The concept of support and resistance is essential for traders. Support and resistance represent areas where the price action is expected to face obstacles. Let’s study this in detail.

Support is a price level where the falling price tends to slow down or reverse. This means the price is more likely to “bounce” off this level rather than break through it. However, once the price has passed this level, it will likely continue dropping until it finds another support level.

Resistance is a price level where rising prices slow down or reverse. The price will likely bounce back from this level rather than a breakthrough. However, a break above this level opens further price growth until it finds another resistance level.

How to trade?

Support and resistance allow traders to guide themselves through the market. Once you mark these levels on the chart, you will see the market structure and be able to predict the direction of the price’s next steps and their size.

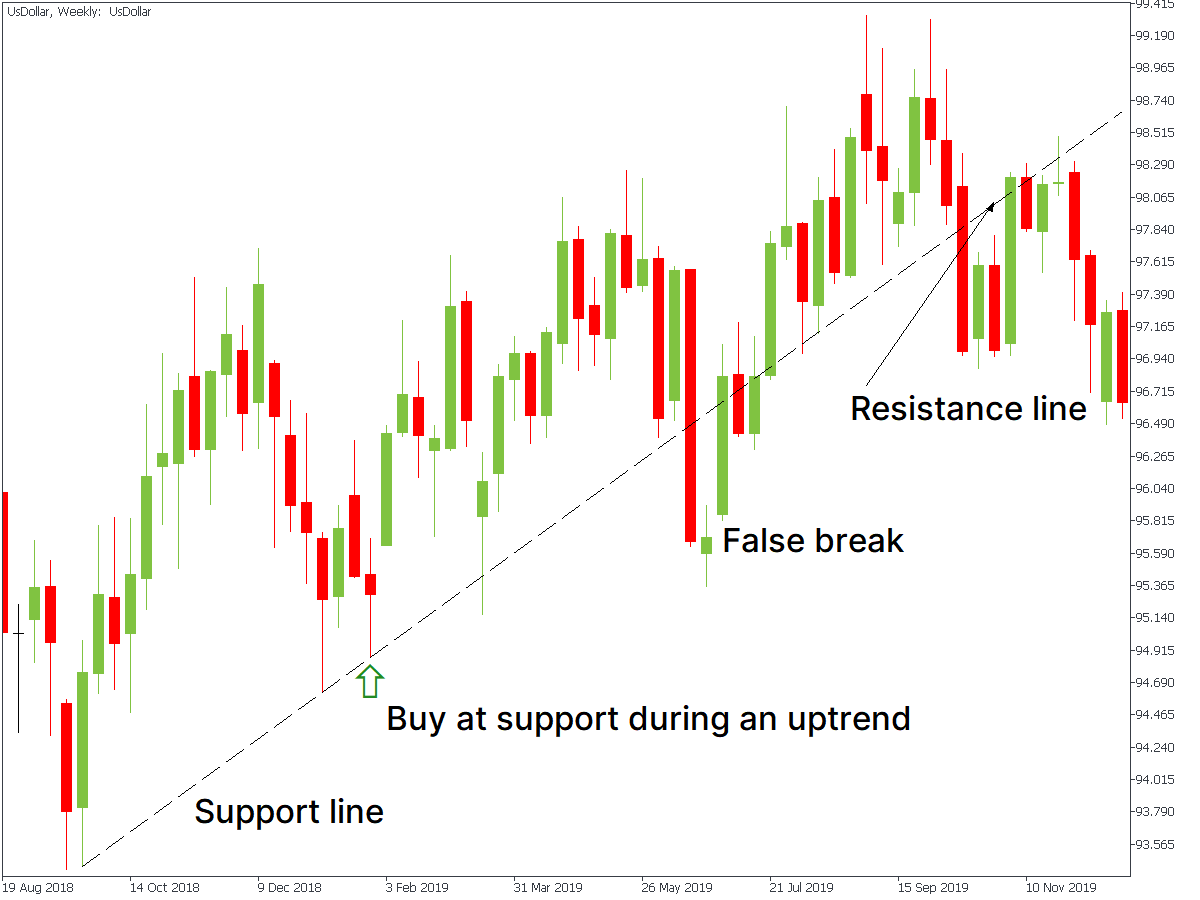

The idea is that these levels will likely stop the price action and make it reverse. As a result, it’s a common approach to open buy trades at support and sell trades at resistance. Support and resistance levels also give a trader a hint of where to close a trade. Thus, if you have an open selling position and the price is approaching a support level, you might consider closing your trade. The same thing is with a buy trade – when the price approaches the resistance level, it may be time to close your trade.

