Tesla: the most valuable automaker

Top Wall Street analysts bet on Tesla for the third quarter. Has the era of electric cars started?

What happened?

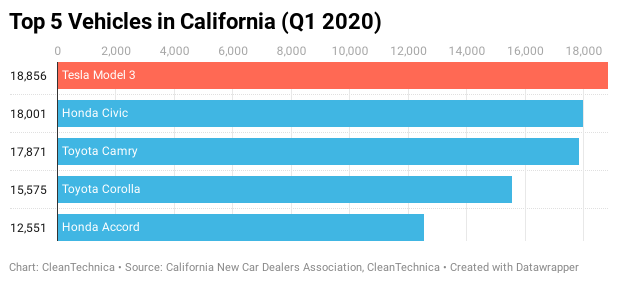

It’s unbelievable, but Tesla even outperformed Toyota by its market value, despite the fact that Tesla has never managed to make its annual profit. Tesla’s value exceeded 208 billion dollars, leaving behind Toyota with its 203 billion dollars. Tesla’s stock value has risen by 500% since this time last year. The overall improvement in the tech sector boosted the company, despite the coronavirus outbreak. The last week report showed that Tesla has tripled sales of “Model 3” cars in China in May in comparison with April. Actually, Tesla has become the bestseller among other electric vehicles in China this year. What’s more, in California it has become the top selling car in the first quarter among all cars, including petrol-driven ones.

Indeed, there is a global tendency towards electric cars. According to Bloomberg, global sales of oil and diesel driven cars has been in the permanent decline since 2017. It’s written that electric vehicle sales could reach 10% of global sales by 2025, then 28% by 2030 and, finally, 58% by 2040. It’s hard to imagine how far the Tesla stock will surge by then.

Q2 sales

Tesla’s deliveries for the second quarter bet all estimates. Just look at this data: total Q2 deliveries were 90 650, while the FactSet’s forecast was 68 380. The total production turned out 82 272 (6 326 ModelS/X and 75 946 Model 3/Y). Five-star Oppenheimer analyst Colin Rusch has immediately claimed his buy rating on Tesla after that report. Tesla reached the record high at 1 220 on Thursday after that report. As a result, Tesla is one of few companies that managed to make a progress even during the coronavirus pandemic.

Why is it important for a trader?

Many traders have made a huge profit on Tesla, sometimes due to their intuition, sometimes due to their good understanding of the stock market and the fast reaction to news. Thanks to Elon Musk’s tweets and leaked emails traders have the opportunity to make money even without economic releases. However, least ones are still main drivers of the stock price. Tesla will report its earnings report for the second quarter this month. Don’t miss out.

As you can see on the chart below, Tesla is trading at its record highs near $1 200. Further news and the earnings report will add the fresh volatility to it. Support levels are at key psychological marks at $1 200 and $1 000. If it breaks them down, it may fall deeper to the low of June 26 at $960. Follow further news on Tesla and make profit!

Just for fun

Now that we’re speaking about Elon Musk actions. When Tesla surpassed Toyota by the stock value, Musk decided to make fun of that and launched short red shorts for short sellers! To mock those who didn’t believe in Tesla’s growth. Due to the Musk’s love for encryption (Do you remember how he named his son?), he encrypted a joke even into the price of the shorts for short sellers. He set the $69.420 price. People easily decrypted his message. They said last three digits - 420 - is the reference to Musk’s tweet in 2018. After that the stock price fell down significantly.

What should you do for trading Tesla’s stock?

Trading stocks with FBS is easy. Follow the simple steps described below.

- First of all, be sure you’ve downloaded Metatrader 5. FBS allows you to trade stocks only through this software.

- Open the MT5 account in your personal area.

- Reveal all trading instruments by clicking “show all” at the “Market Watch” window.

- Start trading!