Fundamental Factors Affecting the Japanese Economy & Yen

- Rate Cut Looming Despite Rising Inflation Expectations

- BOJ survey shows 86.7% of households expect price increases, the highest since June 2024.

- Wage and price hikes are finally materializing, suggesting Japan may be close to sustainable inflation—usually a trigger for rate hikes.

- However, geopolitical shocks (Trump's tariffs) have derailed the hiking narrative.

- Tariffs Trigger Shift to Easing

- Trump's 125% tariffs on China and other reciprocal trade measures have revived global recession fears.

- Markets recall the August 2024 crash following an earlier round of tariffs—leading analysts to predict that the BOJ may cut rates imminently (possibly today or tomorrow) to stabilize sentiment.

- Naomi Muguruma of MUFG has pushed back her rate hike forecast by six months to January 2026.

- Tightening QE, Shrinking BOJ Footprint in Bond Market

- BOJ began reducing bond purchases last year, targeting a 7–8% cut by early 2026.

- Focus has shifted from short-term JGBs to super-long maturities, starting last month.

- The Ministry of Finance is now seeking foreign buyers to plug the demand gap.

Key Takeaway for Traders

- BOJ Rate Cut = Likely Today or Tomorrow. If delivered, it could trigger a broad risk-on rally—especially in Japanese equities, global bonds, crypto, and gold.

- However, structural pressure on the yen will persist, particularly if foreign inflows don't fill the bond-buying gap left by BOJ.

- Risk: If Japan's inflation expectations keep rising, today's easing could backfire long-term, leaving the BOJ with even fewer options if the trade war intensifies.

GBPJPY – D1 Timeframe

.png)

The price action on the daily timeframe chart of GBPJPY shows an initial bullish break of structure, followed by a steady retracement towards the drop-base-rally demand that gave off the initial bullish momentum. On this basis, I am inclined to search for confluences in favor of the bullish direction on the lower timeframes.

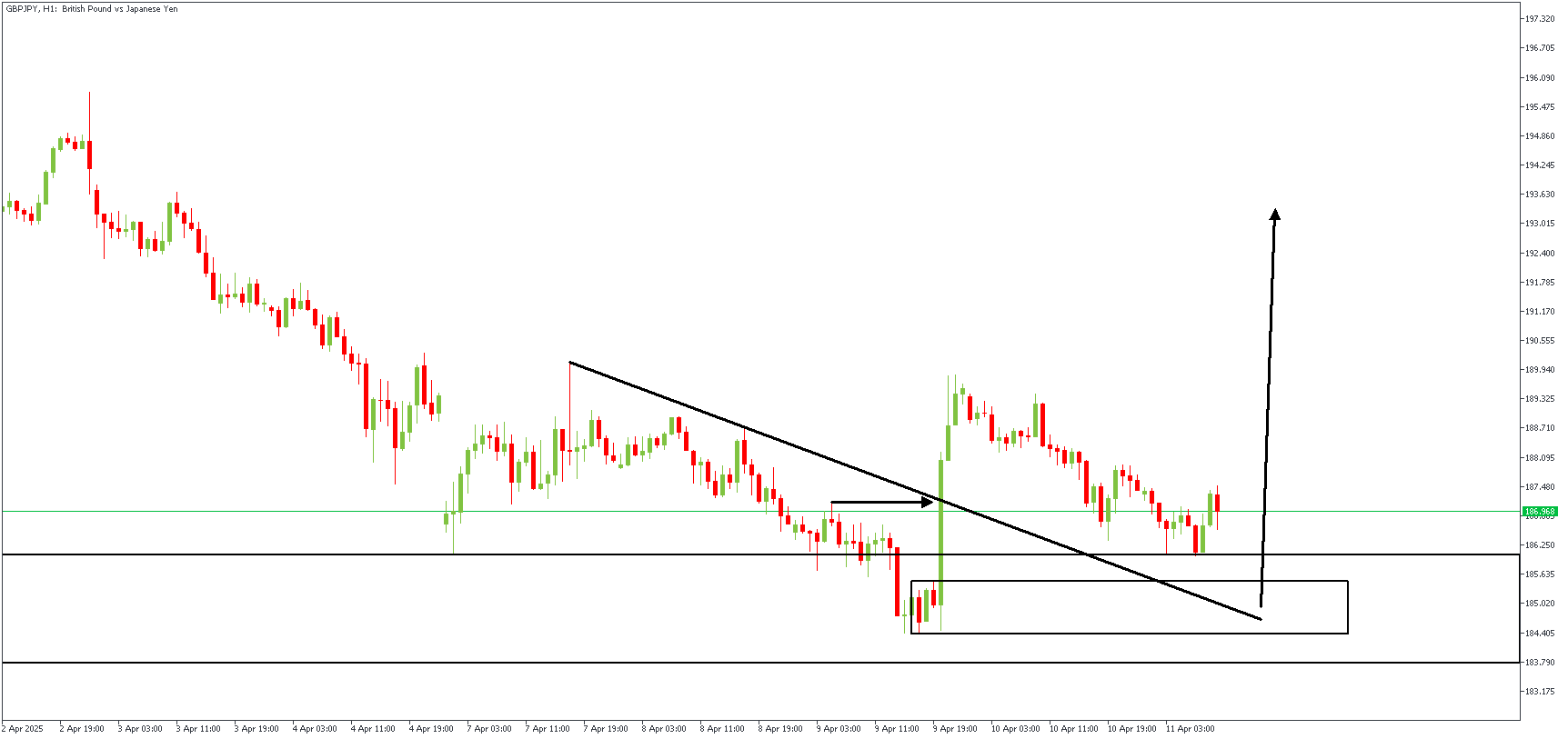

GBPJPY – H1 Timeframe

On the 1-hour timeframe chart of GBPJPY, we see that the recent bullish reaction from the daily timeframe demand zone sparked a bullish impulse that broke both the bearish market structure and the trendline resistance. On this note, waiting for a retest of the 1-hour demand zone within the daily timeframe demand region is the requisite confirmation for entry.

Analyst's Expectations:

Direction: Bullish

Invalidation- 183.670

Target- 193.311

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.