US dollar: outlook for July 3-7

The US dollar fell to a 9-month low versus a basket of currencies. Market participants still don’t believe that the Federal Reserve will raise interest rates more times this year. At the same time, traders interpreted communication from other central banks – primarily the European Central Bank and the Bank of Canada – in a hawkish way.

The upcoming days will contain a lot of important events for the greenback. ISM manufacturing PMI on Monday will provide an update on the current state of US economic activity. The FOMC meeting minutes on Wednesday will give insights into the thinking of the Fed. It’s worth remembering that the central bank’s June statement was rather hawkish, so this release may offer the US currency a chance for some upward correction. Thursday will bring ISM services PMI, oil inventories and ADP employment report, while on Friday there are plenty of reasons to expect a spike in volatility as nonfarm payrolls (NFP) will be out. In addition, the Fed will release monetary policy report, which is published twice a year. The document will contain a summary of discussions of the conduct of monetary policy and economic developments and prospects for the future.

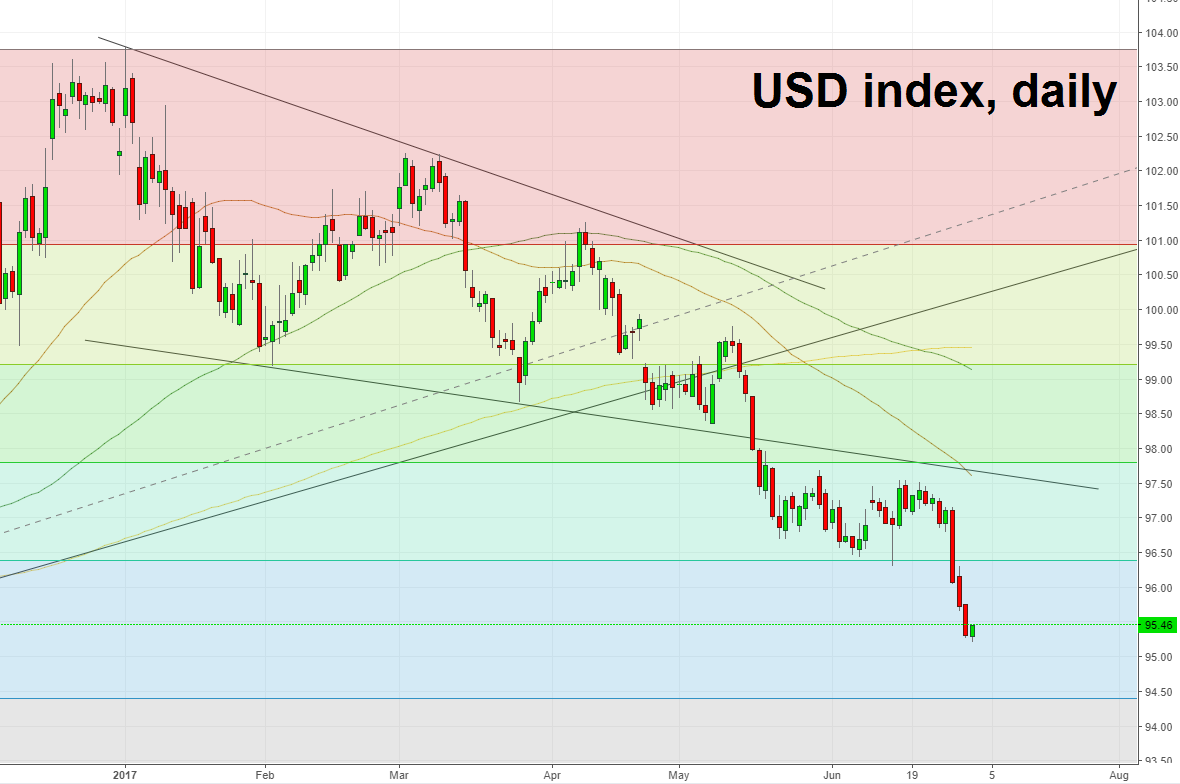

The US dollar index (DXY) fell to 95.22, the lowest level since September 2016. The asset breached support at 96.40 (bottom of the sideways range and 61.8% Fibonacci retracement of 2016-2017 advance). This area will now play the role of significant resistance. Bears have already reached the target of the broken sideways range (rectangle), but there’s still space until the next Fibo level on the downside lies at 94.40. Good data out of the US and hawkish comments of the Fed members are needed to save the USD from further declines.