What is an ICT trader?

An ICT trader is someone who follows the Inner Circle Trading strategy.

A key element of being an ICT trader is focusing on trading psychology — the skill of managing your emotional responses and remaining disciplined. To uphold trading discipline, the strategy establishes specific guidelines for trade size, exit points, and well-defined rules to help avoid erratic decisions leading traders off course.

Basic principles and objectives of the ICT trading strategy

The ICT strategy was developed by Michael J. Huddleston.

A sophisticated approach to forex trading that represents the actions of large institutional players on the market, it enables retail traders to gauge market movements by learning and mimicking the forex trading strategies used by these institutions. This method is developed through an in-depth study of market structure, order flow, and price action.

Key components of the ICT trading strategy

ICT strategies include a number of components that are necessary for spotting potential trading setups and projecting market behavior. These collectively represent several frameworks for traders, including order blocks, fair value gaps, liquidity pools, and much more.

A brief overview of trading strategies

This trading strategy performs an essential function: giving traders a system for making trading decisions. The ICT trading strategy is particularly notable for its detailed analysis of market cycles, which helps traders handle the complexities of financial markets. Traders who are good at using this strategy have a considerable lead over their competition.

How does the ICT trading strategy work?

The ICT trading strategy covers a number of concepts: market structure, optimal trade entry points, and the significance of various trading sessions. These make you better at forecasting market movements by helping you understand what drives them. Traders need to master these concepts to apply the method effectively.

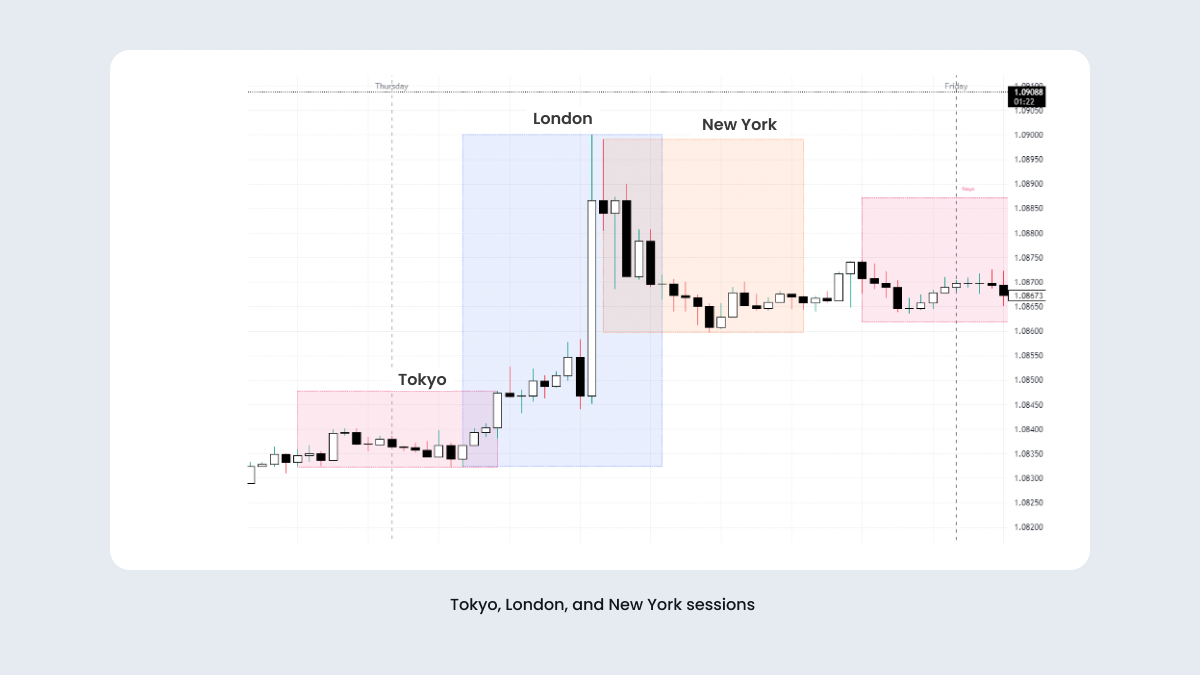

First, market structure helps traders see the overall trend and key price levels, so they can tell if the market is likely to keep moving in the same direction or if a reversal might happen. Next, based on certain price patterns that signal a good opportunity, optimal trade entry points help them spot the best moment to jump into a trade. Finally, understanding trading sessions is essential for choosing the right hours to trade, and what to trade at what time.

