EUR/USD: outlook for June 5 - 9

EUR/USD currency pair was trading in a horizontal band during the past week as investors await the European Central bank’s meeting on June 8. ECB policymakers are set to strike a cautious tone about future tightening of monetary policy because of doubt around inflation. Preliminary data released on Wednesday fell short of market expectations having posted 1.4% in May which is well below the bank’s 2% target. The ECB president Mario Draghi said on Tuesday that a massive monetary policy stimulus is still needed to fight with weak inflation figures. On Friday, EUR/USD regained its strength following a bit disappointing US labor market report. The nonfarm payrolls revised to 138K from expected 182K. Wage growth was mediocre, while the jobless rate fell a bit lower to 4.3%. in general, the report wasn’t so bad. It shouldn’t prevent Fed from raising rate at its June meeting.

Apart from the ECB meeting, we will receive the Eurozone countries’ PMIs and industrial production figures on Monday and Friday respectively. Political turmoil in the US seems to come back to life next week as the former FBI director Comey is scheduled to testify in an open and closed session on June 8 before the Senate intelligence committee which is currently investigating into possible collusion between Russian entities and Trump’s election campaign.

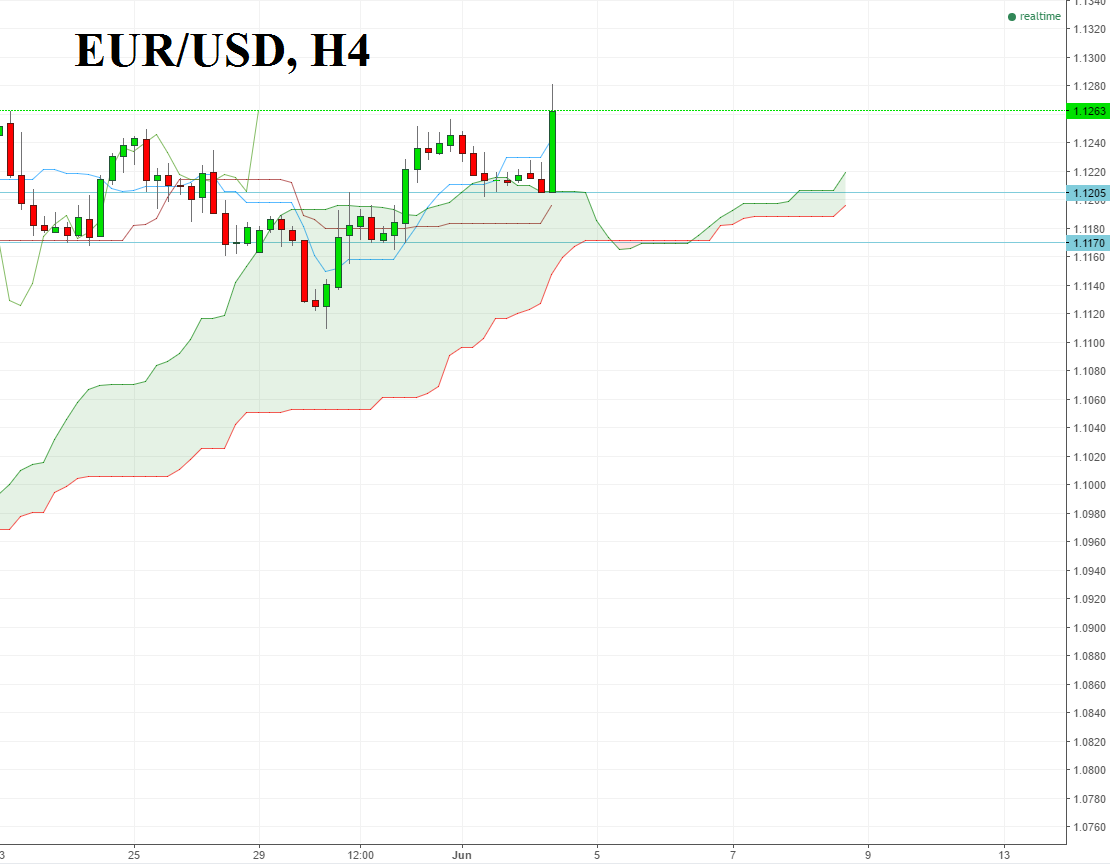

At the present moment, the pair is trading at 1.1265. The undertone for the single currency is still positive, but only a clear break of 1.3000 will indicate that EUR/USD has entered into bullish phase. The key supports are located at 1.1205, and at 1.1170.