Major movement ahead in NZDUSD—time to prepare!

The NZDUSD pair, often referred to as the "Kiwi," represents the exchange rate between the New Zealand Dollar and the US Dollar. The New Zealand Dollar is influenced by various factors, including domestic economic data, commodity prices (especially dairy, as New Zealand is a major exporter), and monetary policy decisions by the Reserve Bank of New Zealand. On the other hand, the US Dollar is affected by US economic data such as employment figures, GDP growth, inflation reports, and interest rate decisions by the Federal Reserve.

New Zealand Interest Rate Decision, Oct 9, 3:00 (GMT+2)

The Reserve Bank of New Zealand is predicted to cut interest rates from 5.25% to 5.0%. If this forecast is true, it will likely weaken the New Zealand dollar, as lower interest rates will make the currency less attractive to investors, and the NZDUSD pair may decline. If the decision turns out to be better than expected, such as keeping the current rate, it will mean that the RBNZ sees the economy as stronger, which could lead to a rise in the NZDUSD pair.

However, if the RBNZ cuts the rate sharply by 0.5%, it could signal more economic problems, which would lead to a fall in the New Zealand dollar and a further decline in the NZDUSD.

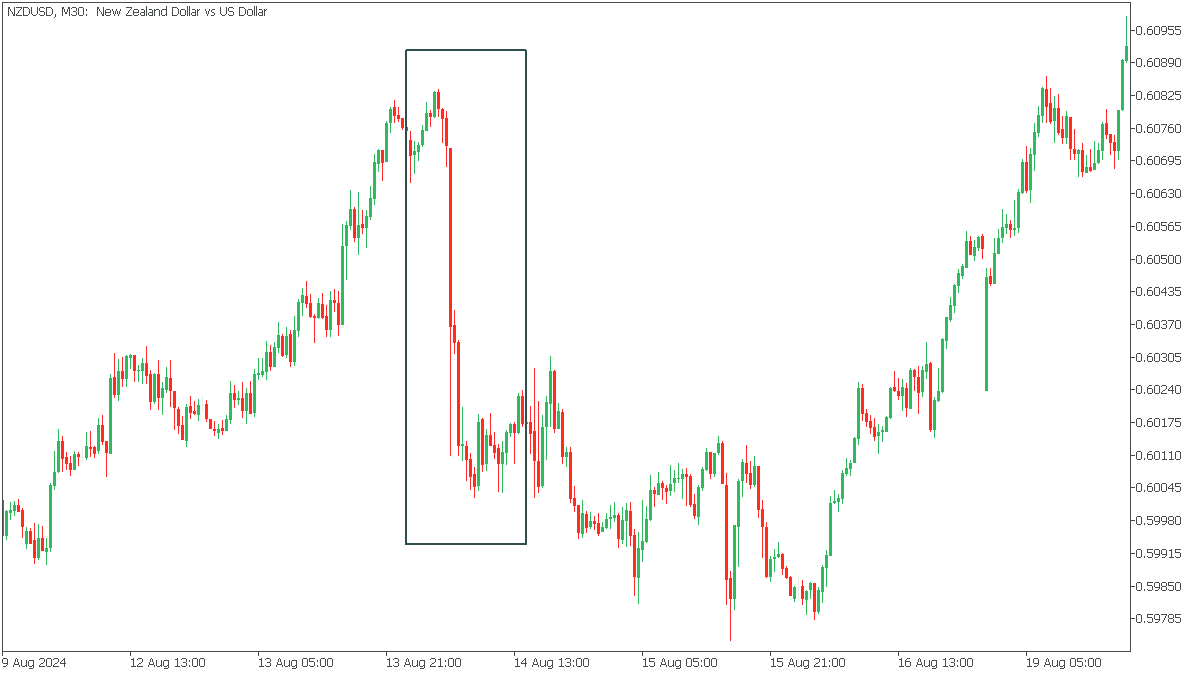

The last time the RBNZ cut the rate was on August 14, 2024, which was unexpected and caused the NZDUSD to fall hard!

