What to Trade in June

Hey guys, this is the last full trading week in May, and many forward-looking individuals like myself are already preparing themselves to seize whatever opportunities June may have in store. On this note, I will review a few commodities that have satisfied my quest for swing-trading opportunities in the coming month. Follow me!

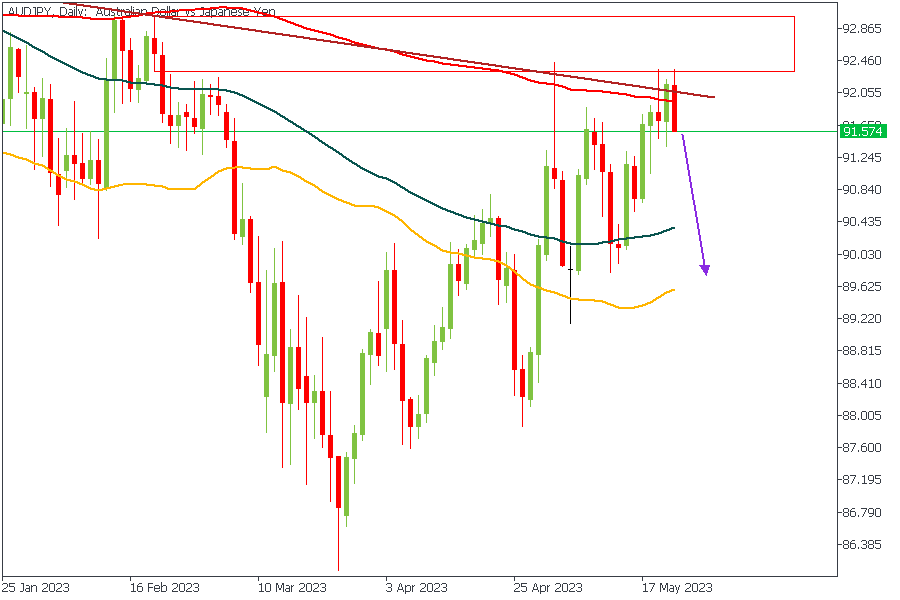

AUDJPY - Daily Timeframe

The daily timeframe of AUDJPY already gave an initial reaction from the combined resistance from the supply zone, the resistance trendline, and the 200-Day moving average. Looking at how the moving averages are also clearly arrayed in descending order, it is safe to expect a good amount of bearish volatility on AUDJPY soon.

Analyst’s Expectations:

Direction: Bearish

Target: 88.899

Invalidation: 92.373

CADJPY - Daily Timeframe

CADJPY, as shown in the attached chart, is currently trading within a rising channel, with an initial rejection from the confluence of the resistance trendline of the channel and the pivot zone. It is essential to mention that the pivot zone also doubles as a drop-base-drop supply zone. Fair warning, though, be wary of the 200-period moving average as it is still undecided whether or not it would act as a support.

Analyst’s Expectations:

Direction: Bearish

Target: 100.636

Invalidation: 102.985

EURGBP - H4 Timeframe

On the monthly timeframe, EURGBP is currently resting on the 50-period moving average, which suggests the possibility of a bullish reaction. In line with that, we see the price reacting to the support trendline on the daily timeframe, as attached above, just a few pips below the 200-Day moving average. However, the good thing about this is that traders can easily use an oscillating indicator to determine whether or not to take an entry from this point.

Analyst’s Expectations:

Direction: Bullish

Target: 0.87873

Invalidation: 0.86519

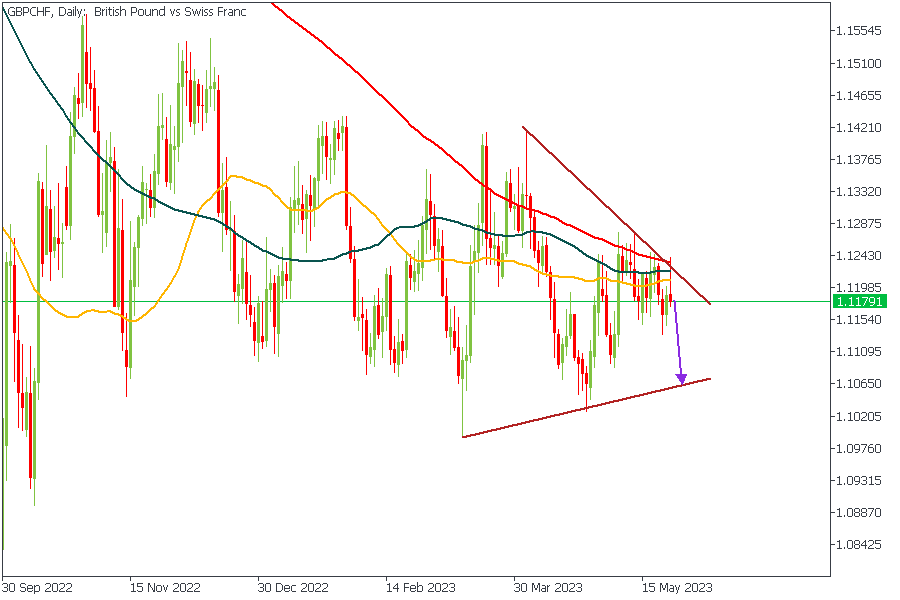

GBPCHF - Daily Timeframe

Looking at the order of arrangement of the moving averages, I'm sure you would already be able to guess my sentiment on GBPCHF - Bearish. The 200-period moving average has also greatly resisted the bullish price action. The resistance trendline's confluence serves as the final hint to figuring out the analysis.

Analyst’s Expectations:

Direction: Bearish

Target: 1.10813

Invalidation: 1.12280

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.