GOLD: US Dollar Hits Supply Zone, What Next?

Here's the latest news from Federal Reserve Chair Jerome Powell. While speaking at a conference in Portugal, Powell expressed optimism about the US economy and decreased the possibility of a recession, stating that the economy has shown resilience and is still growing, albeit at a modest pace. He acknowledged the possibility of a recession but emphasized that it is not the most likely scenario. The Federal Reserve recently paused its series of interest rate hikes after ten consecutive increases. Powell mentioned that the Fed's goal is to slow down the economy and reduce consumer demand to curb inflation, which currently stands at double the Fed's target of 2%. The policy approach seems to work, as economic activity has slowed while consumer spending and hiring remain solid. The labor market has been strong, with robust job growth in May. Despite a slight slowdown in wage increases, Powell sees it as a positive development for the fight against inflation. Overall, he believes that finding a balance without a severe downturn is the most plausible outcome.

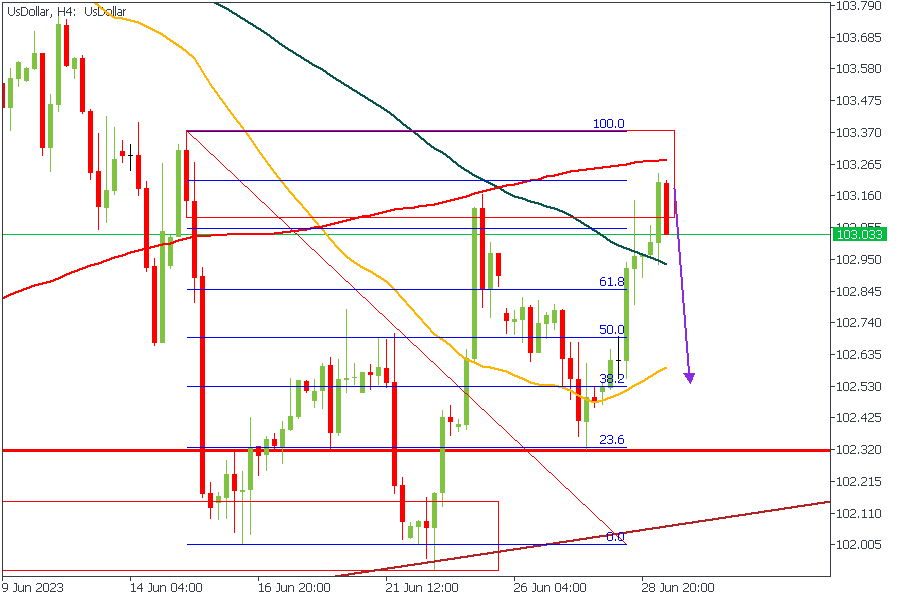

US DOLLAR - H4 Timeframe

Here on the 4-hour timeframe of the US Dollar, we see the price has now reached a supply zone; a crucial one because it overlaps the 200-period moving average while the moving averages are arrayed in descending order - from top to bottom. The implication of this is the likelihood of rejection from that zone, which would, in turn, result in a bearish impulse from the Dollar.

Analyst’s Expectations:

Direction: Bearish

Target: 102.221

Invalidation: 103.258

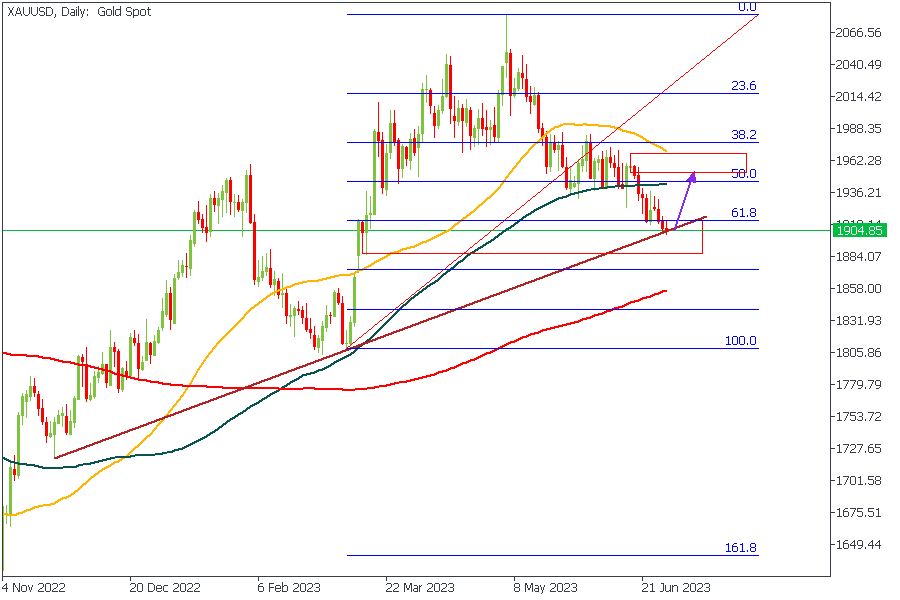

XAUUSD - D1 Timeframe

Just like we’ve discussed in several of my past pieces, the price action on the US Dollar often correlates negatively to that of the XAUUSD commodity because Gold is often used as a crucial safety net to hedge against inflationary forces and economic instability. On that note, since the price action on the US Dollar suggests a weakening USD, we can also begin to expect bullish price action from Gold. However, let’s see what the lower timeframe looks like now.

XAUUSD - H4 Timeframe

On the H4 timeframe, XAUUSD has reached an area of demand and would be looking to make a quick reversal from this zone in line with the correlation against the US Dollar. There is also trendline support cutting across this demand zone, adding a confluence to the original sentiment. As a result, I believe the price action would favor the bulls.

Analyst’s Expectations:

Direction: Bullish

Target: 1945.73

Invalidation: 1885.80

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.