GBP/USD: outlook for May 23 - 26

The political turmoil that gripped the White House this week resulted in the weakening of the USD against its major counterparts, such as the British pound. US President Donald Trump was accused of pressuring ex-FBI director James Comey to drop the investigation into ties between Russia and former security adviser, Michael Flynn. This was regarded as a serious, impeachable offense – an obstruction of justice. The latest development is circulation of Comey’s testimony in which former FBI director confirmed that he hadn’t been pressured for political purpose. This has lifted pressure from the US dollar, but only partially. In its turn, GBP was supported by the numerous economic data releases and actively tested 1.30.

On Tuesday, the Bank of England Governor Mark Carney will testify on inflation and the economic outlook before Parliament’s Treasury Committee. British inflation figures continue moving upwards: CPI rose by 2.7% in April. The BoE is ready to tolerate inflation at around 3%, a higher rate may make the central bank to raise its interest rate. On Wednesday, traders will wait for the FOMC meeting minutes’ release, though it shouldn’t bring any great market fluctuations. Towards the end of the week, we will be focused on the second estimate of GDP figures and preliminary business investment gauge both coming out of the UK on Thursday. On Friday, keep an eye on the US preliminary Q1 GDP figures.

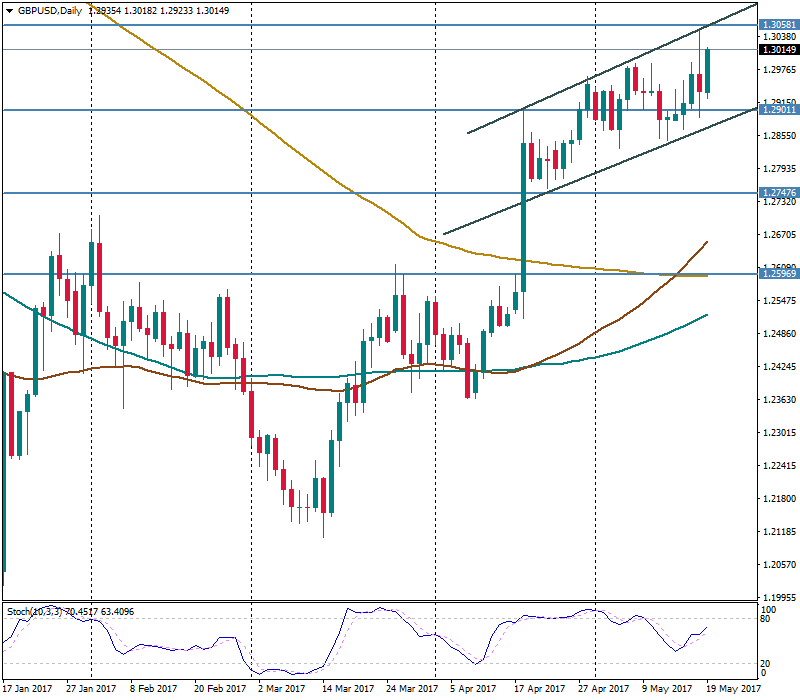

The technical outlook for GBP/USD currency pair is neutral with some bullish bias. Most likely, the pair will be trading choppily within the range between 1.2850 and 1.3070 in the upcoming days. Stochastic indicates a room for the pound’s extension towards the upper border of consolidation range or higher, towards 1.3150 (38.2% Fibo of the post-Brexit decline). On the downside, there is a support at 1.2750 and 1.2710 which previously served as a very important resistance line.