1. Safe-haven demand & geopolitical tensions

Gold is trading around $3,339–$3,350/oz, buoyed by elevated safe-haven flows amid US tariffs and unrest in the Middle East. Central banks—especially in Asia—continue to stockpile gold, reinforcing structural demand.

2. US economic data & dollar-yield dynamics

Robust US data (retail sales, jobless claims) and rising Treasury yields have boosted the dollar, weighing on gold in recent sessions. Traders expect Fed rate cuts in September, but current inflation fears remain a headwind.

3. Technical picture & trade setup

Gold is consolidating between $3,323 (50‑day SMA) and $3,400. Support lies near $3,323–$3,330; resistance sits around $3,375–$3,400. A break above $3,375 could target $3,440, while a drop below $3,323 may bring $3,300 into view.

Summary: Gold remains range-bound near $3,330–$3,375, supported by safe-haven demand and central bank buying, but capped by dollar strength and yields. Key catalysts include US inflation reports, Treasury auctions, and trade-policy headlines.

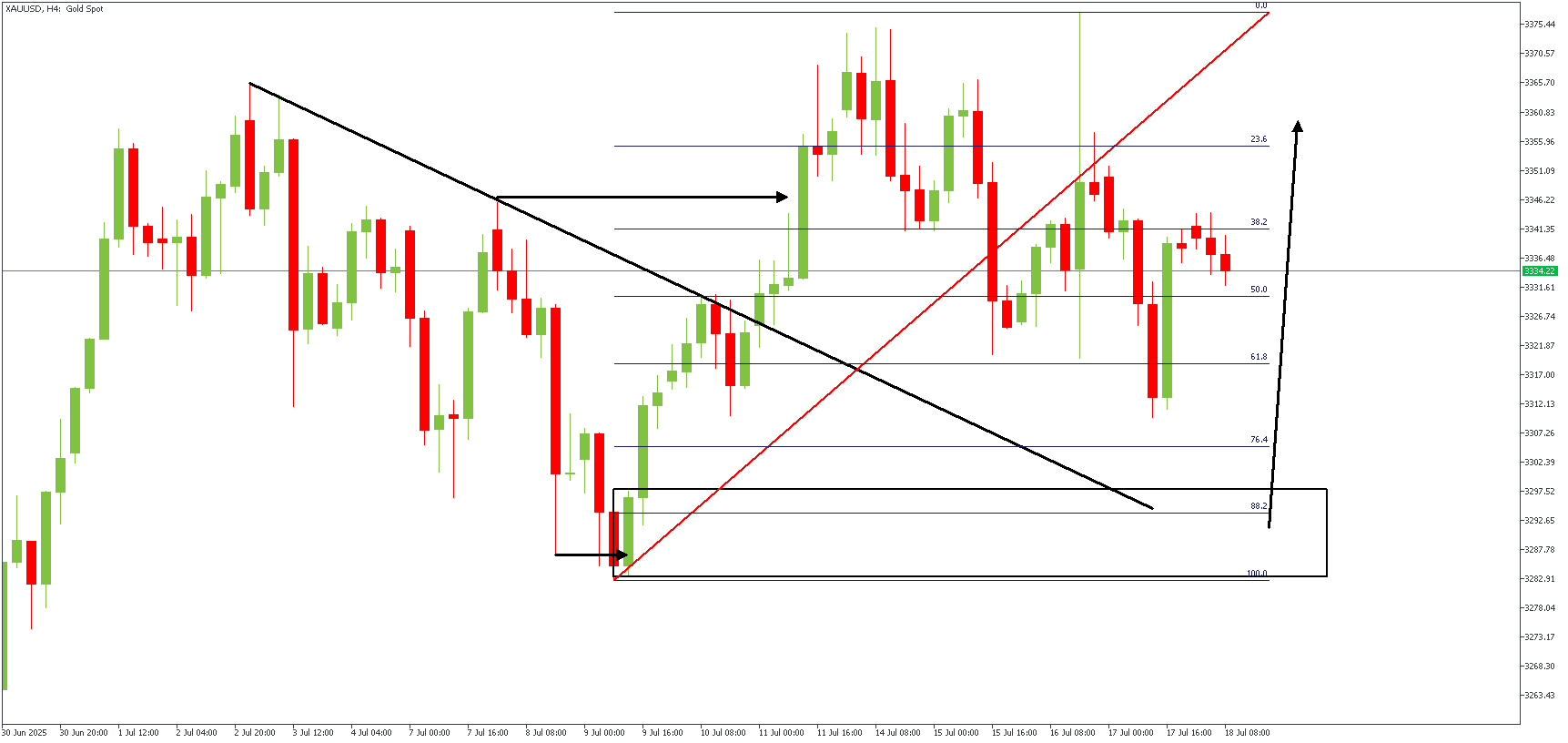

XAUUSD – H4 Timeframe

On this XAUUSD 4-hour chart:

- Price broke out of a falling wedge (black trendline) with strong bullish momentum.

- A bullish impulse followed, and we are now in a retracement phase, respecting Fibonacci levels.

- Price is currently hovering around the 38.2%–50% retracement zone.

- A bullish demand zone (highlighted box) lies between the 88.2% and 100% Fib levels—a strong confluence area and potential reversal zone.

My Trading Plan:

- I'll wait for price to dip into that black demand zone (near 3280–3292).

- If bullish price action forms there (engulfing, pin bar, etc.), I'll go long, targeting a retest of the recent high (around 3375+).

- I'll stay out and reassess if price breaks below the demand zone.

This setup assumes the broader uptrend remains valid and demand holds. The tight Fib cluster + structure = high-probability reaction zone.

Direction: Bullish

Target- 3359.94

Invalidation- 3273.68

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.