The Nasdaq jumped on Thursday, leading a recovery in U.S. stocks, thanks to Tesla’s strong earnings report and optimistic sales forecast. The Nasdaq Composite gained around 0.6%, while the S&P 500 rose by 0.3%. However, the Dow Jones Industrial Average dropped more than 100 points, down nearly 0.3%.

Tesla's impressive quarterly profit, the highest in over a year, sparked optimism, lifting stocks after sharp losses on Wednesday. Tesla shares surged over 14%, adding more than $80 billion to its market value, following CEO Elon Musk’s prediction of 20-30% growth in EV sales next year. Other tech giants like Amazon and Meta also saw their stocks rise.

On the downside, Boeing shares fell by nearly 2% after striking workers rejected a pay deal, adding to a rough patch for the company. Meanwhile, the 10-year Treasury yield eased to 4.22%, after hitting a high of 4.25% on Wednesday, as investors remained uncertain about future interest rate cuts from the Federal Reserve.

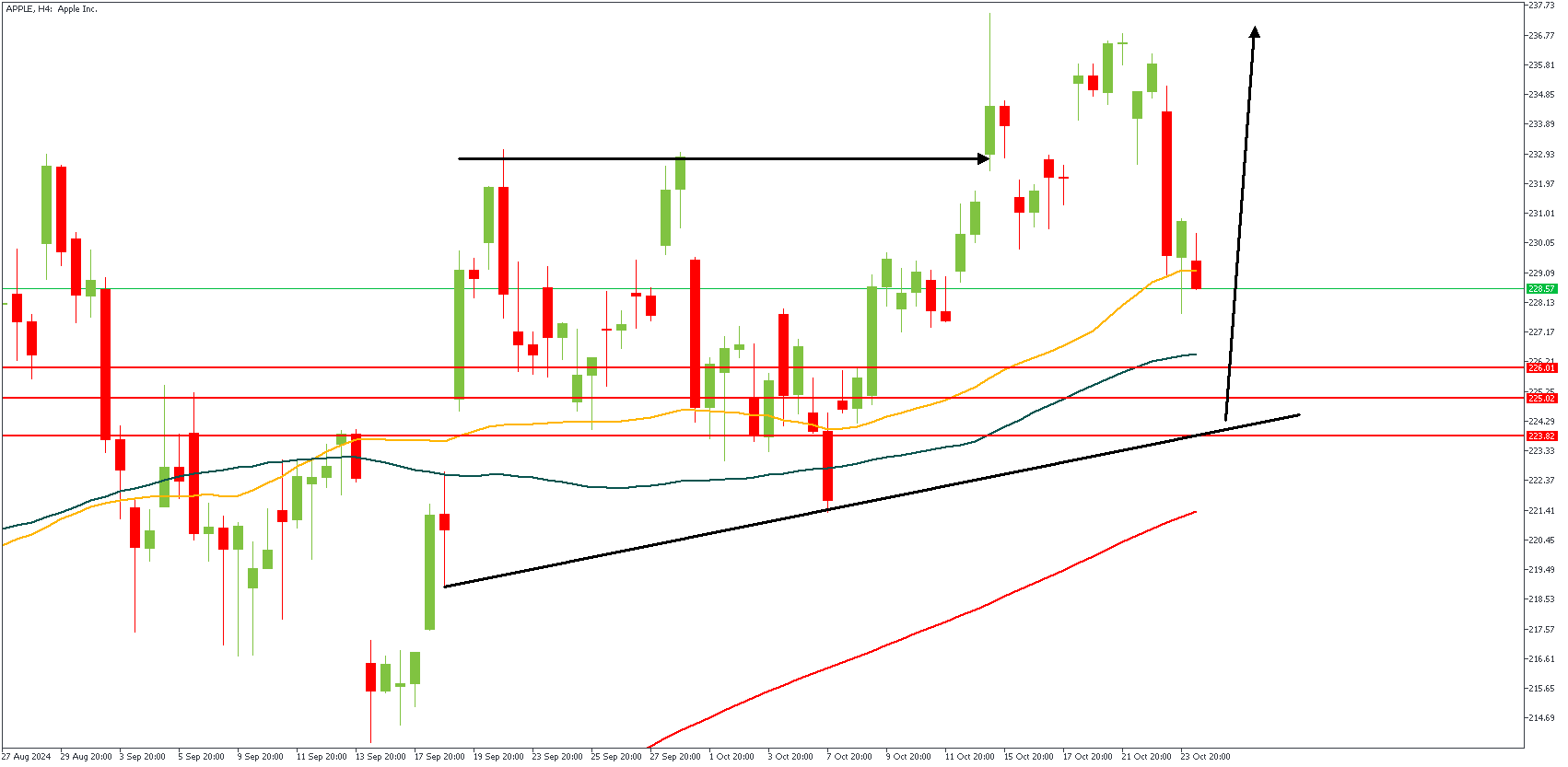

APPLE – H4 Timeframe

The horizontal arrow on the attached 4-hour timeframe chart of APPLE share prices represents a recent break of structure above the previous high. The retracement that followed is currently approaching the 76% of the Fibonacci retracement, whilst moving average array remains clearly bullish. Based on these factors, I expect to see a bullish reaction from the confluence region of the daily timeframe pivots (red horizontal lines), trendline support, and the drop-base-rally demand zone.

