USD/JPY: outlook for July 3-7

The US dollar performed better against the Japanese yen than it did versus the other major currencies. The reason for that is the still dovish approach of the Bank of Japan and the rather favorable market’s risk sentiment.

Japanese retail sales slowed to just 2.0% in May, compared to 3.2% a month earlier. This is a sign that Japanese consumers are not eager to spend money. Japan’s core consumer price index rose by 0.4% on the year in May. It’s a small acceleration in price growth, but it’s still very far away from the Bank of Japan’s 2% inflation target. Moreover, core CPI in Tokyo actually stayed flat in June. Although the actual pace of the central bank’s bond purchases has declined, unlike the ECB, the Bank of Japan is still expected to maintain a great extent of monetary stimulus. This is a positive factor for USD/JPY.

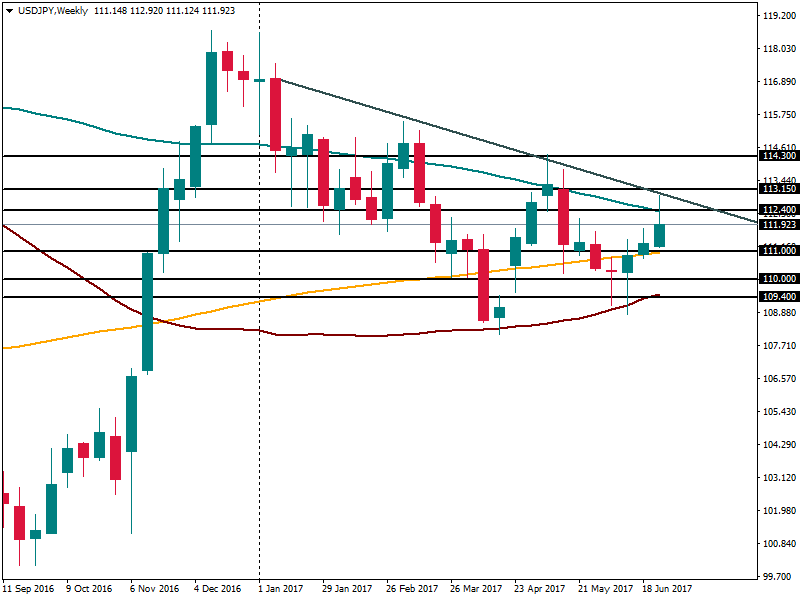

At the same time, after coming close to 113.00, USD/JPY had difficulties with holding above the 100-week MA at 112.40. A weekly close below this area will increase the negative pressure on the greenback and make it aim for support located just below 111.00 (200-week MA). Next supports will be at 110.50 and 110.00. On the upside, above 113.15 the next resistance is at 114.30 (May highs).

Positive data out of the US and hawkish comments from the Fed members can return the US currency some of its strength. As for Japanese economic calendar, pay attention to Tankan manufacturing and services indexes on Monday, the BOJ core CPI on Tuesday and average cash earnings on Friday, though American figures will be surely way more important.