Like the Awesome Oscillator, the Accelerator Oscillator was also developed by Bill Williams. Its aim is to forecast the price changes through measuring acceleration or deceleration of the current market-driving force. This is possible because, according to Williams, the price usually starts moving slower before a reversal. As a result, the Accelerator Oscillator changes direction slightly before the change in momentum. This turn may be used to forecast a price change.

How to calculate the Accelerator Oscillator

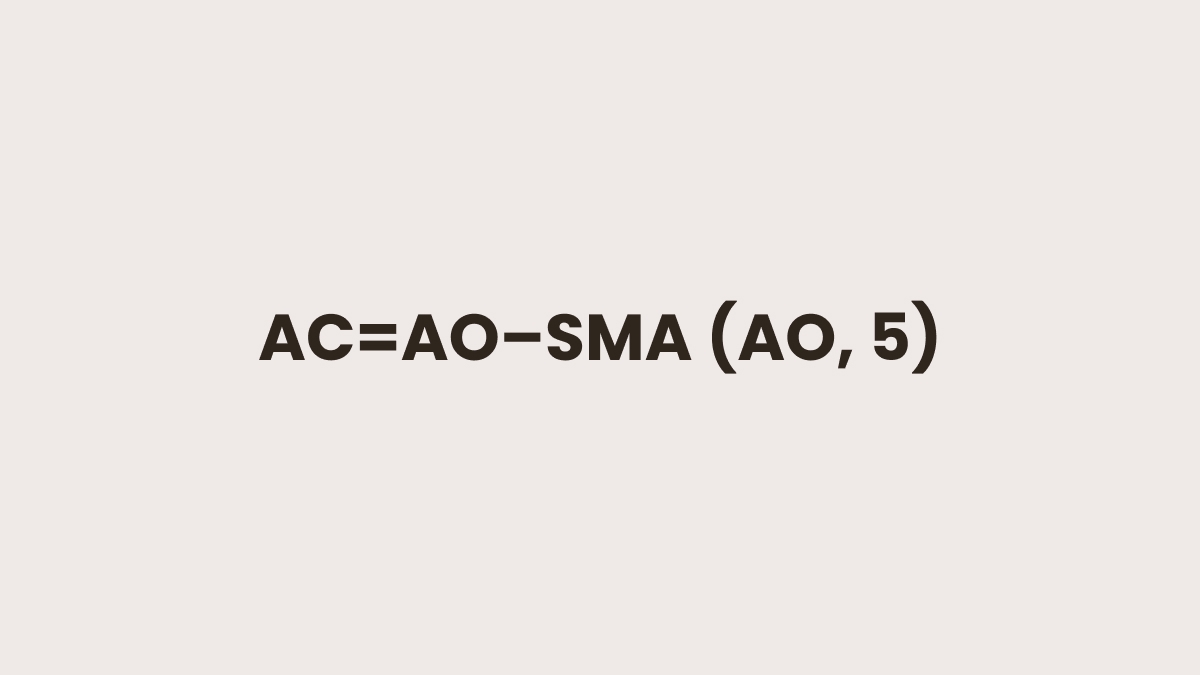

The Accelerator Oscillator is calculated as the difference between the Awesome Oscillator and the 5-period Simple Moving Average of the Awesome Oscillator.

AO – the Awesome Oscillator, which is the difference between a 34-period and 5-period SMA applied to the Median Price;

SMA ( AO,5) – the 5-period Simple Moving Average of the Awesome Oscillator.

To add it to your chart in MetaTrader, click Insert, choose Indicators, Bill Williams and then Accelerator Oscillator.

The oscillator fluctuates around central zero levels. This is a place where the momentum and the acceleration are balanced. Its bars are either green (for increasing acceleration) or red (for decreasing acceleration).

How to trade using the Accelerator Oscillator

It’s necessary to watch both the value and the color of the indicator’s bars. Note that there’s a difference between the Awesome Indicator and the Accelerator Oscillator.

Firstly, the Accelerator Oscillator helps to eliminate bad entries. You shouldn't buy if you see a red bar and you shouldn't sell if the last bar is green.

Unlike the Awesome Oscillator, it’s not a signal when the Accelerator Oscillator crosses the 0 line, although it means a change in the market (a switch from bullishness to bearishness or vice versa) and certainly contributes to a trader’s judgment.

The potential solution is to buy if there are at least 2 green bars above 0 in a row. If the Accelerator Oscillator is below 0 and you want to open a buy trade, the momentum will be against you. As a result, the entry to a long position when the indicator value is negative requires an extra confirmation: you will need 3 green bars to buy instead of 2.

The same goes for short positions. Sell when the Accelerator Oscillator forms at least 2 consecutive red bars below 0. If the red bars are above 0, you will need 3 bars to sell.

Here is an example of signals provided by the Accelerator Oscillator:

The Accelerator Oscillator and the Awesome Oscillator can be used for trade signals together with the Alligator Indicator. Bill Williams advised opening trades when the latter allows it, and using the 2 oscillators to make the trades more precise. In the picture below, the Alligator Indicator signals a downtrend. It makes sense to focus on the sell trades suggested by the Accelerator Oscillator. This will lead to better quality of market entries:

Summary

The Accelerator Oscillator is designed to measure the acceleration or deceleration of market momentum, helping traders forecast price changes. It calculates the difference between the Awesome Oscillator and a 5-period Simple Moving Average of the Awesome Oscillator. The indicator uses green and red bars to indicate increasing or decreasing acceleration. Traders can use the Accelerator Oscillator to avoid bad entries, with buy signals confirmed by at least two consecutive green bars above 0, and sell signals confirmed by two consecutive red bars below 0. It’s most effective when combined with other indicators like the Alligator.