Forex market is open 24 hours a day, five days a week. Trading sessions correspond to when stock markets are open in a particular world region. Usually, trade volume is higher at the intersection of the sessions. Forex trading time always begins in Australia and New Zealand and then spreads to Asia. Then, it’s Europe’s turn, and finally, the United States and Canada join in.

You can trade anytime you wish during the business week. You can open your currency position for a couple of hours or even less (intraday trading) or for a couple of days (long-term trading) – as you see fit.

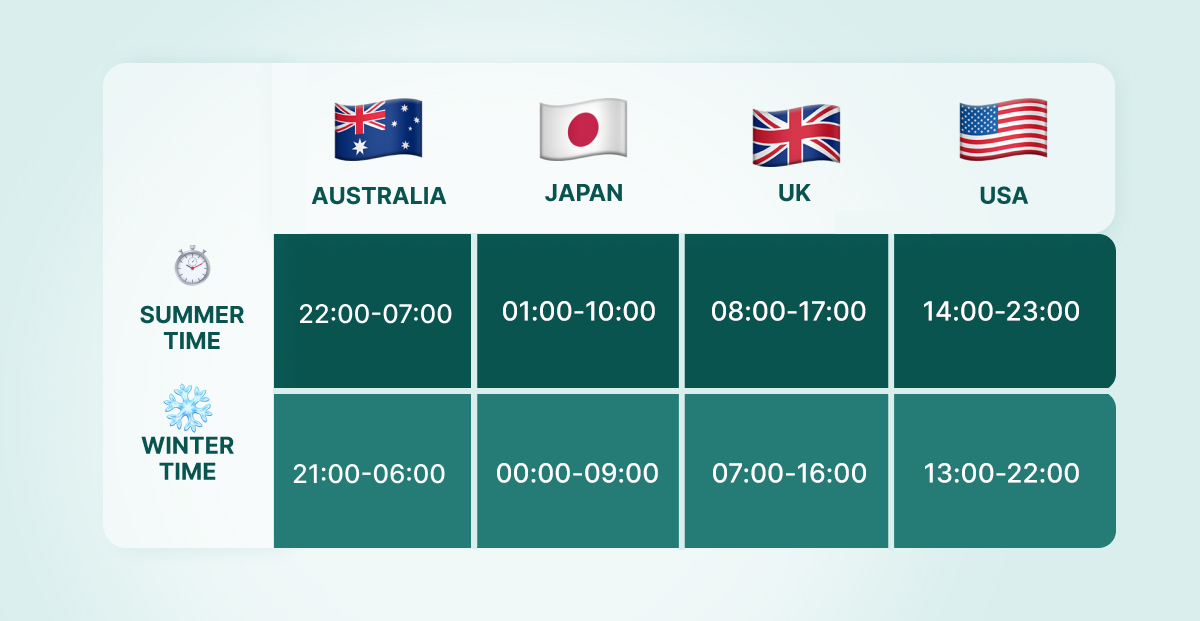

Approximate time of trading sessions (GMT)

There are four types of Forex trading sessions: Australian (Sydney), Asian (Tokyo), European (London), and North American (New York). Some traders refer to them by the continents’ names, while others identify them by their capitals.

The trading week starts on Monday morning in New Zealand, while it’s still Sunday for the rest of the world.

The Australian trading session lasts from 21:00 to 06:00 (UTC+0);

The Tokyo trading session starts at midnight and ends at 09:00 (UTC+0);

The London trading session lasts nine hours, from 07:00 to 16:00 (UTC+0);

Finally, New York Forex market hours are from 13:00 to 22:00 (UTC+0).

Traders usually focus on one of four Forex trading sessions.

The New York and London trading sessions are the busiest. Some traders consider the period between the London and New York trading sessions the best time for Forex trading due to active markets.

On the contrary, the time between 19:00 and 22:00 (UTC+0) has the lowest volatility. This happens because most American traders leave the market, and the Australian traders step in.

It’s essential to keep in mind Daylight Saving Time (DST). This is the practice of setting the clocks an hour back in the fall and an hour forward in the spring.

Due to this, the Forex market timings are different in the summer and winter. The figure below shows trading times in the UTC+0 time zone.

