The Inflation in Europe and the EUR Forecast

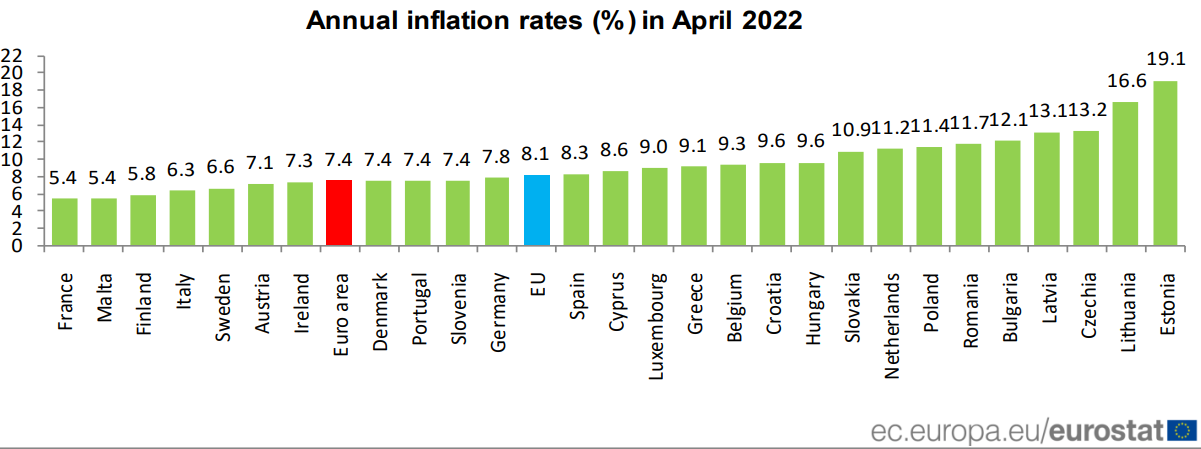

The euro area (EA) faced a 7.4% annual inflation in April, and the European Union (EU) had an 8.1% price growth. Rates hikes are crucial for the economy to stop collapsing; still, the ECB is doing nothing but talk. Step by step, we’ll find out what will happen with Europe.

The fight against inflation

At the press conference on Thursday, the European Central Bank tried to demonstrate a gradually accelerating hawkishness, keeping the door open to a series of rate hikes. Here’s what it said:

- The asset purchase program will end on July 1.

- Reinvestments of the “Pandemic purchase program” will continue till 2024.

- The first hike in several years will come in July, and it’ll be a 25 basis points increase. There will be another rate hike in September by 25 or 50 basis points.

- “A gradual but sustained path of further increases in interest rates will be appropriate.” By that, the ECB means more rate hikes will come later in Autumn and Winter.

To sum up, the ECB will start the tightening process at the end of June, and this process will continue until inflation in the EU is not close to the target of 2%.

The latest projections of the Eurosystem estimate inflation will come in at 6.8% in 2022, 3.5% in 2023, and 2.1% in 2024. GDP growth is expected at 2.8% in 2022, 2.1% in 2023, and 2.1% in 2024. We won’t try to predict the numbers for 2023 and 2024 now, but we are sure that the target of 6.8% in 2022 will be extremely hard to reach, considering the energy crunch and food supply disruptions. The ECB has only half of the year to lower the prices, and the first half of 2022 does not augur well.

The euro path against the dollar

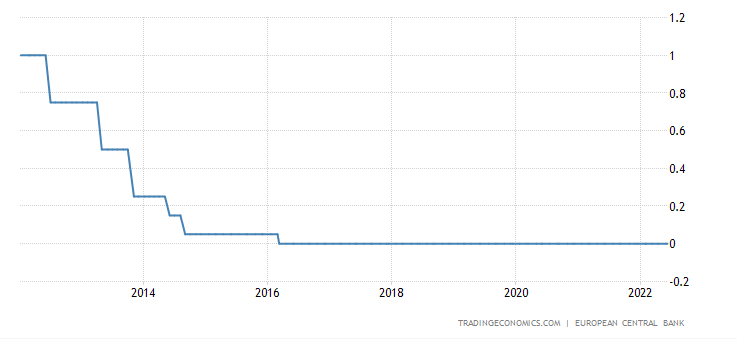

Following the results of the press conference, we can say that ECB started its journey toward positive interest rates (now, the rate in the EU is 0.0%). With the US Fed having three hikes and aiming for more, we are bullish on the EUR prospects as the spread between interest rates of two economic zones will stop increasing.

As for the chart, we have several weeks ahead of the first rate hike, and EURUSD may go lower. The market will start pricing in the ECB decision a little later. Now the volatility in the pair comes from the US CPI release (it exceeded expectations by 0.3%). The closest demand area is 1.0350-1.0470, from which we will look for buy trades. If the pair reverses from this support zone, it may break through the channel’s upper border and reach 1.1100-1.1300 by the end of the summer.