Key ICT trading concepts

Market structure | Price levels (highs/lows) that shape market behavior |

Liquidity zones | Areas with significant buy/sell orders that affect price |

Smart money concepts | Concepts that focus on institutional traders’ actions and market impact |

Order flow analysis | Involves analyzing orders to understand supply and demand |

Price action trading | Making choices shaped by price movements, no indicators |

Fair value gap | Identifying price deviations for trade opportunities |

Optimal trade entry | Entering trades at the best price points |

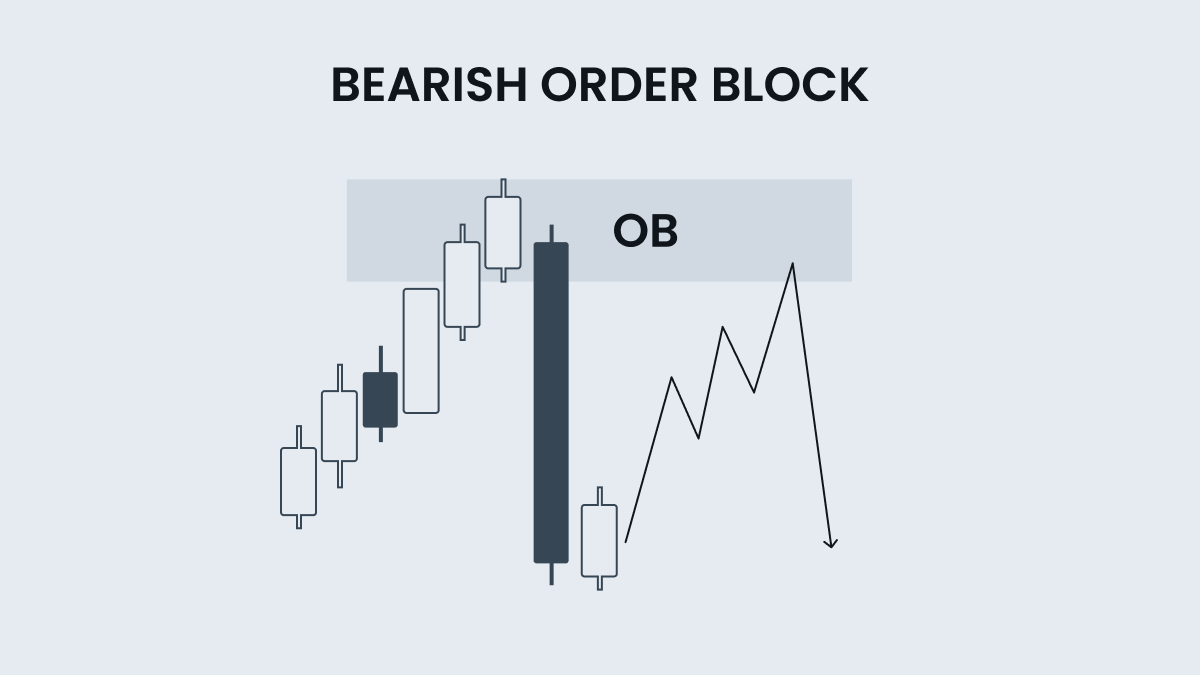

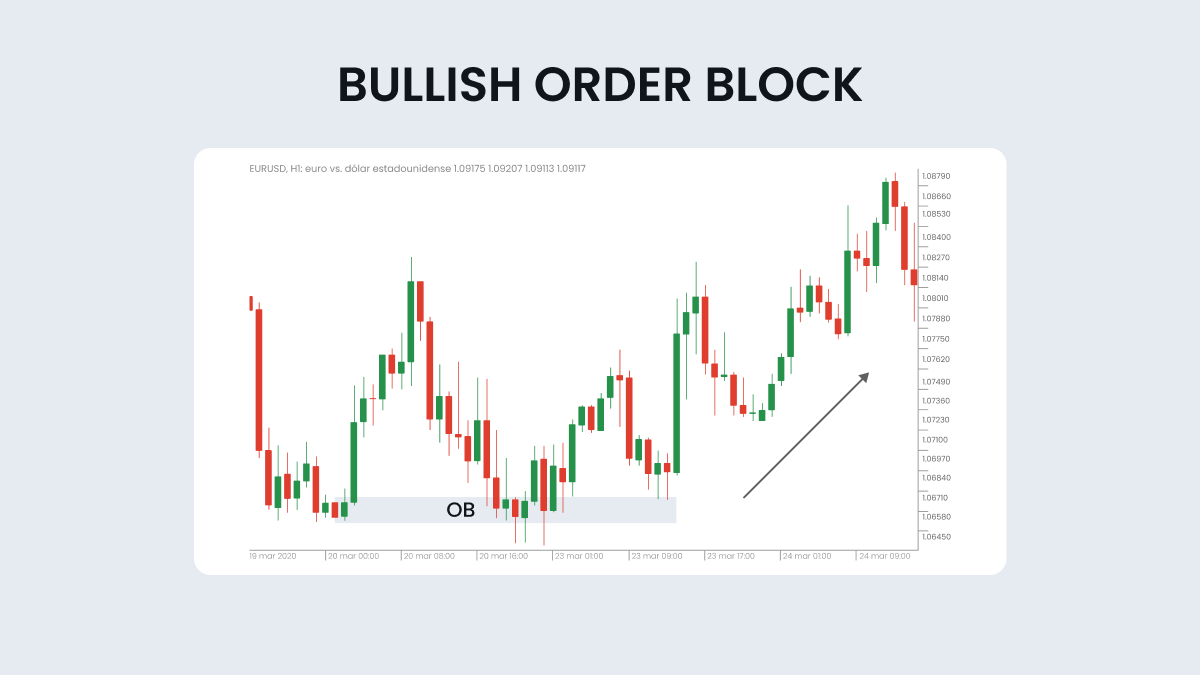

Order blocks | Support and resistance levels where institutions place large orders |

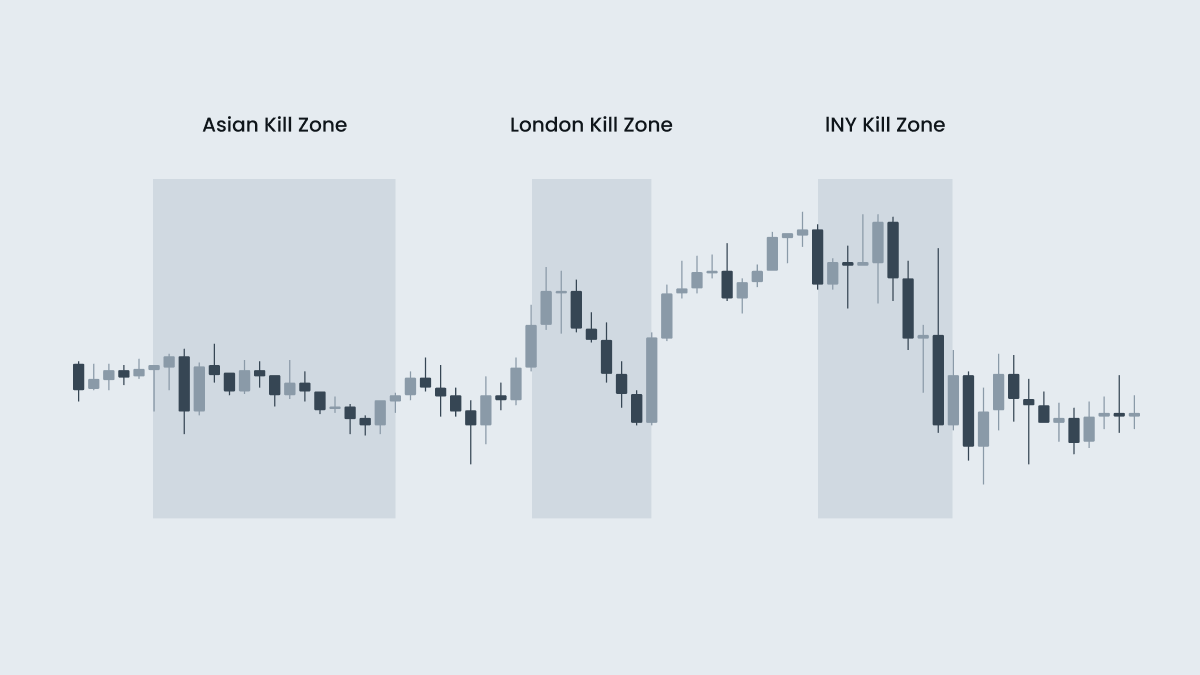

Kill zones | High-movement times during trading sessions |

Asian session range | The price range set in the Asian session, which impacts later sessions |

Some of these concepts require further explanation, and others have yet to be mentioned. Let’s dive deeper.

