Will GOLD (XAUUSD) Keep Dropping Still?

The price of Gold (XAU/USD) has experienced a significant sell-off, dropping to around $2,040 after failing to surpass the weekly high of $2,062. This decline occurred as investors reassess the potential timing of interest rate cuts by the Federal Reserve (Fed). The sell-off followed the release of the Consumer Price Index (CPI) report for December, which showed resilience, and hawkish comments from European Central Bank (ECB) officials.

Investors are now reevaluating the possibility of a rate cut in March, with the Fed appearing in no rush to adopt a dovish stance on interest rates. Despite inflation in the U.S. being nearly double the 2% target, labor demand remains stable, and the risk of a recession is deemed low. The current interest rates ranging between 5.25-5.50% allow the Fed to maintain a relatively restrictive monetary policy stance for the time being. The gold price is expected to remain uncertain until there are clearer signals regarding the Fed's stance on interest rates. If it fails to hold above the January 3 low of $2,030, it could face further downside pressure, potentially reaching the psychological support level of $2,000.

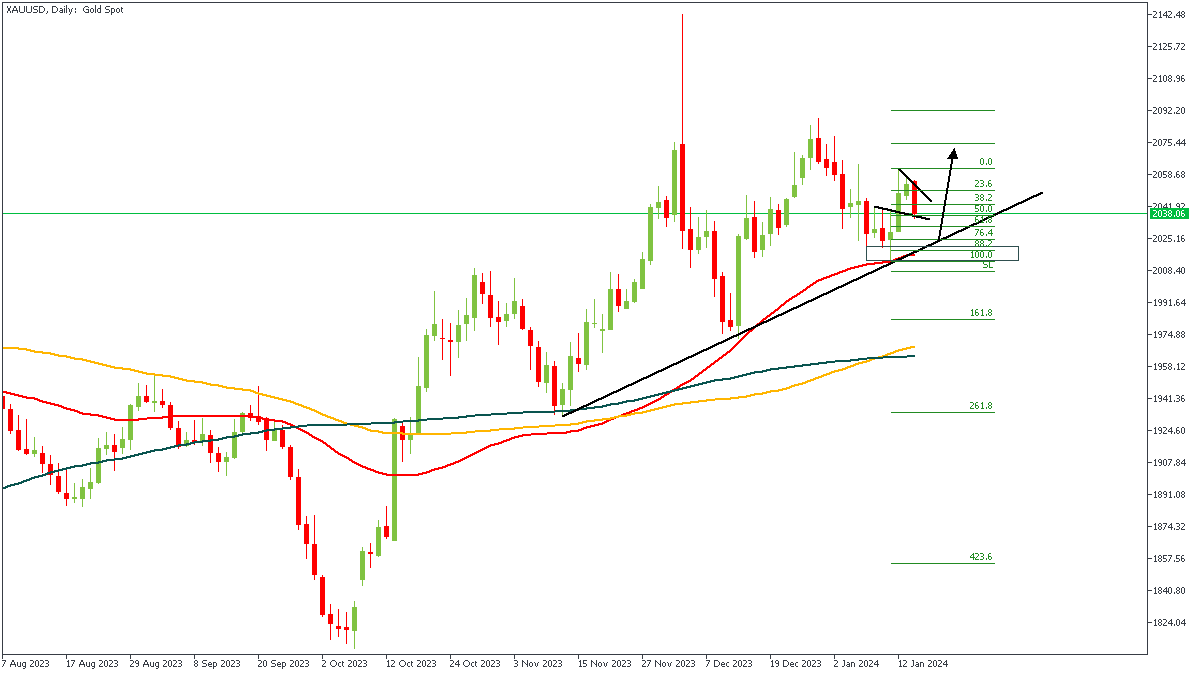

XAUUSD - D1 Timeframe

On the Daily Timeframe of XAUUSD, we see the bullish array of the moving averages indicating the likelihood of a bullish continuation. The presence of a trendline support adds further confirmation to the bullish sentiment, as well as the 76% of the Fibonacci retracement.

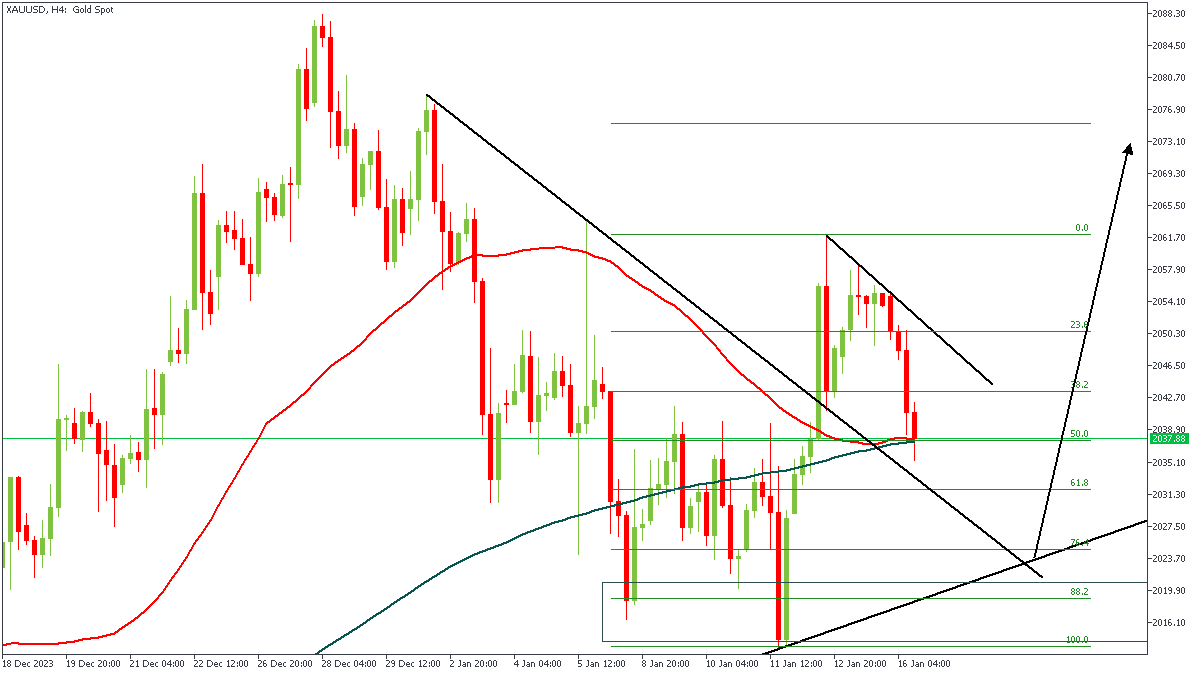

XAUUSD - H4 Timeframe

On the 4-hour timeframe of XAUUSD, we can see the intersection of support trendlines, as well as a convergence of moving averages. Based on my strategy, I can also see the presence of an inverted head-and-shoulder pattern. In summary, all factors point in favour of the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: $2050

Invalidation: $2012.67

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.