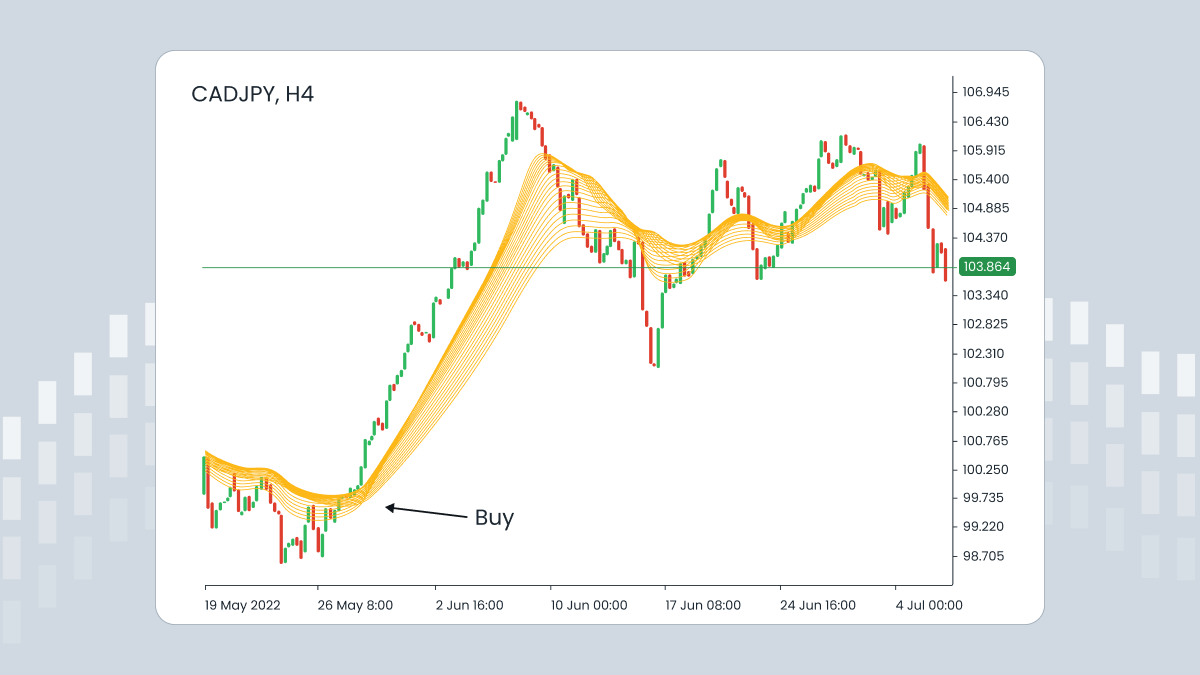

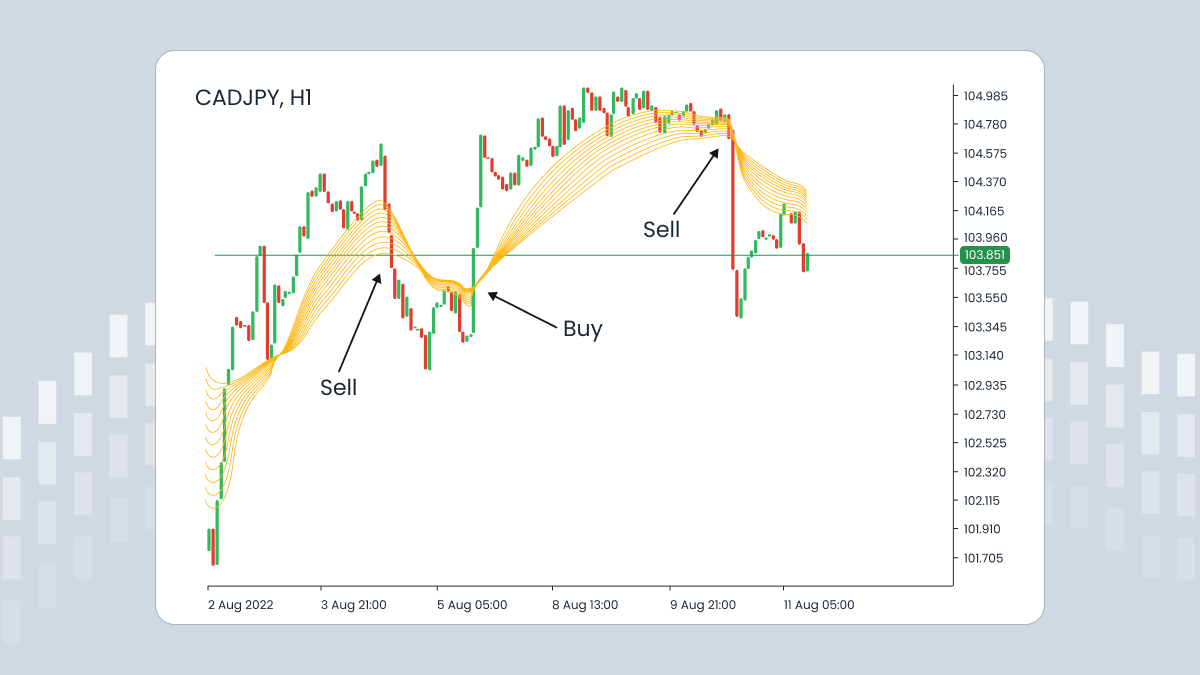

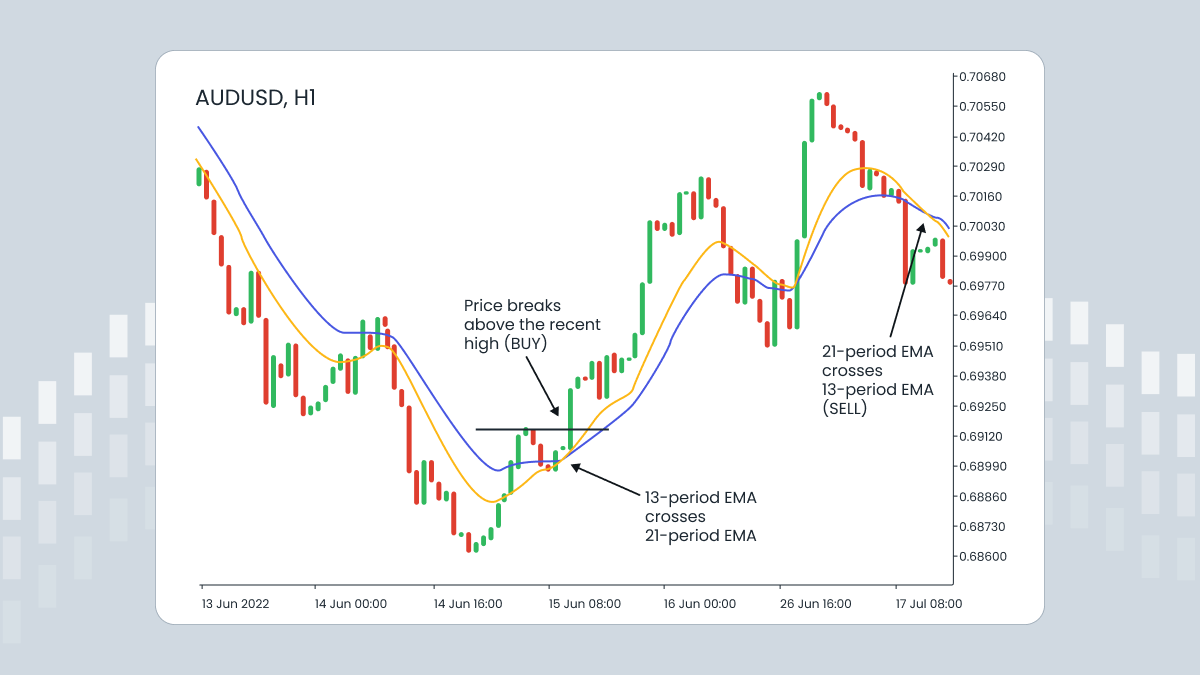

Moving averages are tools frequently used in trading strategies. When used correctly, they can be of great advantage. This article covers the difference between EMA and SMA, calculating exponential moving average, setting the EMA for trading, and using EMA-based strategies.

What is the simple moving average?

The simple moving average (SMA) shows the average of a selected range of prices. It is calculated by adding the most recent prices and dividing the resulting number by the number of periods in the calculation average.

What is the exponential moving average (EMA)?

While the SMA gives equal weight to all values, the exponential moving average (EMA) provides a higher weighting to recent prices. Because the EMA gives more weight to current data than older data, it is more reactive to the latest price changes than the SMA. For that reason, some traders prefer this type of moving average.

The other two types of moving average are smoothed weighted and linear weighted.