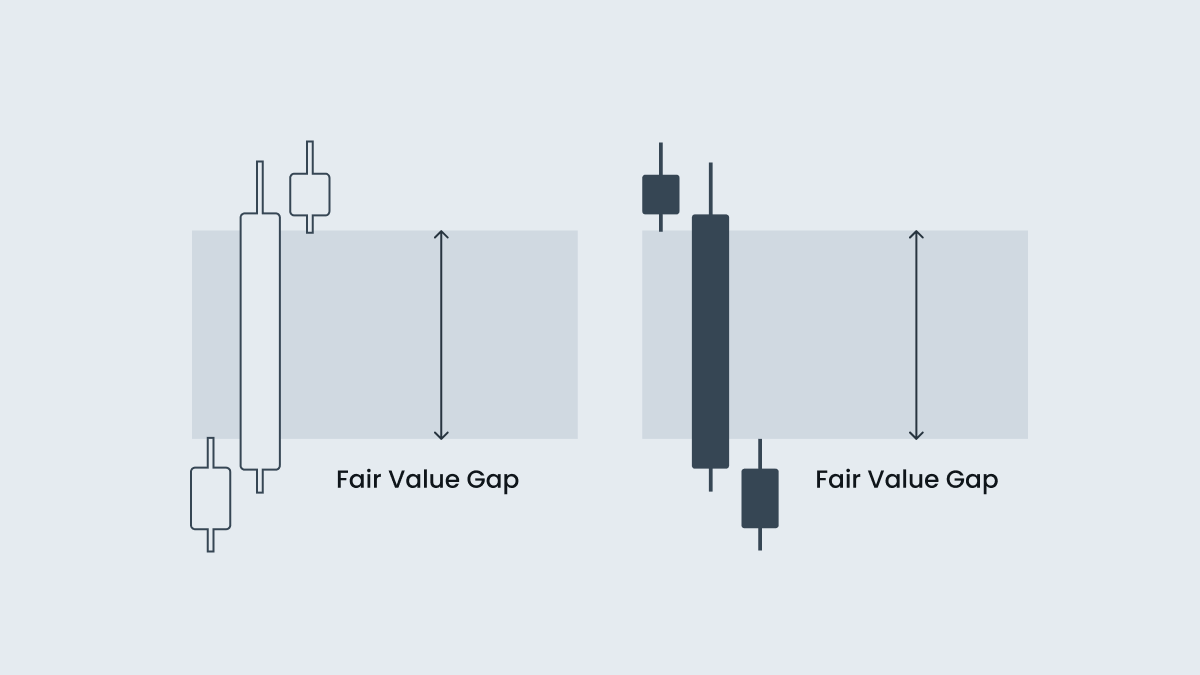

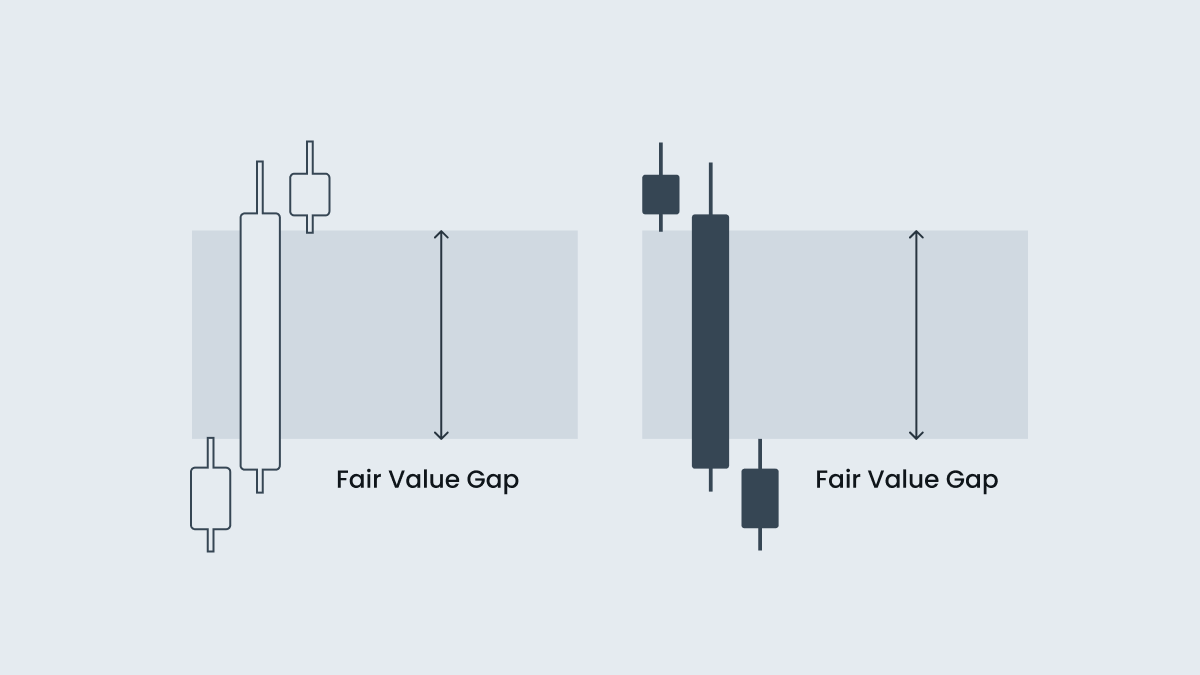

Fair value gap

The fair value gap (FVG), also known as imbalance, is critical to the ICT forex trading strategy. The term refers to a price gap created by an imbalance in buying or selling, often leading to a robust price movement away from its fair value. These gaps typically get filled as the market seeks a balance and gives traders possible entry and exit strategies.

FVG is usually presented on a price chart as a three-candlestick pattern. In a bullish scenario:

The upper wick of the first candle does not connect to the lower wick of the third candle.

