Trading plan for November 16

The US dollar index (DXY) declined below 93.50 on Wednesday. The USD was pressured by the decline of the US Treasury yields. American data came out mixed on Wednesday: there was a slight increase in core CPI growth rate, but wages remained soft. Next support for DXY lies at 93.05 (October 19 low). The US will release unemployment claims and Philly Fed manufacturing index at 15:30 MT time and industrial production at 04:15 MT time on Thursday.

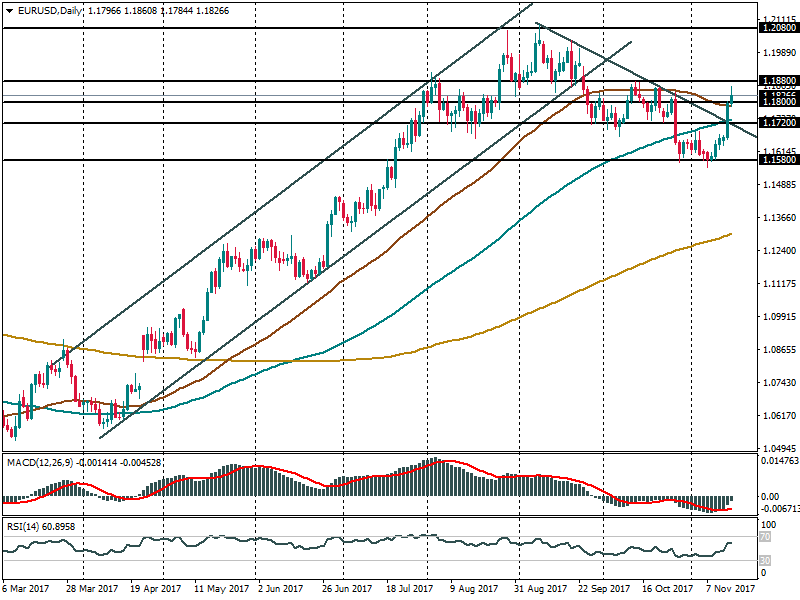

EUR/USD rose above 1.1800 for the first time in 3 weeks. Demand for the euro rose as investors resumed buying European equities and the region’s economic figures remain strong. Resistance is at October high of 1.1880 and 1.1910.

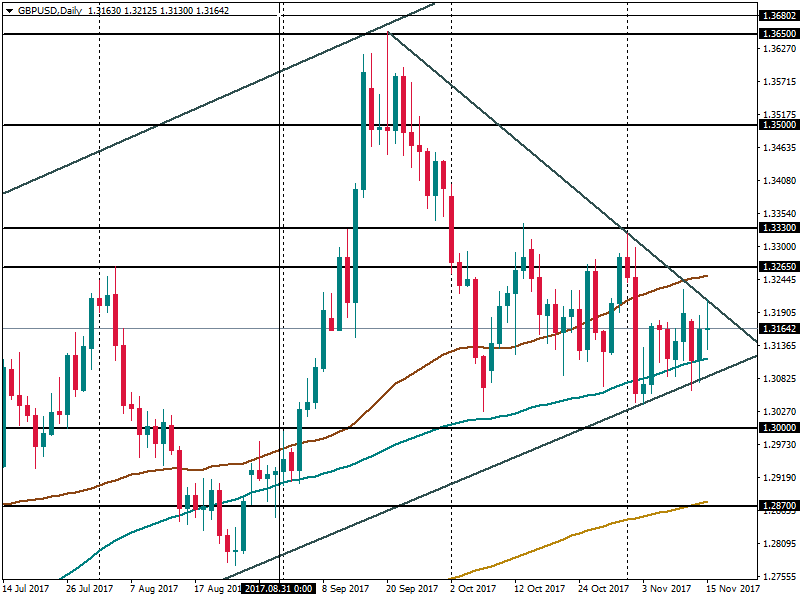

GBP/USD is hesitating around 1.3170 after the release of the UK labor market figures. Wage growth exceeded forecast a bit, although the inactivity rate – a number of people not working or seeking job – rose by most in nearly 8 weeks. The release of retail sales on Thursday is the next important event in British economic calendar at 11:30 MT time. In addition, the market will await comments from the Bank of England’s governor Carney during the day. On the upside, the pair’s limited by resistance line from September highs at 1.3210. Support is in 1.3090 area (support line since February) ahead of 1.3000 (psychological level).

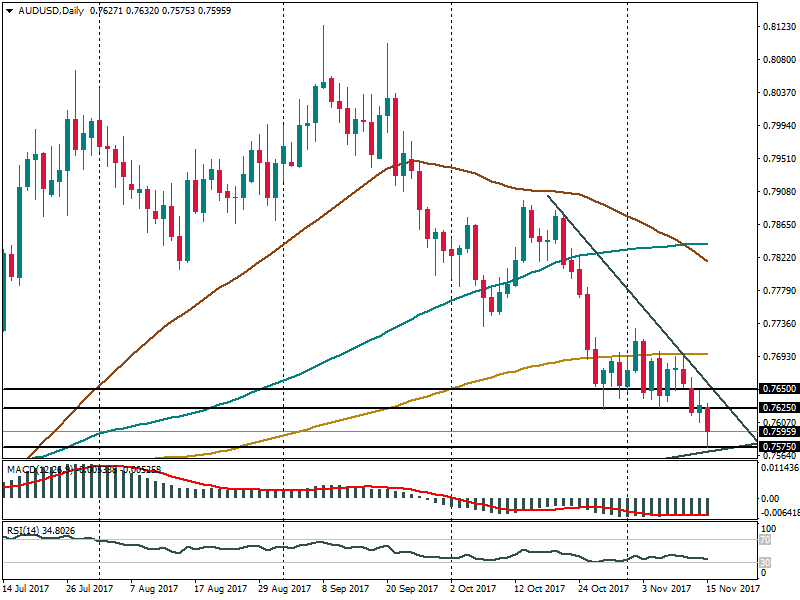

AUD/USD fell as Australian wage price index disappointed. The Aussie found support at 0.7575 (long-term support line). Attempts to recover will face resistance at 0.7625 (previous support), 0.7650. On Thursday, Australia will release labor market figures at 02:30 MT time.