This week, five major tech giants, often called the "Magnificent Seven," are set to report their earnings, including Alphabet, Apple, Amazon, Microsoft, and Meta. Investors are closely watching to see if these companies' artificial intelligence investments translate into profits. In total, 169 companies from the S&P 500 are expected to share their results this week.

Besides company earnings, important economic data are also coming out. The Federal Reserve's preferred measure of inflation and the October jobs report will be released, which could influence the Fed's decision on interest rates at their November meeting. Meanwhile, with the US elections around the corner, shares of Trump Media & Technology Group jumped by as much as 20% after Donald Trump's rally at Madison Square Garden over the weekend.

US100 – H4 Timeframe

.png)

US100, on the 4-hour timeframe, currently has a bullish outlook. The price is currently holding at the 23.6% Fibonacci retracement level. In comparison, the upward trendline and the 50.0% to 61.8% Fibonacci levels provide additional support, forming an ideal zone for a potential entry based on the confluence of a rally-base-rally demand zone. If the price respects this demand area, we could see a bullish move toward recent highs, with targets set around the 0.0% Fibonacci level or even further.

Analyst's Expectations:

Direction: Bullish

Target:20705

Invalidation:20024

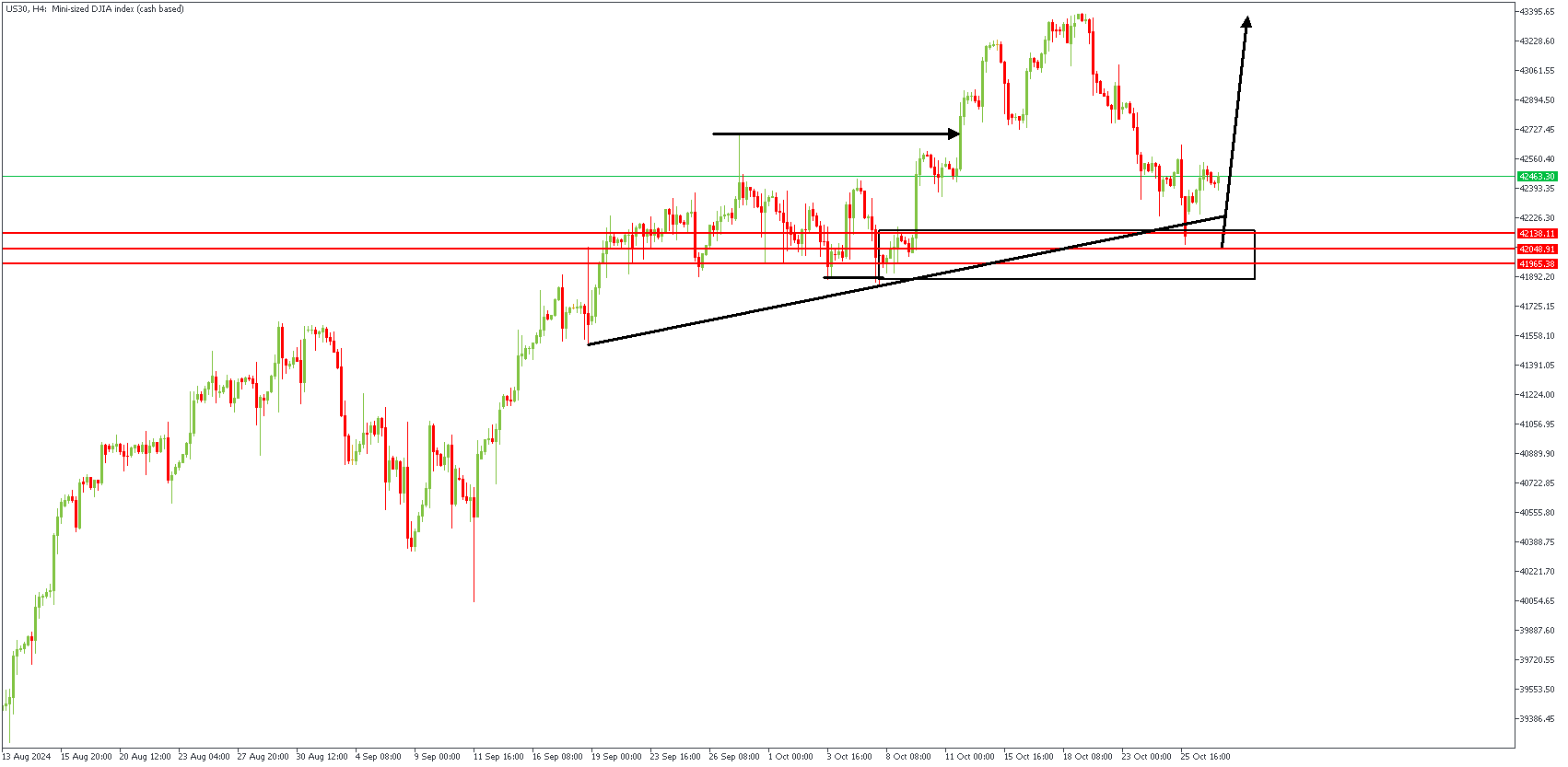

US30 – H4 Timeframe

This trade idea on the 4-hour timeframe of the Dow Jones (US30) chart looks for a bullish move from a critical support zone. Price is near an upward trendline and within a demand zone marked by three support levels from the daily timeframe pivot, which have previously held strong, suggesting this as a favorable entry area. If the price holds above the trendline and within the support zone, a long position could be worthwhile, with a stop just below the zone and take-profit targets aimed at recent highs.

Analyst's Expectations:

Direction: Bullish

Target:43395

Invalidation:41782.66

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.