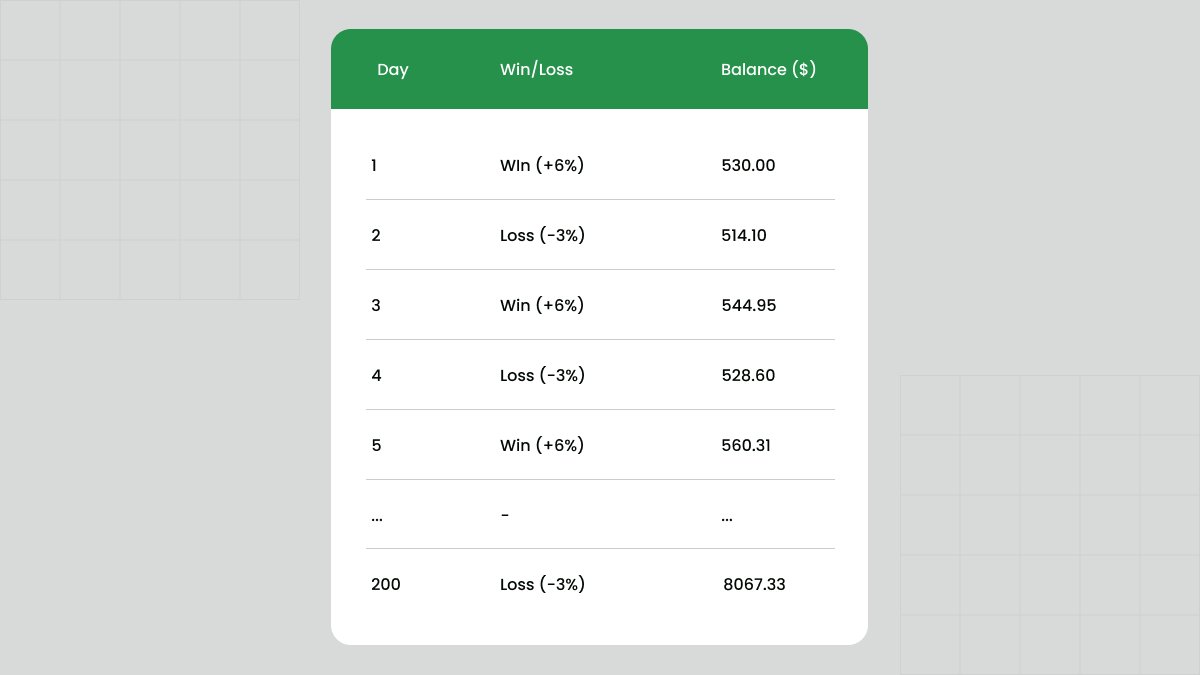

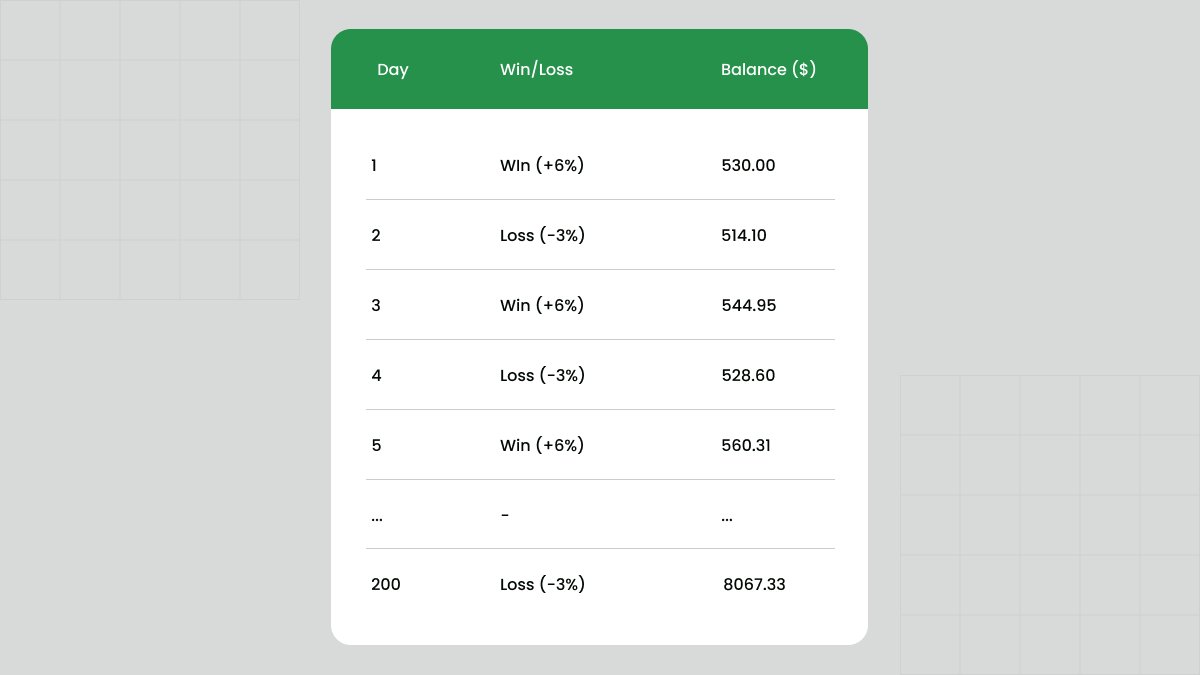

We see the magic of compound interest working if we consider a few trades. With every win, the capital grows by 6%. It is crucial that the impact of losses is mitigated by the lower percentage of losses and capital gains from previous wins.

Using the formula above, we can easily calculate how the deposit will grow using the parameters we’ve mentioned.

E=500×((1+0.06)×(1−0.03))200×0.5

E=8067.33

This formula is very straightforward and convenient, so anyone can use it to build their trading strategy. If you implement such a strategy, you will soon notice how your deposit grows and how you approach your ultimate goals.

True, a year has 250 trading days on average, but since no one trades daily, it will have roughly 200 days for you. We’ve calculated the progress using the formula above and found that on the 200th trading day, the balance will be $8067.33, dramatically higher than the initial deposit of $500. It means that the deposit will grow by 1513% in a single year of trading!

You can see the opportunities the compound interest opens in trading, even with a moderate win rate of 50%. If we consider more efficient trading, the result will be even better. Let's assume that our win rate is 60%. After a similar year with 200 trading days, the balance will reach $14,069. This means the deposit could grow by 2713% in a year!

What if we keep trading for longer than a year? If we stick to the win rate of 50% and use the amount of $8067.33 as our initial deposit, the balance after 200 trading days would reach $130,163.

The effect of compounding is more impressive with time. Even with a moderate 50% win rate, if a trader is disciplined enough to earn 6% on wins and lose only 3% on lost trades, their capital will keep growing. It is important to note that this strategy requires consistency in applying a trading plan and risk management.

Thus, we have yet another proof that trading produces better results when it is based on a sound strategy.