Oil near $130 is a nightmare for inflation

Oil markets were under great pressure amid increased demand and falling supply. OPEC+ is unable or unwilling to achieve its self-imposed production targets and insists on limiting production increases by 400,000 barrels per day despite rising prices. In addition, US producers are unable or unwilling to increase US oil supplies.

Inflation is a number one concern for the markets and everyone has a right to fear. Inflation in the US has jumped to a 40-year high of 7.5%. Inflation in the Eurozone hit an all-time high at 5.8%. It is not much different in the UK, where inflation has reached 5.5%, the highest level in 30 years.

The war between Russia and Ukraine has only made matters worse. If Russian oil and gas supplies are interrupted due to sanctions or by order of the Kremlin to respond to the sanctions, this could drive prices crazy, even before we see an actual impact on demand from the disappearance of Russian oil from the market.

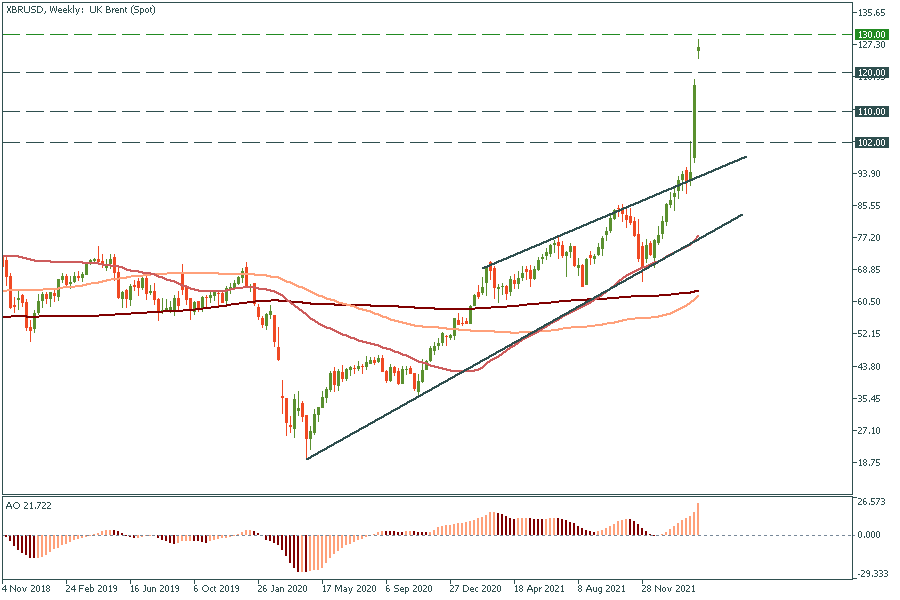

Crude oil soars towards $130 a barrel

Although the sanctions imposed by the West so far do not target Russian energy exports, after the Russian invasion of Ukraine, Russian shipments became toxic for most traders, insurance companies, and tanker owners. Some refiners and traders are concerned about how financial transactions will work after Russian banks are excluded from the SWIFT system. Others are running away to avoid harming their reputation.

To what extent may oil prices rise?

JPMorgan thinks that 66% of Russian oil will struggle to find buyers and expects crude oil prices to reach $185 by the end of the year if Russian oil remains without a buyer. If the Russian energy sector comes under sanctions, or if Germany moves to halt Nord Stream 2 gas pipeline, and if the US fails to reach a nuclear deal with Iran, all of these factors could curb global oil supplies. Together, they will push prices up even more.

What does oil above $125 mean for inflation?

If energy prices go up, inflation will be the first to be affected. This will have fatal consequences for Russia, but it will also increase cost-of-living pressures in the West.

Even before oil prices rose above $110 a barrel, analysts lowered growth forecasts and raised inflation estimates. If Russian energy sector is included in the list of targets, this will mean oil and gas will be more expensive for longer. In the scenario of the oil reaching $150 and remaining above $100 until early 2023, the pressure on consumers will increase. The economy and businesses will also be hit hard, with higher energy costs and lower demand hurting profits. This will increase the risk of turning the economic slowdown into a recession with growing inflation globally.

The US inflation to where?

It is still unknown how the US economy will respond to the oil shock that has sent crude oil prices above $125 a barrel.

The US economy can withstand six months of oil prices at an average of $100, although it may deepen the inflation problem. However, it is almost certain that if oil remains around $125, it will lead to a halt in growth and higher unemployment rates, which could turn into a recession. Another question is how central banks will respond to rising oil prices. Federal Reserve Chairman Jerome Powell said events in Ukraine would not stop the US central bank's plans to start raising interest rates. What is not yet clear is the extent and the speed of rate hikes.

Finally, the economic impact of the invasion of Ukraine will come in the form of slowing US economic growth with higher inflation, while the European economy may enter a recession. Russia will plunge into a deep double-digit recession.

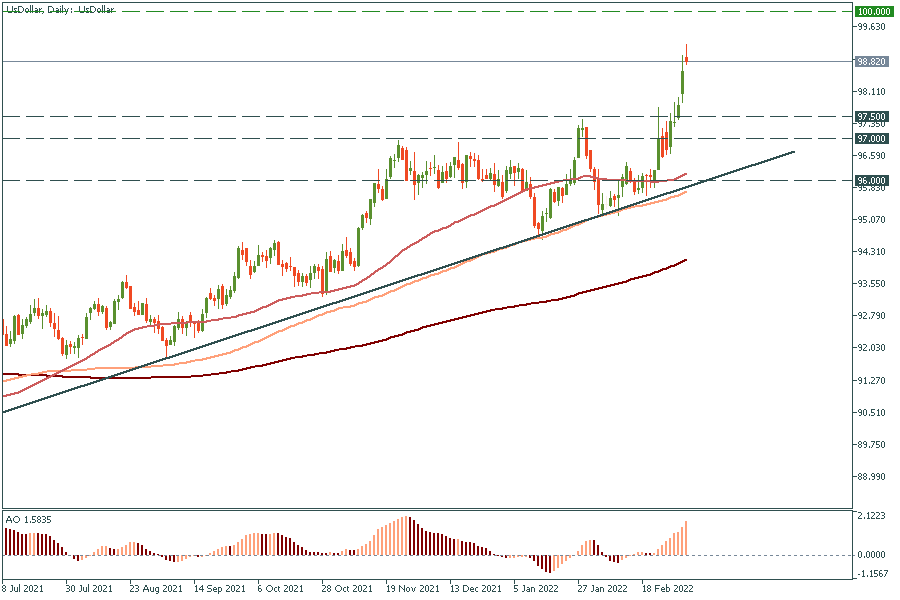

The US dollar index rose to 99.00. For now, the greenback enjoys safe haven demand. Support is at 97.50.