Dedollarisation vs. Gold; what to expect in April

De-dollarization is the hot new trend, as countries give the greenback a break and seek alternatives for international trade. With geopolitical tensions and economic tangoes, the US dollar is feeling the heat. But fear not, gold might just be the star of the show! As nations diversify their reserves, our shiny friend could see its demand and value skyrocket. Imagine a world where gold's once-upon-a-time role as a global currency makes a comeback, how vintage! Inflation and currency woes might just have investors trading greenbacks for glittering gold. So, buckle up and watch the unfolding drama of global finance, as de-dollarization might just make gold the damsel of the ball! Technically speaking, however, there is somewhat of a bumpy road ahead.

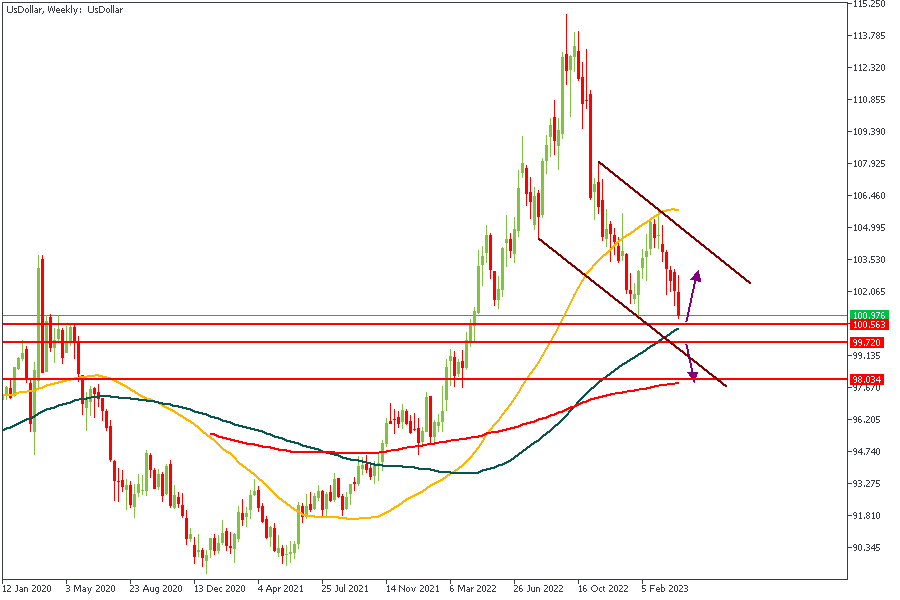

US DOLLAR - Weekly Timeframe

The weekly timeframe of the US Dollar presents a consolidating price action within a descending channel. The movement seems to be approaching a pivot zone which could provide some degree of relief from the forceful pull of gravity on the Dollar - I am not totally convinced though. Hence, you will notice I have marked this as a knife-edge scenario; which means, price could react either way. Before I hit the 'buy' or 'sell' button, I will patiently await a clear reversal chart pattern for further confirmation.

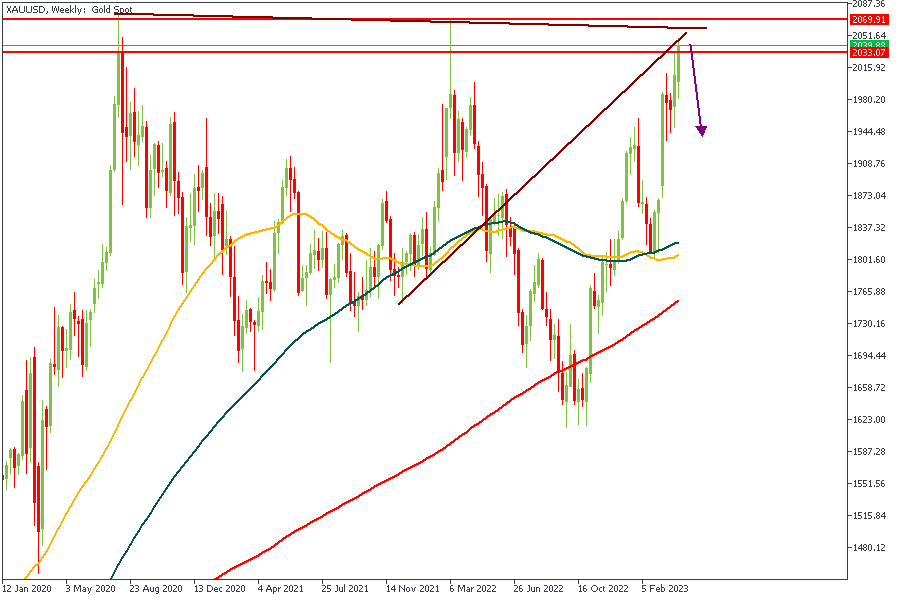

XAUUSD - Weekly Timeframe

The price action on Gold is pretty simple and easy to interpret. First of all, we see price stalling at the pivot zone, then, we also see that there is a confluence of resistance trend lines right within that pivot level. The logical conclusion from this is a bearish sentiment on Gold, however, I would rather err on the side of caution by waiting for further price action confirmations before squeezing the trigger.

Analysts’ Expectations:

Direction: Bearish

Target: $2,006.59

Invalidation: $2063.32

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.