US Consumer Price Index (CPI) MoM, Oct 10, 14:30 (GMT+2)

The September US Consumer Price Index (CPI) is forecast to slow down to 0.1%, compared to the previous reading of 0.2%. If the CPI meets this forecast, inflation will weaken, potentially reducing the likelihood of additional interest rate hikes by the Federal Reserve. This could weaken the US Dollar, leading to a rise in the NZDUSD pair.

However, if the inflation data is weaker than forecast, it could indicate a softer stance from the Fed, weakening the US Dollar and pushing the NZDUSD pair higher.

Conversely, if the CPI is stronger than expected, indicating rising inflation, this could lead to expectations of further Fed policy tightening and a longer continuation of the current rate, which could lead to a decline in the NZDUSD.

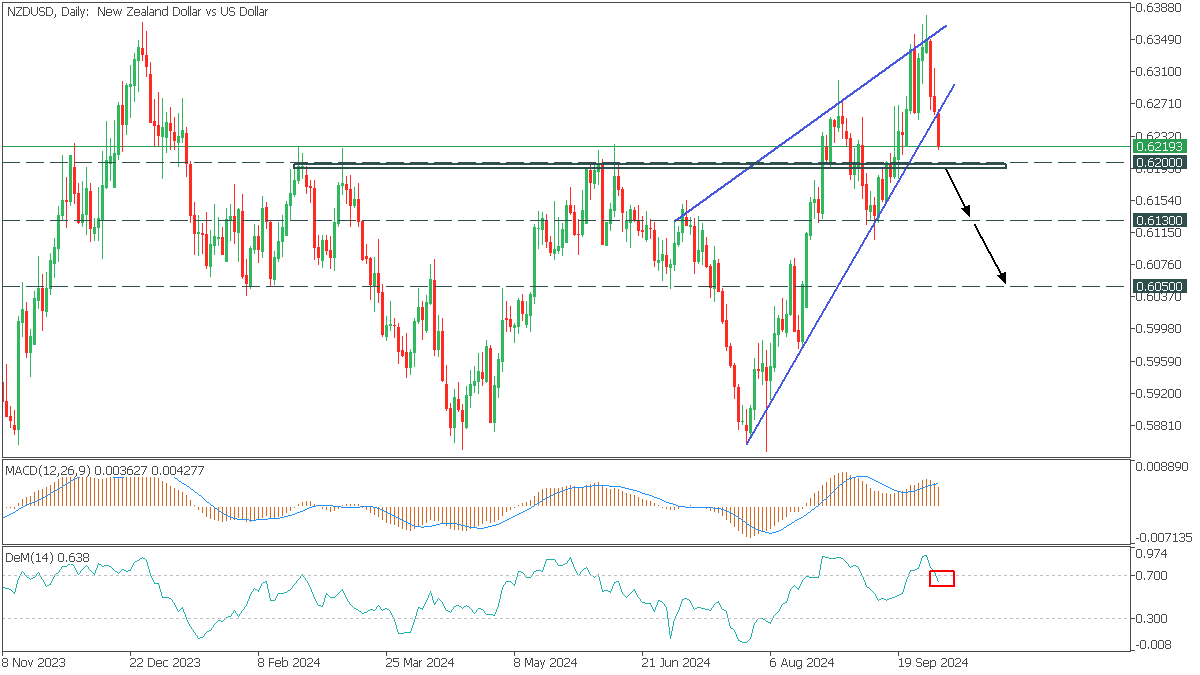

In the Daily timeframe, NZDUSD formed a rising channel pattern. The price broke the lower trend line, with the MACD signal line rising above the histogram and DeMarker coming out of the overbought zone.

NZDUSD can be expected to fall further on a breakdown below the support at 0.6200 with targets of 0.6130 and 0.6050.