US dollar: outlook for May 22-26

US dollar had the worst week in 9 months. The greenback was hit hard by the political turmoil in the United States. The hype was caused by Donald Trump's firing of former FBI director James Comey, talk that he pressed Comey to stop investigating his former national security chief, and his campaign's alleged ties with Russia. There are concerns not only that the President may be impeached, but also that the fiscal stimulus he promised will be unlikely anytime soon.

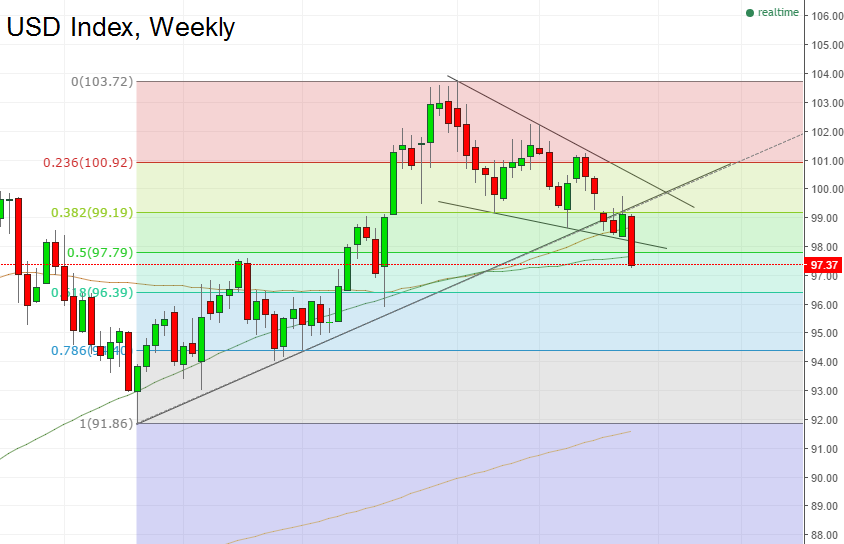

We can now clearly see that the US dollar index recoiled down from the previous support and now resistance line in the 99.50 area. It seems like the index has formed a triple top with the neckline at 99.15 and is vulnerable to a decline to 94.70. Daily moving averages turned to the downside. DXY is trading below 50% Fibonacci of 2016-2017 advance. The next Fibo level lies at 96.40. A weekly close below the 100-week MA at 97.65 will be a very bearish sign. Resistance is at 98.65 and 99.20.

In the coming days pay attention to the FOMC May meeting minutes on Wednesday and core durable goods together with preliminary Q1 GDP on Friday. The Federal Reserve is still widely expected to raise interest rates in June after a rather optimistic May statement. However, as next month’s rate hike is already significantly priced in, so we don’t see how it can provide much strength to the US currency.

The problems of Trump administration should remain in the center of the market’s attention. In addition, analysts warn that risks associated with North Korea have increased and advise to prepare for high volatility in the short-term.