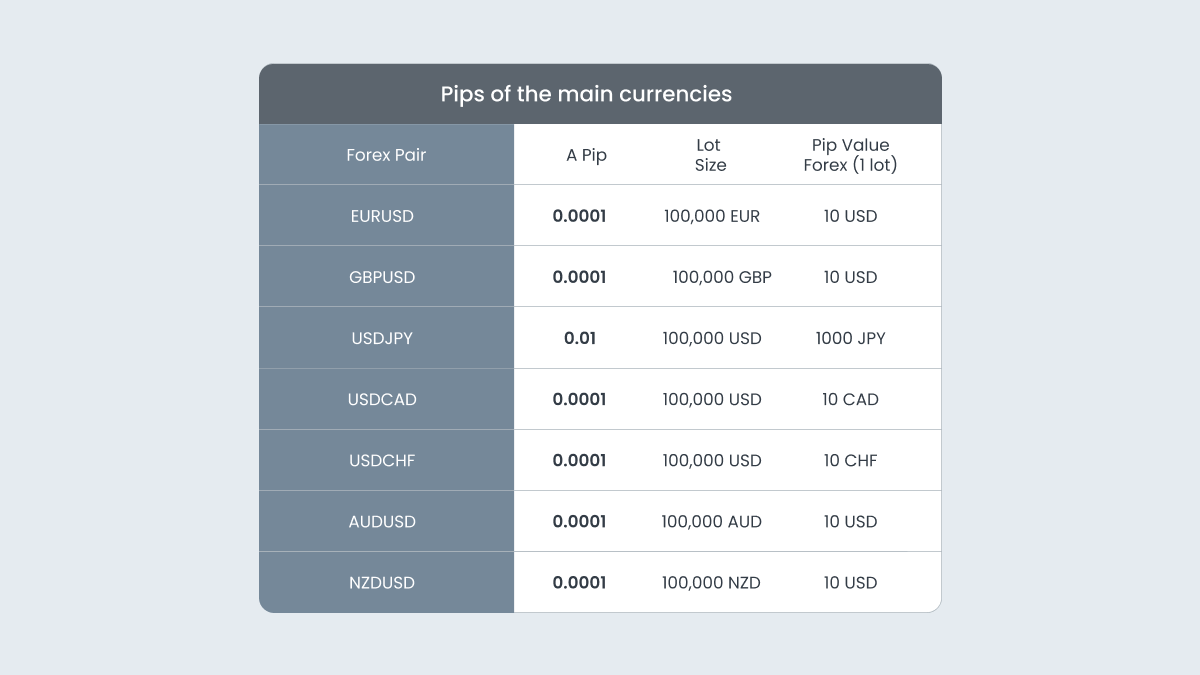

What are the pips of the main currencies?

For most currency pairs, a pip equals a change of 0.0001 in the exchange rate. These values represent the fourth decimal place. However, for pairs involving the Japanese yen, the value represents the second decimal place, so a pip is a change of 0.01.

Pips of the main currencies

Pips in MetaTrader

Open MetaTrader and select the currency pair you want to trade, and you’ll see the real-time price chart for that pair. Find two prices and subtract one from the other to figure out how many pips your asset has moved.

Let’s look at an example. Suppose you are trading EURUSD:

Opening price: 1.1850

Closing price: 1.1875

Calculation: 1.1875 − 1.1850 = 0.0025

This movement represents 25 pips.

Or you can get the MetaTrader pip calculator to tell you how many pips have moved.

