USD/CAD: outlook for May 22-26

USD/CAD slumped to 1.3545 in the past week due to rising oil prices and weaker USD. WTI and Brent oil futures rose after the Saudi Arabia and Russia have committed to extend production cut agreement. The political turmoil in Washington that could potentially end with Trump’s impeachment weighted in the USD depreciation against its major peers.

Next week the main focus will be on the Bank of Canada’s rate statement which is due on Wednesday. The central bank is widely expected to remain its rate on hold despite the soaring prices at Canadian house market. Household debt is poised to reach record levels as continuously low rate whet appetite for credit and inflated a bubble in real estate market. Canadian CPI figures picked up in April, but not enough for the central bank to raise its interest rate. An extremely dovish tone of the BoC’s policymakers will definitely hurt the CAD. The loonie might recoup its losses on May 25 following the OPEC meeting where more details on the extension of production cut agreement will be announced. On the USD front, pay special attention to what FOMC members’ chorus will tell you. A number of Fed’s policymakers will be speaking in the first half of the week. On Friday, traders will be waiting for the preliminary release of GDP figures and a monthly update of core durable goods orders. If headlines beat market expectation, USD might gain a strong momentum.

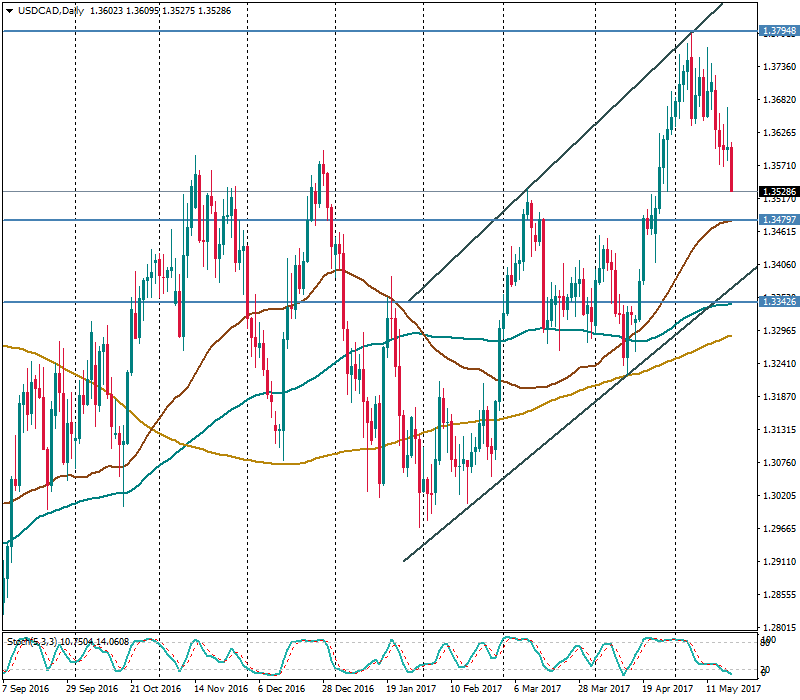

Technically, USD/CAD may slide further towards the solid support at 1.3480, or lower towards 1.2242 (100-day MA intersecting lower border of the rising trading channel). On the upside, there is a strong resistance at 1.3795 that might prevent USD from rising higher.