GBP/USD: outlook for May 29 - June 2

The British pound dropped in the past week on UK election jitters and weak economic fundamentals. Monday’s terrorist attack in Manchester city rattled people’s confidence in the government and shrank May’s lead in the polls. British GDP for the first quarter was revised downwards to 0.2% from 0.3% back in April. UK consumer spending, the key economic growth engine, had its worst quarter since 2014. It seems that Brexit has finally started taking its toll on the British economy.

With only two weeks before the legislative elections, the pound should remain under pressure in the near-term. Next week, investors will be watching for the British manufacturing and construction PMI. If economic data continues posting weak gains, the pound will be set to test lower levels. At the beginning of the week, the US dollar will be a bellwether of the pair with the CB consumer confidence coming on Tuesday, Wednesday’s Chicago PMI followed by the US pending home sales. Thursday will be marked with ADP report, unemployment claims, and manufacturing figures. On Friday, traders will be focused on the US labor market report. Strong readings will bring hopes for an additional rate hike at the Fed’s June meeting.

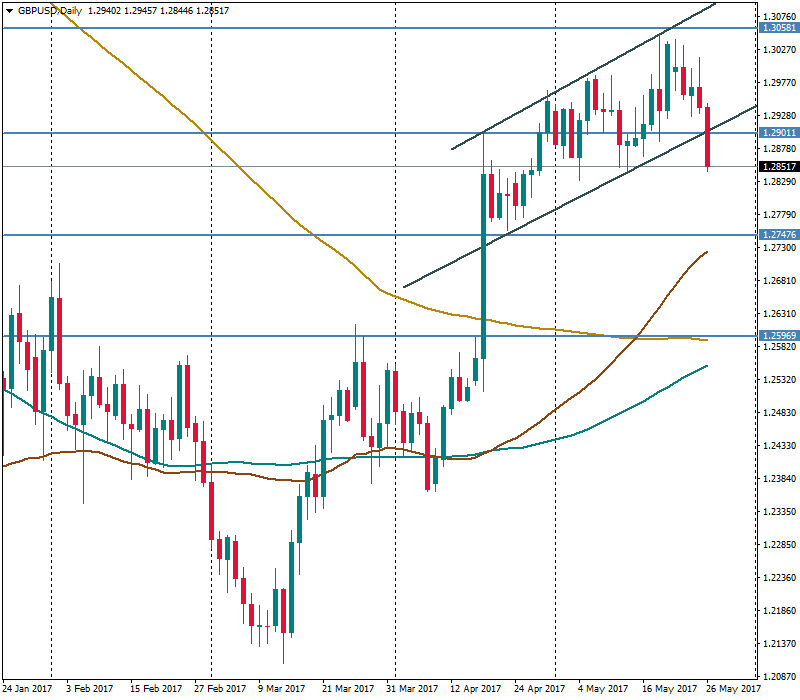

The technical outlook for the GBP/USD is bearish. The pair broke the support border of the short-term upward trading channel. This was a signal of potential reversal or correction. The British pound may slide towards the nearest supports at 1.2825, 1.2750 and 1.2596. To restore the uptrend, the bulls need to break the 1.30 psychologically important round level.