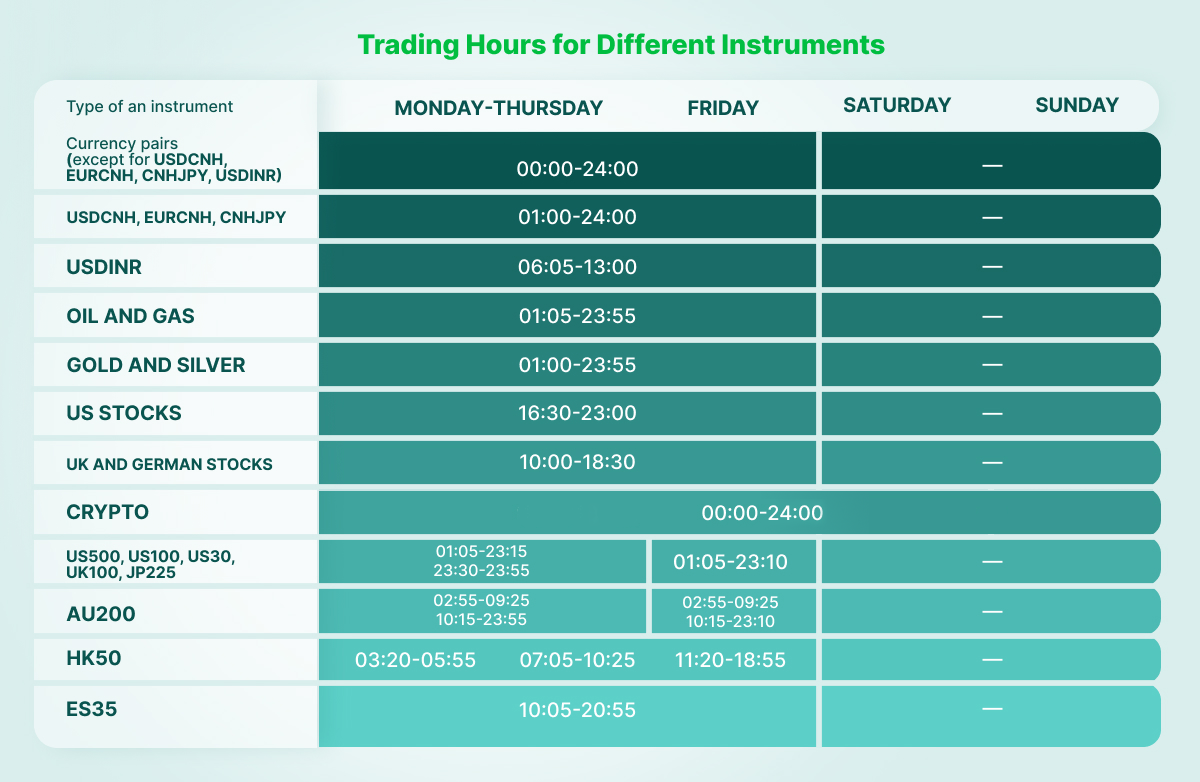

Trading schedule for different instruments

You need to remember that the trading schedule differs for different types of instruments. While most Forex pairs are open for trading non-stop Monday to Friday, there are some exceptions.

Such instruments as metals, oil, gas, US stocks, and indices are traded Monday to Friday, but their trading hours differ. The open time for the gold and silver (XAUUSD and XAGUSD), USDCNH, EURCNH, and CNHJPY on the Forex market is 01:00 MetaTrader time. The close time for metals is 23:55 MetaTrader time. Oil and gas prices (XBRUSD, XTIUSD, XNGUSD) open five minutes later, at 01:05 MetaTrader time.

US stock trading is available at 16:30-23:00 MetaTrader time. The UK and German stocks’ trading hours are 10:00-18:30 MetaTrader time.

Indices have a specific schedule. US500, US100, US30, UK100, and JP225 are open from 01:05 to 23:15 MetaTrader time and 23:30 to 23:55 MetaTrader time on Monday-Thursday, and 01:05 to 23:10 MetaTrader time on Friday.

AU200 is open from 02:55 to 09:25 MetaTrader time, 10:15 to 23:55 MetaTrader time on Monday-Thursday, 02:55 to 09:25 MetaTrader time, and 10:15 to 23:10 MetaTrader time on Friday.

HK50 is open thrice daily: 03:20-05:55, 07:05-10:25, and 11:20-18:55 MetaTrader time. ES30 is open 10:05 to 20:55 MetaTrader time.

Cryptocurrencies are available for trading throughout the whole week.

The table below will let you check the exact trading hours for any instrument you can trade with FBS.

The reasons for 24-hour trading

24-hour trading on Forex enables market participants worldwide to trade at any time that is convenient to them. For example, a trader from the United States can trade alongside a trader in Europe during their respective local business hours.

Forex market liquidity also plays a vital role in the non-stop trading process: traders can buy and sell currencies through a trading platform in a single click, even during off-hours.

Also, 24-hour trading on Forex lets participants take advantage of the news outside their working hours. Thus, traders can access trading instruments anytime, responding to market changes and unexpected events.

Here’s what you need to know about the trading schedule:

The Forex market allows traders to trade 24 hours a day, five days a week, with trading sessions corresponding to the opening hours of stock markets in different parts of the world.

The four main trading sessions are the Australian, Asian, European, and North American, with the London and New York sessions being the busiest.

It's important to remember that the trading schedule varies for different types of instruments. To avoid confusion, traders need to check the exact trading hours for any trading instrument they want to trade. They can find this information in the FBS Guidebook, or check the specifications of each instrument directly through MetaTrader.

24-hour trading on Forex enables traders to take advantage of news and market changes outside their working hours, with prices on the Forex market constantly fluctuating.

Thank you for reading this article, and happy trading!