OIL: OPEC's battle

Key indicators

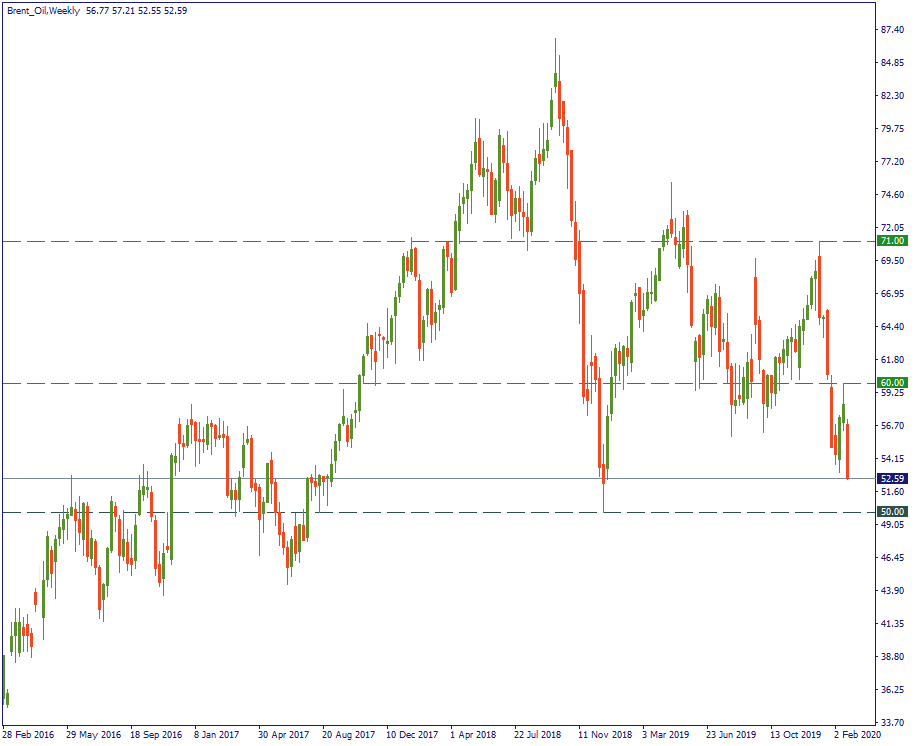

Performance in 2020: -23%

Last day range: $52.50 – $53

52-week range: $52.50 - $75

Oil’s breakeven price

Next Thursday, OPEC will hold its extraordinary (meaning, urgent) meeting in Vienna. Why? Because to many oil-exporting countries from the Middle East (they make the bulk of OPEC) such as Saudi Arabia, $50 per barrel is approximately the breakeven price. That means, the current price of oil leaves little room for those countries to extract as many profits as were planning for – if any. Hence, the urgency of the meeting.

That gains even stronger momentum as there are larger disagreements within the OPEC+ (where Russia is a key player) about further cutting the supply, which is the main (if not only) lever the cartel can use to support the oil price.

Very probably, the dynamics of the global Coronavirus spread outside China will strongly impact the decision to be taken at the meeting on March 5. And the intrigue is: although the issue becomes clearer with China itself (infection pace decreases, projections for confident virus containment are set in mid-April), what about the rest of the world, especially the US? We are yet to see that. As well as Mohammed Barkindo, OPEC Secretary-General.

One thing is for sure: OPEC will use all means to stop the oil price slumping. If we hear strong measures announced by Mr. Barkindo in line with confident virus containment plans by the global community by next Thursday, very likely oil (Brent, in our chart) will get back to $60-70$ channel of movement.

Technical levels

Resistance $60

Support $50