AUD may have a break

The decline of the Australian currency versus the greenback has been steady since July 19. This week AUD/USD has tested the lowest levels since 2009. By the end of the week, however, the pair managed to recover some of the lost ground and even enter positive territory. What’s the fundamental picture for the AUD?

External factors: a bleak picture

The abrupt escalation of the trade conflict between the United States and China has pulled the risk-sensitive Aussie down. The US President Donald Trump threatened the Asian country with new tariffs starting from Sept. 1. China, in its turn, has let the yuan slide versus the USD. The action made Washington call Beijing a “currency manipulator”. The further the parties get from an agreement, the worse it is for the commodity currencies in general and for the AUD in particular. Still, there may be periods when the AUD is able to take a breath and recover as investors tend to take profit on short positions at some points.

Domestic factors: some relief

The central bank of Australia’s neighbor - New Zealand - has delivered a bigger-than-expected rate cut this week. Such a move made traders expect a similar step from the Reserve Bank of Australia (RBA). Yet, the RBA's August meeting took place before that of the RBNZ, and Australian regulator hadn’t changed the interest rate, even though it had cut rates on two consecutive occasions in preceding months. The next meeting of the Australian regulator will take place on Sept. 3.

On Friday, Aug, 9, the RBA lowered its economic forecasts compared to those it gave in May: it now projects GDP growth of just 2.5% this year and only 1.5% inflation. Inflation forecasts for 2020 and 2019 were also slashed to below the key 2% level. Such view of the regulator will keep the AUD under pressure in the medium and in the longer term.

The short-term picture, however, looks not so dark. The RBA let the market know that it’s not as dovish as its New Zealand’s counterpart. Australian central bank hinted that it would wait a while before cutting its benchmark interest rate from the current level of 1.00%. Apart from providing support to AUD/USD, this also gives some bullish fuel to AUD/NZD.

Next week, