USD/JPY: outlook for August 21-25

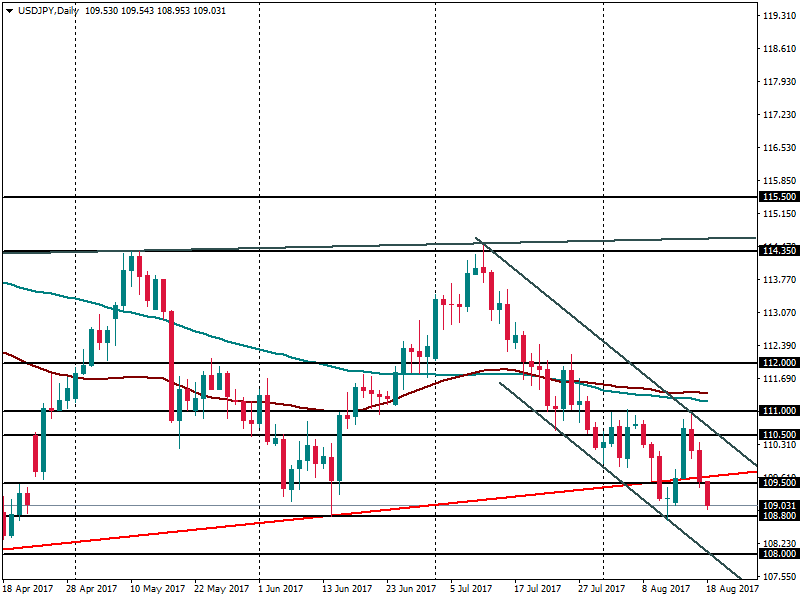

USD/JPY had a very volatile week. The pair rebounded from 109.00 to 111.00, but then was rejected down and returned to 109.00.

Japanese GDP showed the biggest expansion in more than 2 years (+1% q/q) in the second quarter as consumer and business spending picked up. However, wage growth and inflation remain subdued as companies avoid passing more of their profits to employees. Japan will release inflation figures on Friday. Although a small acceleration in price growth from 0.4% to 0.5% is expected, this is still very far from the regulator’s 2% inflation target. As a result, risk sentiment will remain the primary driver of the pair.

The market’s risk aversion is feeding demand for the safe-haven yen. Concerns over US President Donald Trump's ability to push through the pro-growth measures led to significant declines on Wall Street. Terrorist attack in Barcelona also affected the markets. North Korea can also be a source of worries.

USD/JPY remains in short- and longer-term downtrend. A decline below 109.00 will open the way down to 108.80 (bottom of the weekly Ichimoku Cloud/August, June lows). In turn, decline below that point will bring the pair down to 108.10 (April low). A break below the latter will be a signal of the bigger top at Forex market. Resistance lies at 109.50, 110.50 and 111.00.