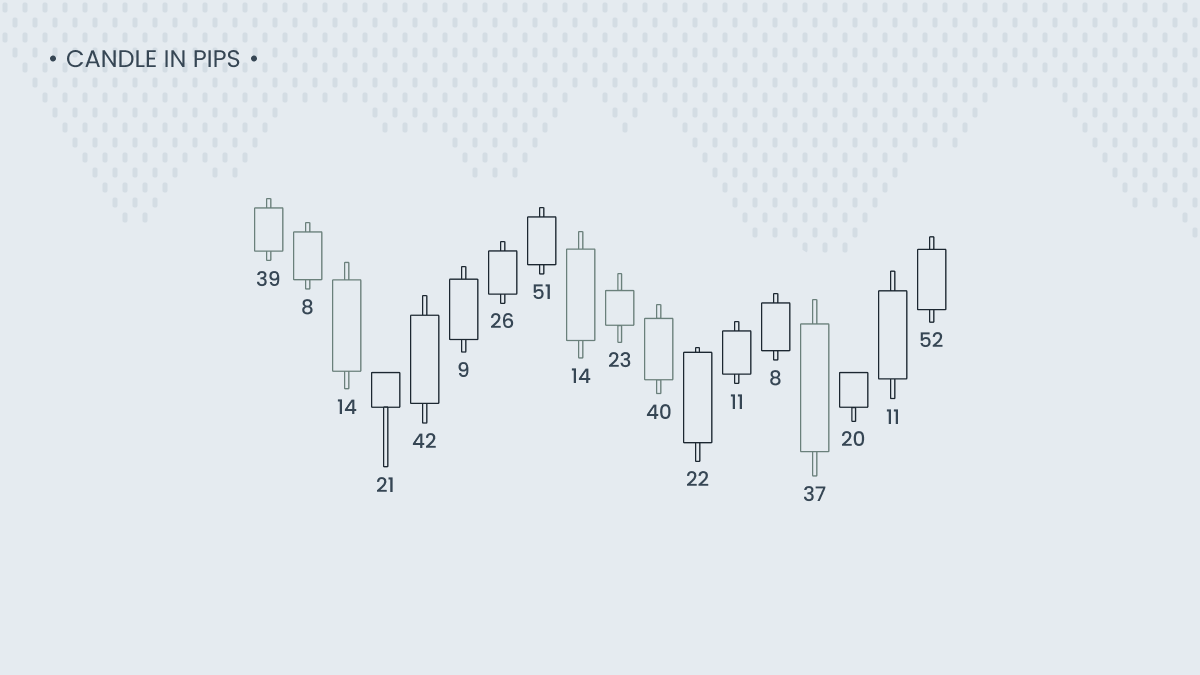

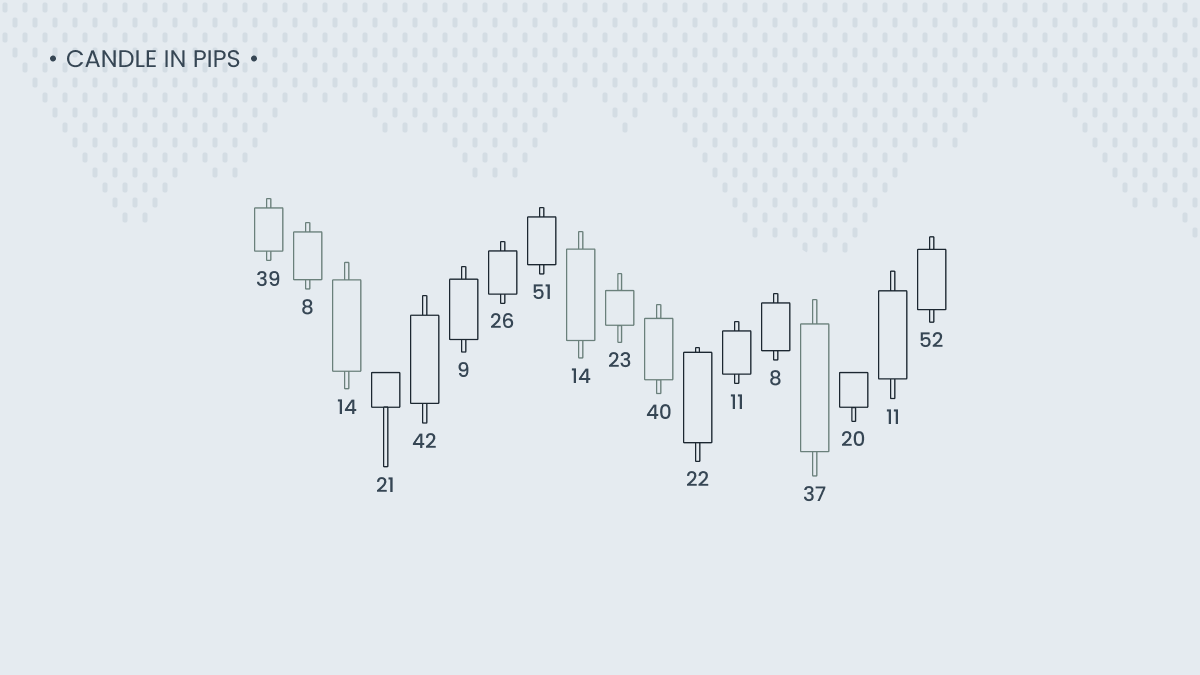

How to measure a candle in pips in MetaTrader

Measuring candles is a simple way to evaluate the size of a price movement over a given period. To do this, you need to open the chart of the currency pair you want to analyze in MetaTrader. Then, activate the “Crosshair” tool by clicking on the toolbar or pressing the middle mouse button (the scroll wheel) on the chart.

For a bullish candle

Measure from the lowest price at the bottom of the lower wick to the highest price at the top of the upper wick.

For a bearish candle

Measure from the highest price at the top of the upper wick to the lowest price at the bottom of the lower wick.

As you drag the cursor, MetaTrader will show the pip difference between the two selected points. Additionally, it will display the number of time periods (if you are measuring more than one candle), and the price difference.

The pip difference will appear as a number followed by “pips” in a small box that follows the cursor.

Make sure you are viewing the chart with enough zoom to place the cursor precisely on the candle’s extremes so you get an exact measurement. The number of pips may vary if you change your chart settings, such as candle types or price scale.