Stock market: the earnings of JPM, Netflix, Coca-Cola and more

The new earnings season is starting this week in the United States. This means that stocks of the largest American companies will likely make big moves. You can trade these stocks with FBS (learn more) and make money!

Tuesday, October 15

Citigroup

EPS forecast: $1.95

Revenue forecast: $18.52B

Citigroup is the forth fourth biggest of the four “too big to fail” American banks. It has a long history of reporting better-than-expected earnings: that happened during the past 18 quarters. This time, analysts expect the bank to once again deliver good results. Apart from earnings per share and revenue, investors will look at Citigroup’s margins (the bigger, the better for the stock) and the buyback program (the bigger, the better for the stock).

Technically, this year the stock of Citigroup has performed rather well after having a bad 2018. The price has firstly recovered 50% of the last year’s decline and then consolidated in a broad range between $61 on the downside and $73 on the upside. However, Citigroup still didn’t manage to regain the highs of 2018 as bank stocks, in general, are pressured by the falling interest rates. Now it’s closer to the upper border of this sideways range, in the $70.00 area: the stock got support from the 50- and 100-week MAs at $65 and $68.25. Notice, however, that both weekly and daily MAs are horizontal. This means that the price lacks overall momentum. The movement after the earnings report should be tied to the mentioned technical levels.

JPMorgan

EPS forecast: $2.45

Revenue forecast: $28.46B

JPMorgan Chase is the biggest US bank by market value. Its stock gained more than 100% during the last 5 years and has reached the record high of $120.40 in September. The bank has been going through the period of global economic uncertainty really fine. This year, its earnings per share have twice managed to beat analysts’ expectations by impressive 12.8%. As for the upcoming release, EPS and revenue are expected to show an annual growth of 4.7% and 2.6% respectively but come out lower than in the previous quarter.

All in all, JPMorgan is the leader of the American financial industry with a big market share in credit cards, investment banking, private banking, and consumer deposits. It’s already a stable business, and the bank is trying to strengthen it even further by adding 400 new branches and enhancing digital banking capabilities for consumers.

Technically support lies at 112.50, 110.00 and 108.90, while resistance is at 120.00.

Wednesday, October 16

Bank of America

EPS forecast: $0.55

Revenue forecast: $22.59B

The expectations for the Bank of America’s financial results are much worse than for those of Citigroup and JPMorgan. According to the forecasts, EPS has declined by 12.12% y/y, while revenue might have contracted by more than 2.5% y/y. Apart from the bank’s profit margins, traders will be watching BofA’s loan portfolio: an increase in the number of delinquencies or defaults will be a discouraging factor.

The stock has been trading sideways between $31 and $26 since the start of the year. The price is near the middle of this range and its fluctuations become narrower. In the near term, resistance is at $29.70 ahead of $30, while support is at $28.55 (200-day MA) and $27.55.

IBM

EPS forecast: $2.67

Revenue forecast: $18.23B

IBM is trying to find a new place in the market as it’s shifting towards cloud computing. Recently it has completed the acquisition of the cloud software firm Red Hat. Such a proactive approach makes IBM look attractive. Investors will look for the positive effects of this transition in the company’s report. In addition, they will want more details about IBM’s plans for the future. Notice that the firm’s financial results for the previous quarter were quite good, so the positive mood looks well placed.

The general bias for the stock has been negative for many years. What we see now is a bullish correction that may grow into something bigger. There’s a 200-week MA at $147.85 and the resistance line from 2017 around $150: it won’t be easy for bulls to overcome these levels. Support is located at $137.30 (200-day MA) and $134.90 (50-week MA).

Netflix

EPS forecast: $1.03

Revenue forecast: $5.25B

The stock of Netflix is down by more than 10% since the last earnings report when its subscriber growth was a big disappointment. The streaming company’s life has become harder as giants like Apple and Disney became its competitors. As a result, besides looking at financial numbers, investors will closely watch subscriber statistics as well as the amount of original content produced by Netflix. The latter is what’s making Netflix attractive to viewers.

The most recent leg of the stock's decline started in July. Only at the end of September, the price managed to find support around 78.6% Fibonacci retracement of 2018-2019 advance in the $263.00 area and recovered to $285. There, however, the price ran into the resistance of the declining 50-day MA. The next obstacles on the upside are at $300 and $307.25.

Friday, October 18

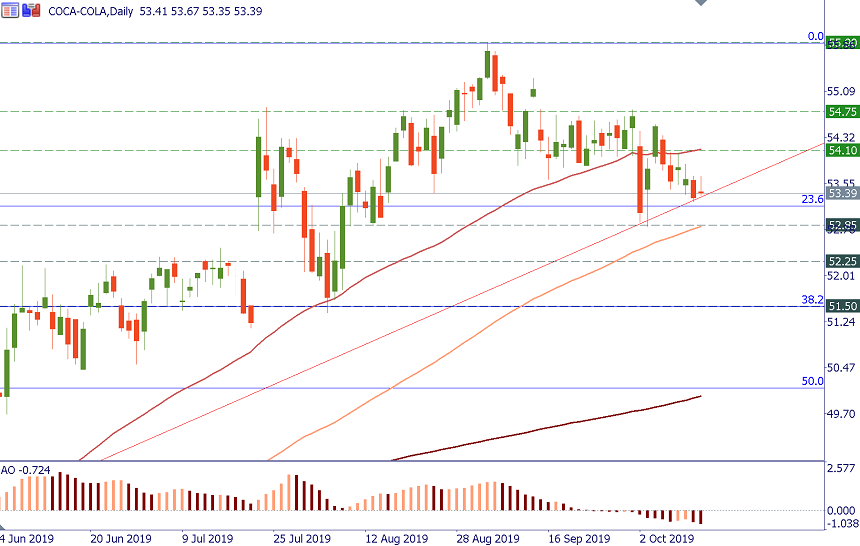

Coca-Cola

EPS forecast: $0.56

Revenue forecast: $9.45B

Analysts expect that just like in the first two quarters of the year, the beverage giant will report fine figures for the Q3: although they forecast EPS to fall by 3.5% y/y, revenue is projected to rise by 15% y/y. Coca-Cola’s sales have been increasing so far as the company joined the market of low-sugar sodas and iced coffees.

The stock has corrected down from the last month's high and is currently testing the uptrend support which has been in place since the end of February. The important support also lies at 52.80 (100-day MA). The next levels to watch on the downside will be at 52.25 and 51.50. Resistance lies at 54.10 and 54.75. Only the rise above the latter will resume the uptrend and allow the price to get to September high at 55.90.