The gap (on the second candle) created by the wicks of the first and third candles is called the fair value gap.

In a bearish scenario, the pattern is reversed, with the lower wick of the first candle not connecting to the upper wick of the third candle.

The market tries to fill this imbalance zone (FGV), acting like a magnet for the price. By recognizing these gaps, traders can anticipate potential price reactions and plan their entries and exits.

.png)

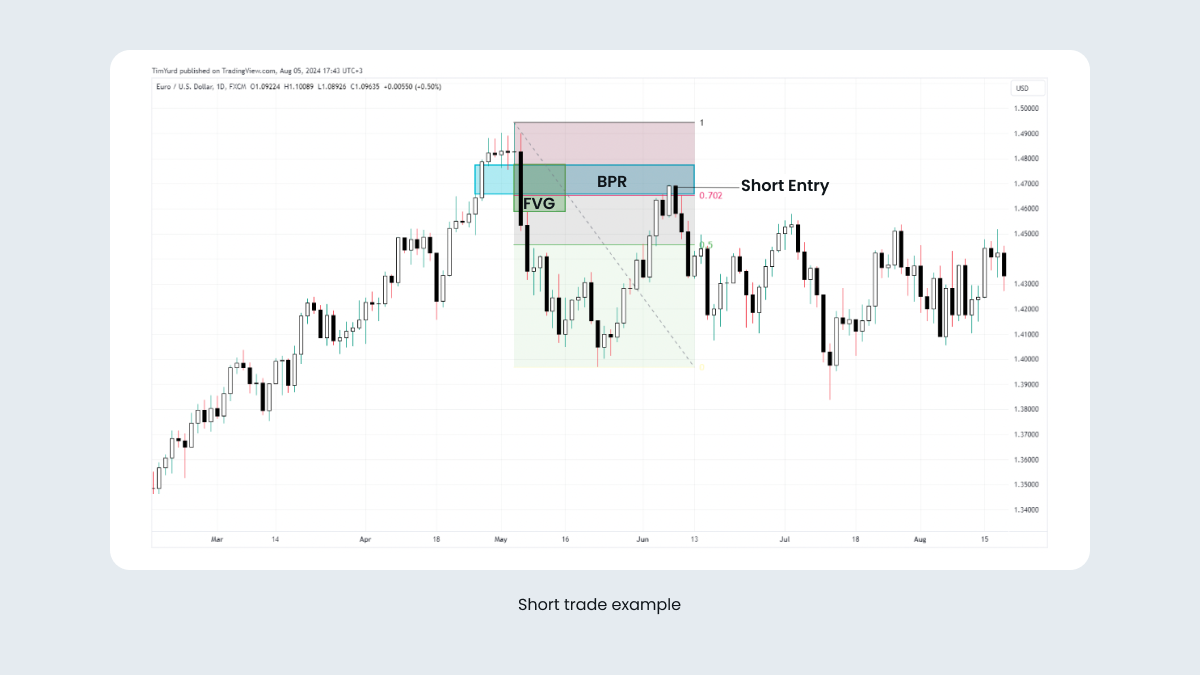

To enter a short trade, wait for the price to sweep the closest liquidity pool and reverse, leaving the FVG behind, as shown in the chart above.

.png)

.png)

.png)

.png)

.png)