Australian GDP: What to Expect

Let's take a closer look at Australia's recent economic performance. Brace yourselves for some interesting developments. The country's economy experienced its slowest growth since late 2021 in the first quarter, raising doubts about the Reserve Bank of Australia's rapid interest rate increases. Despite the bank's record-breaking 12 rate hikes in the last 13 months, the resource-rich economy only grew by a modest 0.2% in the quarter, falling short of economists' expectations. This slowdown challenges the government and central bank as they aim to avoid a recession. The RBA's decision to raise interest rates further reflects concerns about a deteriorating inflation outlook. RBA Governor Philip Lowe has repeatedly warned about stagnating productivity and increasing wage pressures, which could keep inflation higher than desired. Recent wage increases for low-paid and public-sector employees have fueled fears of broader wage gains. Despite solid private and government investment, consumer spending slowed in the quarter, with household spending contributing minimally to GDP growth. The data also revealed a household saving-to-income ratio decline, primarily driven by rising mortgage repayments and rents. On a positive note, wage indicators showed strength, with the compensation of employees increasing. A tight labor market and historically low unemployment rates stoke wage pressures. Stay tuned as these dynamics unfold, and watch how they may impact forex markets.

AUDUSD - Daily Timeframe

From the chart AUDUSD above, the overall trend is bearish - especially considering the direction of the Moving Average array. Therefore, the next action is to find a reliable entry point based on a confluence of technical analysis factors. My confluences, in this case, include the following;

- Trendline resistance;

- Moving average array;

- 200-Day moving average resistance; and

- Rally-base-drop supply zone

The safe conclusion from all of these is that there is a high likelihood of a bearish continuation from the area of these confluences.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65531

Invalidation: 0.68248

GBPAUD - Daily Timeframe

The weakening of the Australian economy is expected to impact positively on the GBPAUD pair. There are also a few interesting confluences to consider, namely;

- Bullish moving average array

- The support trendline of the wedge pattern

- 50-Day moving average support

- Drop-base-rally demand zone

Overall, bullish price action seems the most credible direction for price.

Analyst’s Expectations:

Direction: Bullish

Target: 1.89720

Invalidation: 1.83911

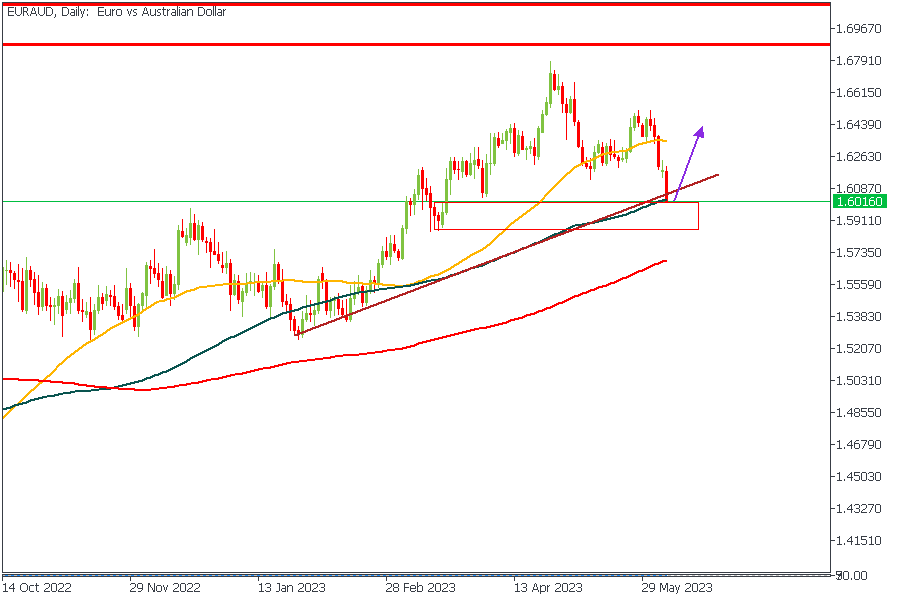

EURAUD - Daily Timeframe

As I mentioned, the fundamental factors based on the GDP figures largely suggest a bullish sentiment on pairs against the AUD. This pleads an interesting case in favor of a bullish price action on EURAUD, akin to what we saw on GBPAUD. The confluences for this bullish price action include;

- Trendline support

- 100-Day moving average support

- The bullish array of moving averages

- Drop-base-rally demand zone

Analyst’s Expectations:

Direction: Bullish

Target: 1.63880

Invalidation: 1.58443

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.