TD Securities: sell euro, buy dollar

What happened?

Analysts from TD Securities claimed that "risk sentiment could struggle to find near-term highs just as the global growth backdrop shifts lower, leaving us inclined to hold a sell on rallies posture for the EUR. With this in mind, we implement a short EURUSD position as our Trade of the Week".

The bank sees investor sentiment and the stock market’s performance as key drivers. Indeed, Biden’s stimulus package isn’t likely to be unveiled till mid-March. In combination with the vaccine delays, these issues worsened the sentiment.

Besides, investors express concerns about whether the global stocks are overextended or not. As a result, the backdrop in stock growth increases the demand for the US dollar. Moreover, Fed’s meeting this Wednesday may trigger a pick up in the yields, if the Fed claims to withdraw stimulus earlier than expected. Rising yields will underpin the USD.

Forecast

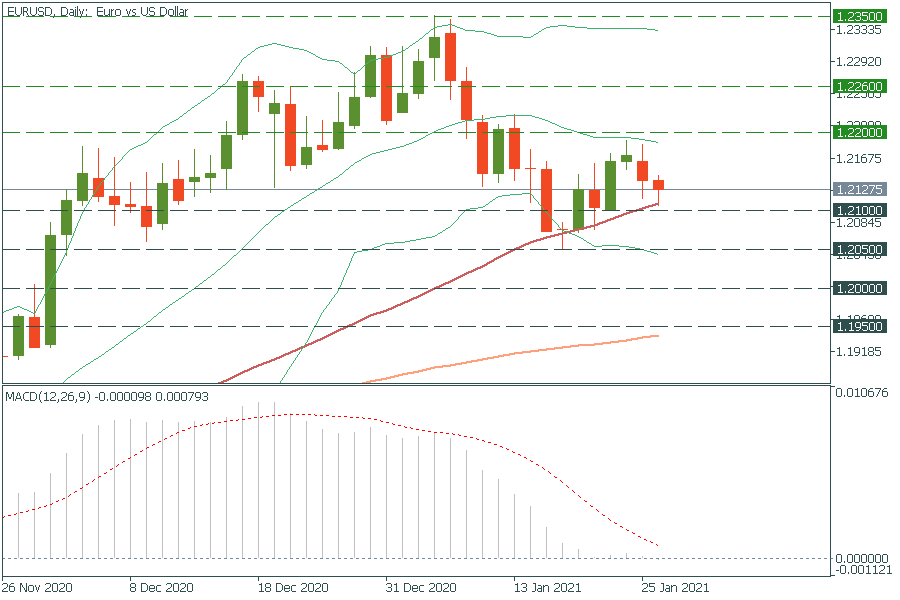

TD Securities expects EUR/USD will reach 1.2050 by the end of January.

Technical tips

On the daily chart, EUR/USD is supported by the 50-day moving average at 1.2100, which the pair has failed to cross several times. However, we shouldn’t rule out that the euro may drop below this level amid the current strong fundamentals. Therefore, the breakout of 1.2100 will drive the pair to the low of January 18 and the lower line of Bollinger Bands at 1.2050. The MACD indicator is moving back and forth near the zero line. When the MACD gets below 0 to turn negative, it can be used to confirm a downtrend. Resistance levels are at the recent highs of 1.2200 and 1.2260.