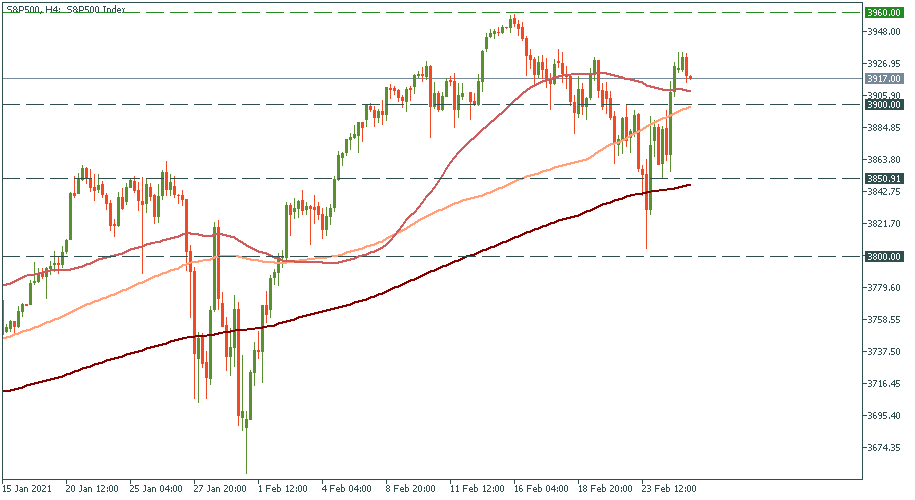

S&P 500: recovery and reconquest?

Finally, the stock market is seeing better days. After having peaked at 3 960 two weeks ago, the S&P went into a fortnight plunge. It dropped as low as almost 3 800 in the beginning of this week. However, since then, it recovered most of the losses crossing all the MAs above 3 900.

What we have to do now is to watch the support of 3 900 and the MAs around it. It’s advisable to hold and abstain from entering the market so far. If the index crosses this formidable support downwards, that would mean that the bearish potential is not exhausted, and we are yet to see more downtrend.

Otherwise, the S&P will bounce from the support upwards – in this scenario, it will likely cross 3 960 to finally challenge 4 000 forming a new uptrend.

Action plan:

- Wait for the 3 900 support to either get crossed downwards or send the index upwards

- Buy if the S&P bounces upwards

- Sell if the S&P crosses 3 900, 100-MA, and 50-MA downwards