USD/CAD surged on failing oil and risk-off sentiment

The Canadian dollar broke out through the 1.40 psychological mark. What’s the reason?

Market uncertainty

The loonie is quite sensitive to the market mood. Today’s news turned it down. Firstly, China refused to set the GDP target. Secondly, it decided to impose new Hong Kong security law, that raised more doubts and fears about the future recovery. And finally, the US-China relationship remains tense, as Donald Trump continues to blame China for the coronavirus spread. The Canadian dollar dipped under that pressure.

Oil drop

Based on all news above, oil prices plummeted, as well. No wonder that now investors prefer safe-haven assets such as USD and JPY rather than the commodity-linked Canadian dollar.

It’s really interesting to observe next movements of CAD, as fears of the second wave may grow too strong and become well-founded. That can push USD/CAD higher. Also, today Canadian retail sales will be reported at 15.30 that will determine the future price for USD/CAD in the short-term. If the indicator is worse than expected, the Canadian dollar will fall.

Technical outlook

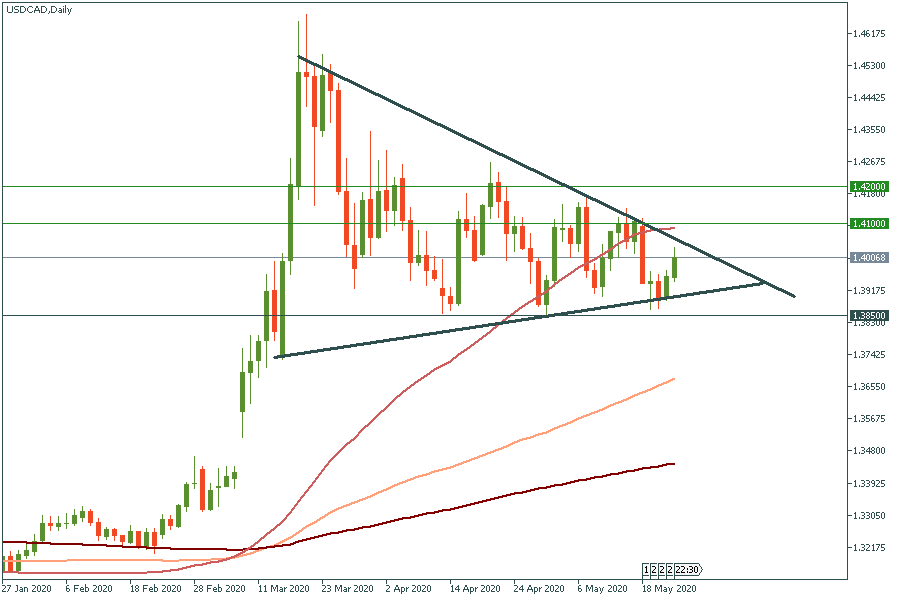

The USD/CAD formed a symmetrical triangle chart pattern, that’s a signal of the upcoming breakout or breakdown. At the time, it’s unclear where the price is headed. It’s better to wait a little bit for some hints. If the price breaks through the retracement level at 1.41, bulls will win and USD/CAD will head up to the next level at 1.42. Support is at 1.385.