Analyst’s Expectations:

Direction: Bullish

Target: 237.00

Invalidation: 221.64

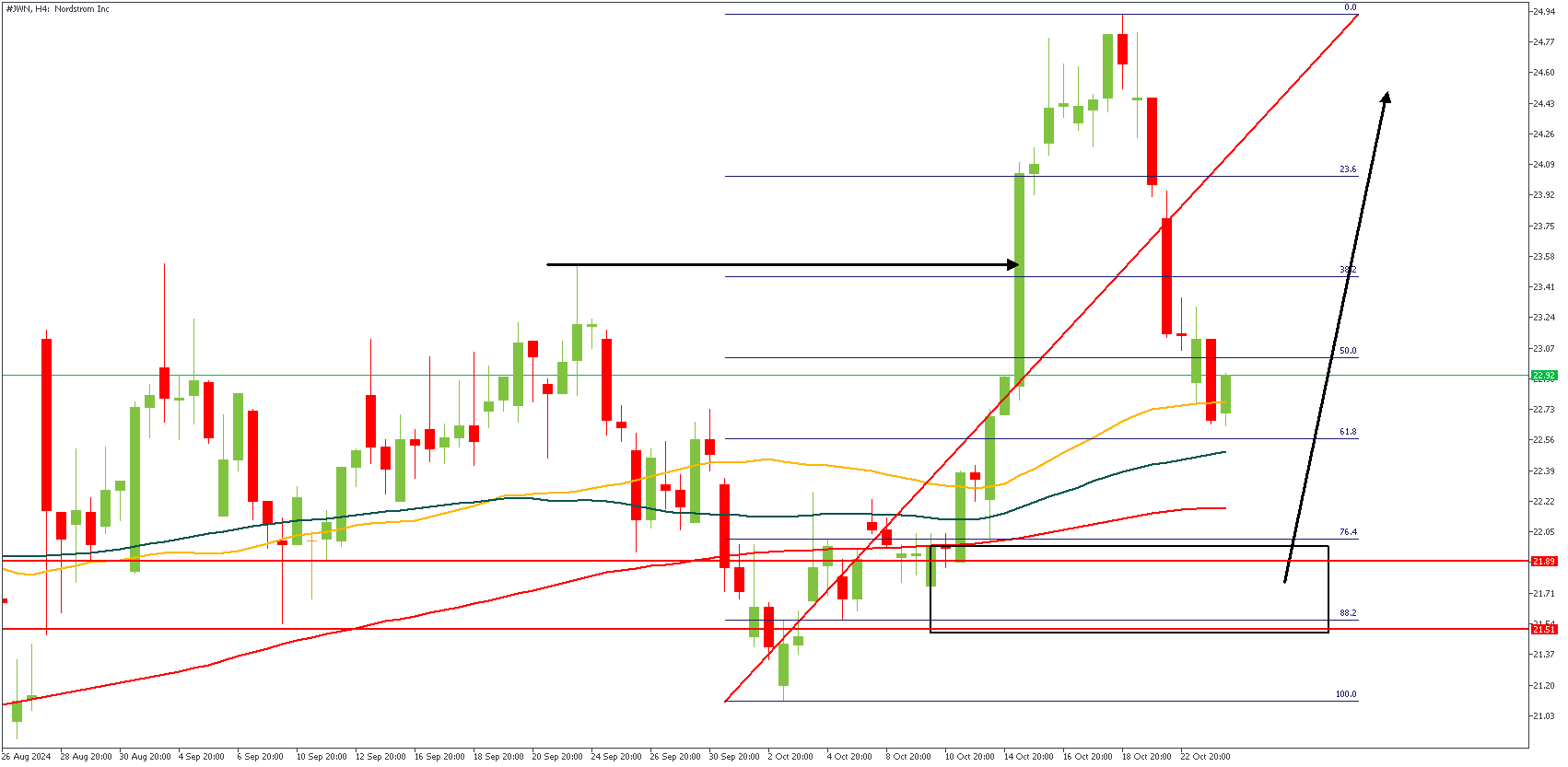

NORDSTROM – H4 Timeframe

Nordstrom Inc share prices recently broke above the previous high on the 4-hour timeframe as shown on the chart. Notably, the moving averages 50, 100 and 200 are maintaining a bullish array, with a demand zone overlapping the daily timeframe pivots around the 76% of the Fibonacci and the 200-period moving average. My sentiment in this case is strongly bullish.

Analyst’s Expectations:

Direction: Bullish

Target: 24.60

Invalidation: 21.03

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.