The New Zealand dairy industry – key for NZD traders

Why is it important for traders to know the priority industries of countries whose currencies they trade and take into account such events as the Global Dairy Trade (GDT), for example?

Let’s look at New Zealand. If you trade the New Zealand dollar, you should know that New Zealand is the world dairy leader. The dairy industry is the biggest export earner of New Zealand, it contains 29% of its export.

Fonterra

It is important to tell about Fonterra. Fonterra is a New Zealand multinational dairy co-operative that is responsible for about 30% of the world’s dairy exports. It is owned by around 10,500 New Zealand farmers.

What can affect the New Zealand dairy industry

Any changes in global dairy prices lead to changes in New Zealand trade, in turn, the New Zealand dollar.

It is worth to say that dairy industry was affected by several events. They are the Russian trade embargo, the cut of Chinese imports and dynamics in the international currency exchange market.

In 2013 Russia banned the imports of the Fonterra products, that was the second exporter on the Russian market. So it means that New Zealand lost a big importer, that affected the supply and New Zealand dollar as well. But nowadays New Zealand products have come back to the Russian market, that created good prospects for the currency.

It is important to take into account that China is one of the main trade partners of New Zealand, so any changes in import will affect the New Zealand export and exchange rate as well. Now New Zealand is raising its share in Chinese import of dairy products.

Considering currency exchange market, the weakness of the US dollar has a good impact on the New Zealand dollar.

What GDT is

Coming back to another important part of our question, let’s talk about GDT. GDT is the leading global auction for trading large volume of dairy ingredients and reference price discovery. Global Dairy Trade affects the price of currency because it regulates the number of dairy products that imports and exports in the world.

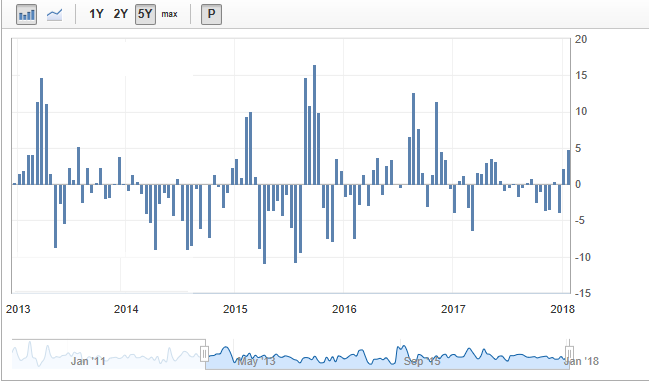

Below you can see the New Zealand Global Dairy Trade Price Index. It measures the weighted-average price of 9 dairy products sold at auction every two weeks. So we can see if commodity prices rise, export income increases and vice versa.

Tips

In February 2018 the GDT will take place on Tuesday, February 6 at 12:00 UTC and on Tuesday, February 20 at 12:00 UTC.

Conclusion

Let’s sum up why traders should take into account main industries of the countries whose currencies they trade. We can say on the example of New Zealand that if traders know strengths of countries and take into consideration even such specific events as Global Dairy Trade, it can help them to make right decisions about currency trade.

Talking about prospects of New Zealand dollar we can say that it has good chances according to its dairy industry: the come back to the Russian market, the weakness of the US dollar and the increasing share in Chinese imports support its increase.