Is the NZD under real risk?

The downward trend of the New Zealand dollar started in the middle of April 2018 and has been continuing until current days. This week the NZD/USD pair reached lows of May 2016. Strengthening US dollar, weak economic data and trade war tensions weigh on the currency.

According to the Bank of New Zealand (BNZ), there are downside risks to kiwi despite the fact that it’s already trading below its fair value.

- The Bank sees emerging market prices together with rising US dollar as the biggest near-term risks for the NZD. According to the bank, the rising US short-term interest rates will be more attractive for investors than NZD rate with risks of cuts.

- The Bank says that domestic forces and the Central Bank are a big stone on the way to NZD’s growth. New Zealand economic data are weak to encourage the Central Bank’s decision on the rate hike. Furthermore, such weak data make the market price in a possibility of the rate cut. And although the BNZ doesn’t see this threat for the New Zealand currency, near-term risks invest in worries about rate cuts putting additional pressure on the currency.

- BNZ warns that New Zealand commodity prices fell as well. Moreover, BNZ’s risk appetite index declined to 56% that is down to the lowest level over the past 1,5 years.

Despite the negative assessment of the current NZD’s environment, the Bank doesn’t see reasons to be overly bearish. BNZ says that easing commodity prices won’t have a negative impact on the NZ trade. As a result, New Zealand's terms of trade will likely remain close to a record high. Additionally, fiscal stimulus will support growth over the second half so the recent soft data will be just temporary.

Although the BNZ is optimistic about the future of the NZD and the New Zealand economy, other authoritative institutions bet against the NZD.

The International Monetary Fund said that despite recent depreciation, New Zealand's Real Effective Exchange Rate is above its long-term average and the NZD is moderately overvalued. That is not a positive comment for the NZ currency.

According to analysts at JP Morgan, the idea of the rate cuts prevails in the market as the RBNZ recognized unfavorable growth forecasts. As a result, the bank bets to NZD shorts.

ANZ expects a further weakness of the NZD. According to the Bank, the price around current levels is close to where it’s supposed to be fair.

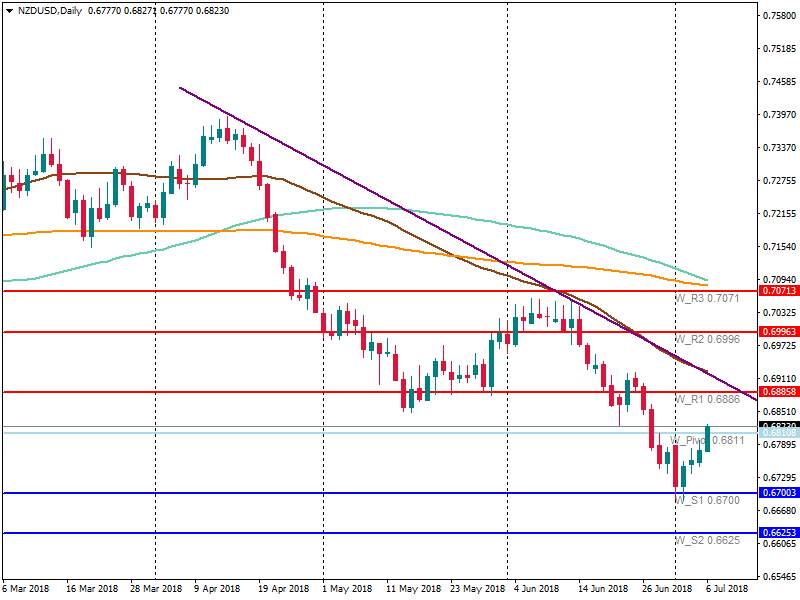

Let’s take a closer look at a technical setup in the near-term.

Up to now, NZD/USD is recovering. The pair managed to break the resistance at 0.6810. The strength of the NZD is based mostly on the weakness of the USD. If the US dollar continues to weaken, the pair will be able to reach the next resistance at 0.6885. The trendline lies at this level, so 0.6885 may become a reversal point for the pair. If the pair reaches the resistance, it will be a good sign to sell. Otherwise, a fall to the support at 0.67 is anticipated.

Making a conclusion, we can say that negative factors for the New Zealand dollar prevail. Even the major institution, the Central Bank, says about risks for the economic growth. It creates a possibility of the rate cut that is highly negative for the domestic currency. Trade wars issues put additional pressure on the commodity currencies including the NZD. Until the New Zealand economy presents more optimistic economic data, the NZD will suffer.