FAQ

Is momentum trading a good strategy?

This strategy can be very effective in volatile markets. At the same time, there are risks, as trends can reverse unexpectedly and cause significant losses.

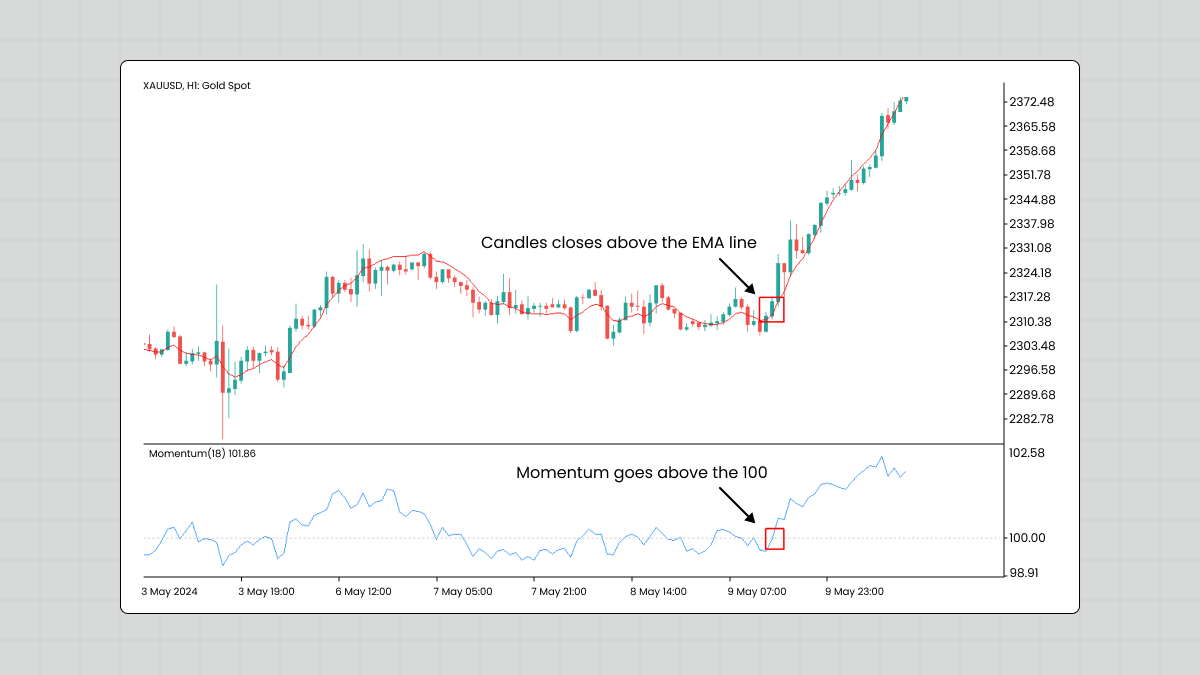

Momentum trading takes a more detailed approach, using advanced tools, indicators, and a mix of technical and fundamental analysis. To make it work, traders need to understand market signals, have good timing, and be ready to act quickly when things change. It’s a strategy that requires constant attention and quick decision-making.

What is the best momentum indicator for Forex?

The Relative Strength Index is considered one of the most useful momentum indicators for Forex trading. It helps traders spot when an asset might be overbought or oversold, and signal that a price reversal could be coming soon. Traders often use RSI with other indicators to confirm trends and optimize entry and exit points.

What is the best momentum time frame?

The time frame really depends on the market and what assets you’re trading. That said, many momentum traders go for a time frame of 3 to 12 months. It’s long enough to catch meaningful trends but still short enough to manage risks.

What are the disadvantages of momentum trading?

Momentum trading moves fast and can be stressful because traders have to stay alert and often be glued to the screens to monitor the market. Sudden price reversals can quickly turn a profitable trade into a loss. Plus, it takes a high tolerance for risk and a good grip on handling emotions like fear of missing out.

Is momentum trading profitable?

It can be profitable, especially in markets where trends are strong and clear. The positive outcomes depend on how well traders time their open positions, manage risks, and stick to their plan. So, they should know not only how to spot a trend but also when to get out.