Stock market: PepsiCo is suffering

Trade idea

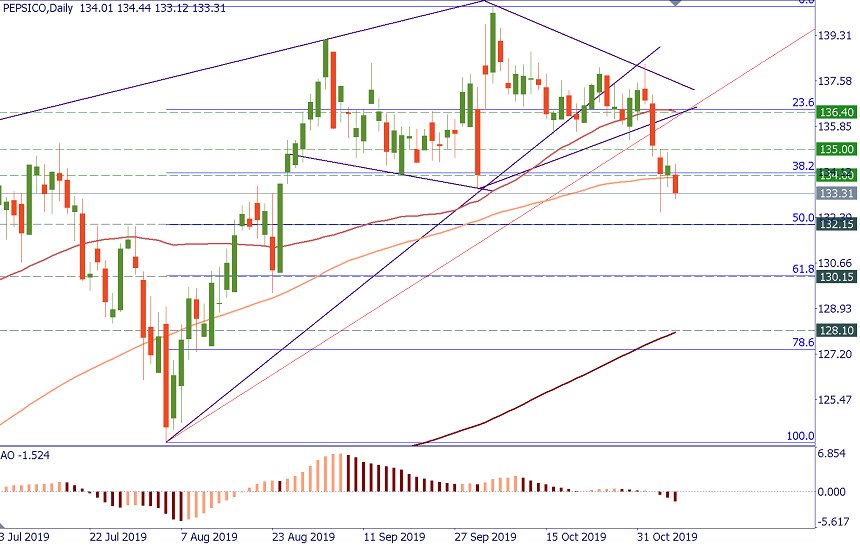

SELL 132.00; TP1 130.20; TP2 128.20; SL 132.50

Despite the overall positive sentiment for stocks, the stock of PepsiCo has experienced a substantial decline this week. The price broke below the support of the ascending wedge and closed below the 100-day MA at $134. In addition, the price action resembles a “diamond” pattern. All of this means that the downside will likely continue if the price slips below $132.15 (50% Fibo of the August-October advance). Targets lie at $130.15 (61.8% Fibo) and $128.10 (200-day MA). Resistance lies at $135.00 and $136.40.