The end of QE – the rise of the euro

To make it clear how the quantitative easing affects the euro, it is worth to start from the definition of it.

Quantitative easing (QE) is an unconventional monetary policy when a central bank buys government bonds to increase the money supply. Interest rate declines and a domestic currency depreciates against foreign currencies.

The European central bank launched the quantitative easing in January 2015 to stimulate inflation and GDP growth and succeeded.

There are reasons to believe that the central bank is going to close the quantitative easing program to the end of 2018 because of the positive dynamics of the European economy. Now it is purchasing the 30 billion euros worth government bonds, and it is going to continue until September considering the opportunity to expand it again if it is needed or end the program.

But some analysts suppose that the positive dynamics of the euro can support the sooner end of the QE. For example, analysts at Barclays argued for the end of QE in September and a first hike of the rate at the end of the year.

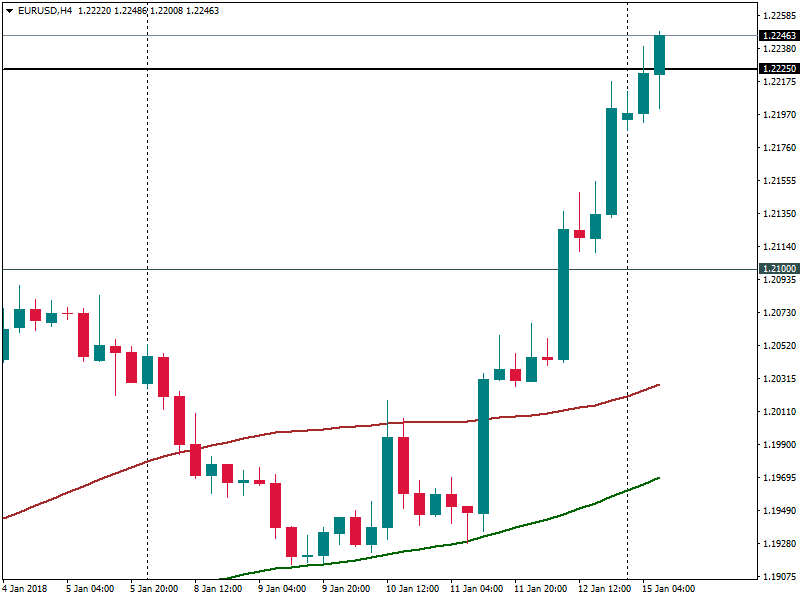

The economic world is waiting for the quantitative easing tapering and making forecasts about it because as soon as the central bank closes this program, the euro will appreciate against the dollar. We could see that even a small news about the prospects of the QE tapering led to the growth of the euro nearly to 0.8% against the dollar on Friday, January 12.

But not only news about the quantitative easing tapering led to the rise of the euro, and also negotiations in Berlin about a new coalition government that lowered political risks supported the euro growth. It is important to take all factors into consideration.

Making a conclusion, analysts are giving good chances to the euro. However, it is important to say that there are risks for the euro because the European central bank not always supports the growth of the euro that can reduce the European export.