GBP/USD: outlook for June 19 -23

The British pound gained as more members of the Bank of England monetary policy committee voted for the rate increase. The BOE decided to maintain its monetary policy settings but at 5-3 vote. Three dissenters advocating rate hike became increasingly worried about the inflation that could easily reach 3% by the fall and thereby flatten British consumers’ wallets. Others seemed to be more concerned with hardships the UK may experience during the Brexit. Sterling rose to 1.2795 on the announcement and managed to retain its strength in subsequent sessions. In the US, the Fed raised its interest rate on Wednesday. But this didn’t help the USD to climb higher, as rate increase was overshadowed by extremely soft consumer prices and weaker retail sales released ahead of the FOMC meeting.

Next week, the quotes will likely be led by political goings-on as the economic calendar for GBP/USD is very light. Brexit negotiations will start the week, as main negotiators agreed to launch them on Monday, June 19. Then, we will hear the speeches of several Fed’s officials that are set to uncover their further monetary policy projections. Datawise, pay attention to the UK public sector net borrowing report and the US jobless claims coming on Wednesday and Thursday respectively. The clamor surrounding the investigations into Russian interference in the 2016 US presidential elections will continue to weigh on the USD.

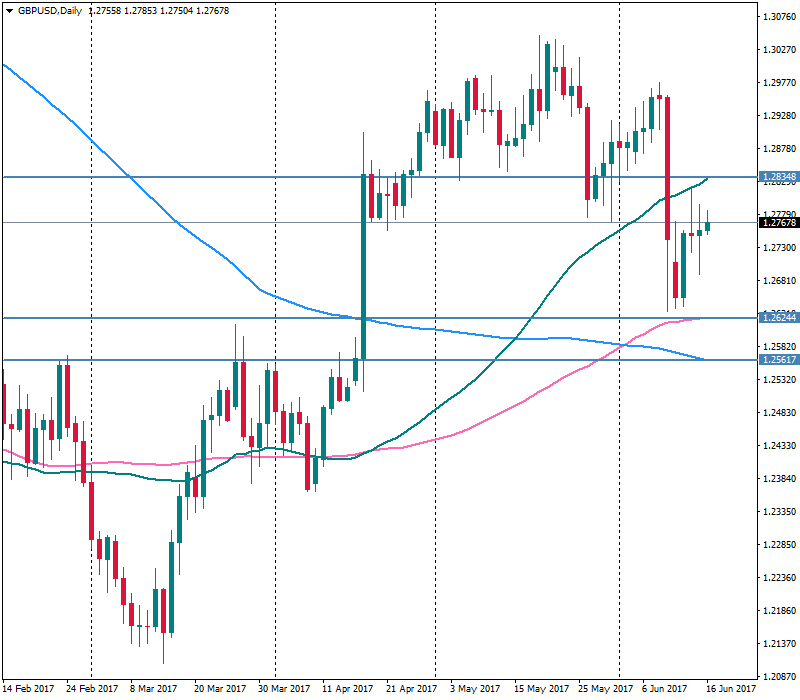

GBP/USD rose to 1.2775 in the course of the past week. While downside momentum is still intact, the quotes have scope for a further extension to at least 1.2820. The solid resistance at 1.2835 (50-day MA) may prevent quotes from rising higher. The break of 1.2625 will be a good indication that we have moved into bearish phase. The next support from there can be found at 1.2560 (200-day MA).