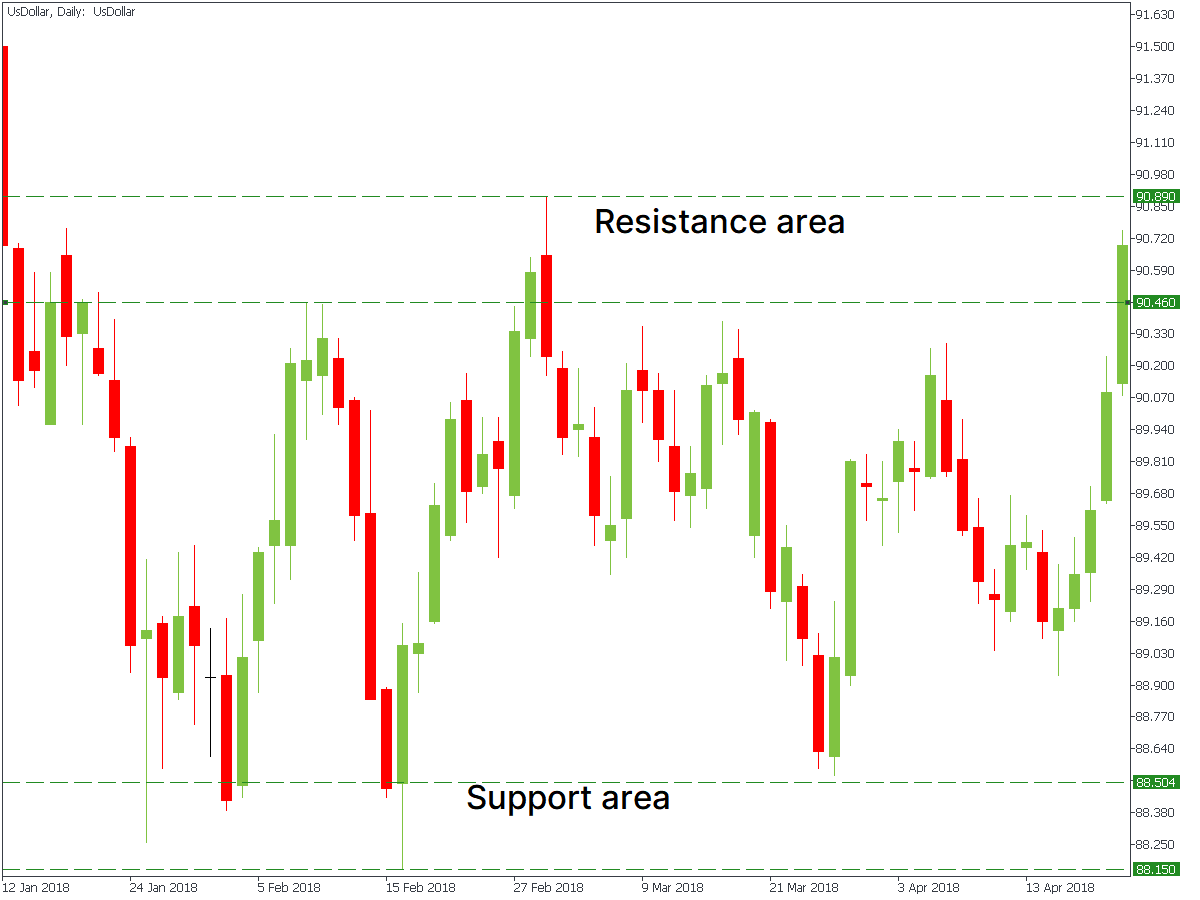

Support and resistance can be located in every timeframe. Yet, keep in mind that the bigger the timeframe, the more important the support/resistance level is. In addition, although we talk about levels here, trading is not a precise science, so you need to think about support and resistance as an area. When you’ve identified support or resistance, you need to include a couple of pips around it. This will help you make your trading more accurate.

