DAX Index

Indices are great for evaluating the performance of the country’s biggest companies. All major economies have their indices. In this article, we’ll discuss the main German index, the DAX.

What is DAX?

The DAX (Deutscher Aktienindex (German Stock Index)) is a German stock market index comprised of the top 40 German companies. All these companies are traded on the Frankfurt Stock Exchange through the Xetra trading floor. Similar to the US Dow Jones index, the DAX comprises only a small sample of companies and doesn’t necessarily reflect the state of the German economy.

DAX was created in 1988 with an initial index level of 1163 points. DAX member companies represent approximately 80% of the total market capitalization traded on the Frankfurt Stock Exchange. Historically, the index consisted of 30 companies, but as of September 3, 2021, it has been expanded to 40.

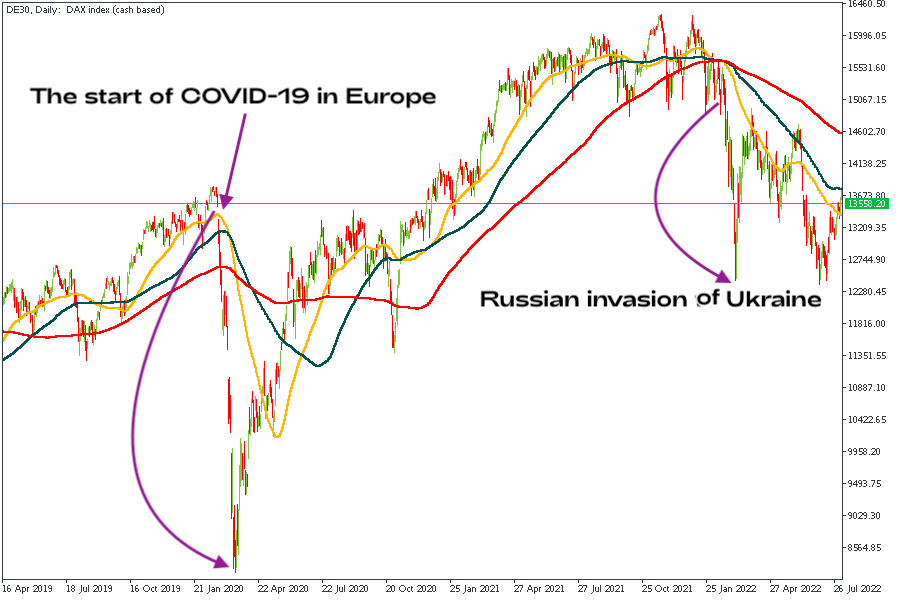

Since its inception in late 1987, the DAX has reflected other indices during major economic events, including the technology bubble 2000, significant lows in 2003, and other fluctuations in subsequent years. The index fell in 2008 amid the global financial crisis and again during the global Covid-19 outbreak.

Companies included in DAX

As of 2022, the index includes the following companies:

Company | Industry group | Index weighting (%) |

Adidas | Clothing | 3.54 |

Airbus | Transport and Aviation |

|

Allianz | Insurance | 7.81 |

BASF | Chemicals | 7.98 |

Bayer | Pharmaceuticals and chemicals | 8.27 |

BMW | Manufacturing | 2.75 |

Brenntag | Chemicals |

|

Continental | Manufacturing | 2.38 |

Covestro | Chemicals | 1.28 |

Daimler | Manufacturing | 5.62 |

Delivery Hero | Food delivery |

|

Deutsche Bank | Banking | 1.73 |

Deutsche Borse | Banking |

|

Deutsche Post | Logistics | 2.82 |

Deutsche Telekom | Communications | 4.47 |

Deutsche Wohnen | Real estate |

|

E.ON | Energy industry | 2.03 |

Fresenius | Medical | 2.77 |

Fresenius Medical Care | Medical | 1.8 |

HeidelbergCement | Building | 1.11 |

Hellofresh | Food processing |

|

Henkel | Consumer goods and chemicals | 1.88 |

Infineon Technologies | Technologies | 2.72 |

Linde | Industrial gases | 3.49 |

Merck | Medical | 1.06 |

MTU Aero Engines | Transport Aviation |

|

Munich Re | Insurance | 2.72 |

Porsche | Manufacturing |

|

Puma | Clothing |

|

Qiagen | Genetic testing |

|

RWE | Energy industry | 1.07 |

SAP | Technologies | 10.56 |

Sartorius | Laboratory equipment |

|

Siemens | Industrial, electronics | 9.34 |

Siemens Energy | Technologies |

|

Siemens Healthineers | Medical technologies |

|

Symrise | Nutrition and cosmetics |

|

Volkswagen Group | Manufacturing | 2.88 |

Vonovia | Real estate | 1.85 |

Zalando | Clothing |

|

What drives the DAX index?

The main driver of the German stock index is the European Central Bank and its monetary policy. The DAX falls as the ECB raises rates. Conversely, the index rises when the ECB lowers the interest rate.

German economic indicators such as GDP, retail sales, labor market indicators, PMI, etc., have a minimal direct impact on the DAX index. Higher GDP growth reflects a positive economic environment, pushing the index higher.

Intraday traders should look at daily sentiment to open buy and sell positions on this stock index. Technical analysis can also be helpful. Long-term traders must keep a close eye on the ECB’s actions.

How to trade DAX?

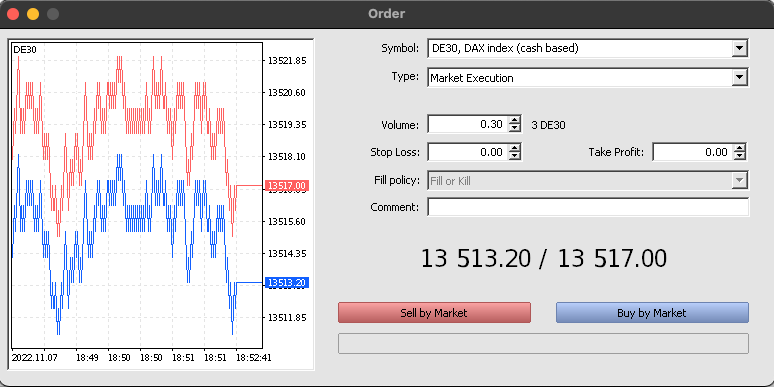

To trade DAX in MetaTrader 5, choose DE30 in the list of tickers on the left. Then, after opening the chart, click “New Order,” set preferable settings, and open your trade. Make your technical analysis, and don’t forget to check the economic calendar, as the releases that are connected to the EU can influence this asset.

Conclusion

The DAX index is a great alternative to other more mainstream assets, as the system there is clear. Try it and improve your trading skills with FBS.