Euro: long-term projections

Recent European economic data seemed to bring optimism to the euro area. European prelim flash GDP growth for the first quarter of 2019 surprised investors with an upbeat. The actual release outperformed the forecast by 0.1%. Spanish flash GDP figure exceeded estimates too. Even Italian data was quite promising - prelim GDP level was placed at 0.2% against -0.1% forecast. German prelim CPI level beat the forecast by 0.5%. Sound good but the long-term picture may be not that shiny.

On May 7, the European Commission published its economic forecasts*. According to them, the European economy will keep suffering during 2019 with a rebound in 2020 only. The GDP growth is anticipated to be at 1.2% comparing to 1.9% in 2018. The unemployment rate should stay at 7.7%. This figure is better than previous ones but not the best. The summary budget deficit in the eurozone is expected to rise to 0.9% of GDP. Although debt of the eurozone will likely decrease, it’s not enough to boost the euro.

In April, eurozone economic sentiment fell to its lowest level in more than two years. What more negative for the European currency is a prediction of low inflation levels both in 2019 and 2020 that is below the ECB’s targets.

Moreover, we should remember about the external factors that will be adding pressure during the year. Trade wars leading to the weakness in emerging markets, especially in China. The Brexit deal that is constantly prolonged may end with a no-deal at all.

All factors mentioned above are signs of the weak EUR.

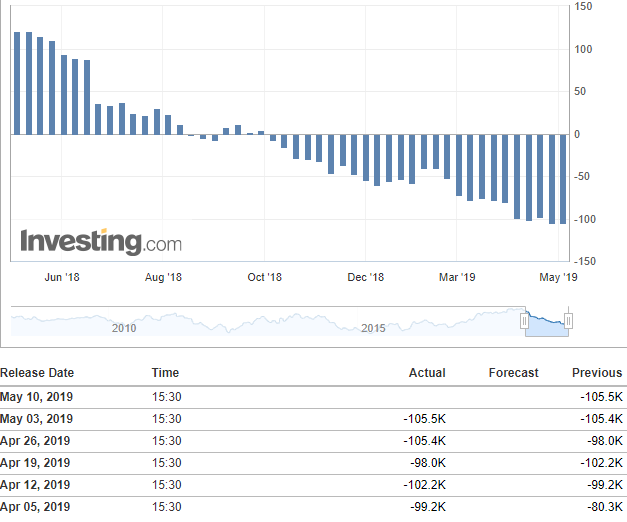

CFTC EUR speculative net positions keep moving down from week to week signaling weakness of the euro. What is next?

What levels to expect for the euro.

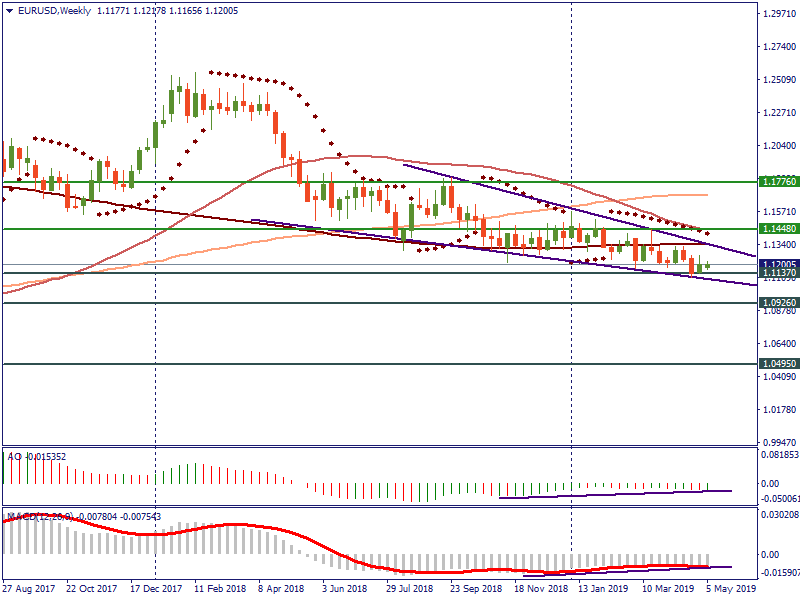

Last time, the EUR/USD pair was at current lows in May-June 2017. The pair keeps trading in the downtrend and although some analysts were sure that accommodative monetary policy of the ECB and external threatens are already priced in, the European currency can’t recover. On the weekly chart, awesome oscillator and MACD formed a bullish divergence with the price chart that was reflected on the chart with a rebound of the pair. The rebound from 1.1137 is positive for the currency but the downward pressure will likely continue. During the upcoming months, we can anticipate a further decline. A breakthrough below 1.1137 will provoke a further decline towards 1.0926 – the bottom line of the previous consolidation. If EUR/USD plunges below 1.0926, the next support will lie at 1.0495. The level is far but additional pressure may lead the pair to it. Recovery of the EUR/USD may happen if only there is a progress in external threats that will cause an improvement in the European economy. Bulls need to push the pair above 1.1448. Only after the pair is above this level, we can hope for the recovery of the European currency.

To conclude, the euro is anticipated to suffer during the year. Negative economic forecasts, easing monetary policy of the ECB and external factors don’t give the currency a chance to recover. If only the situation improves, the EUR will get an opportunity to recover.

* EU Economic Forecasts is the report that includes economic forecasts for EU member states over the next 2 years.