How to draw inclined support and resistance lines

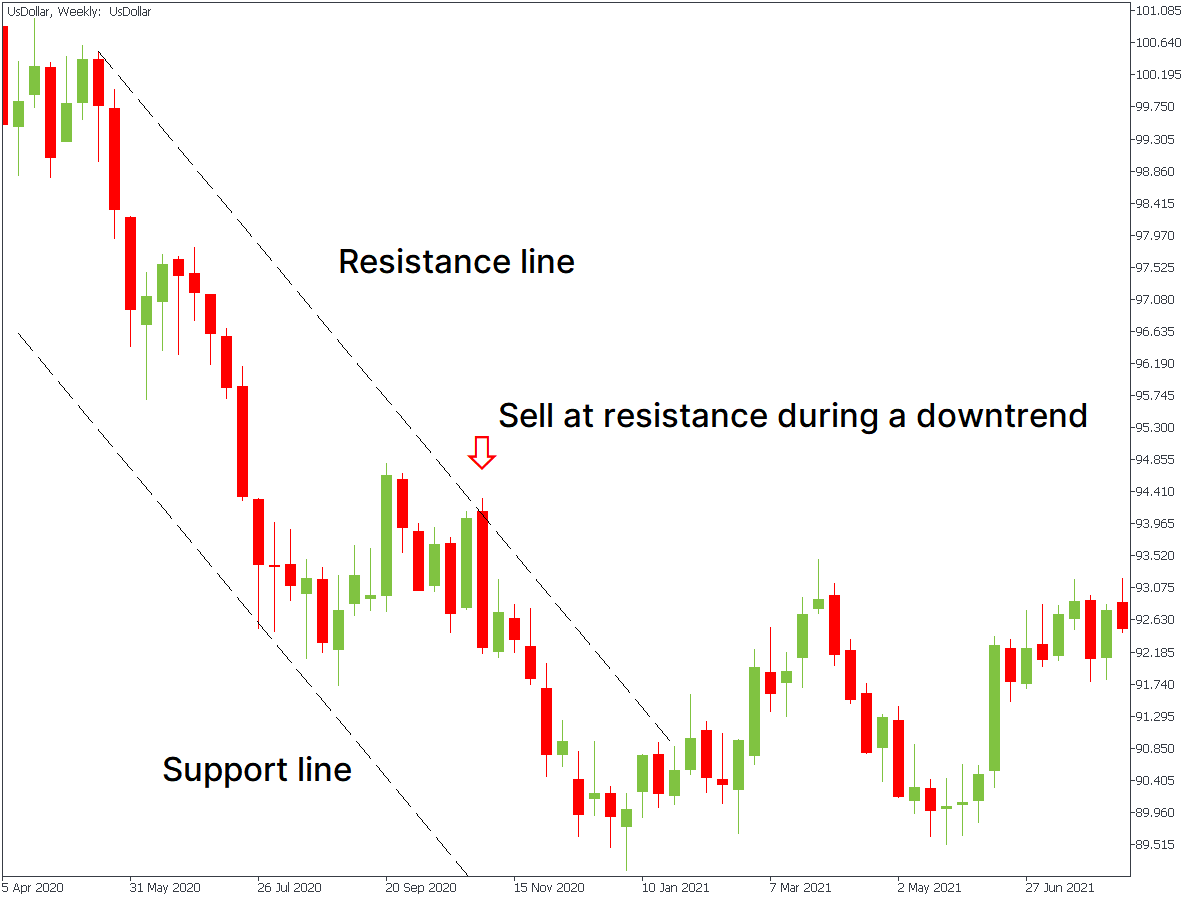

Support and resistance come in different forms. Firstly, there are the diagonal trendlines. A trendline can connect the price’s highs and limit the trend on the upside. In this case, this trendline is called a resistance line. A trendline can also be drawn through the lows of the price chart and limit the price action on the downside. Such a line is called a support line.

Support and resistance lines can be drawn in both uptrends and downtrends. You need at least two highs or two lows to draw a trendline through them. You can find more information about drawing trendlines.

As the market is constantly moving, support and resistance lines and levels often switch places. As you can see in the picture below, after the price fell below the support line, it started to act as a resistance line.

Horizontal support and resistance levels

There are also horizontal support and resistance levels. One of the simplest and most effective ways is to draw them through the previous highs and lows of the price chart:

Other experienced traders also use moving averages, Fibonacci levels, pivot points, etc., to identify support and resistance levels.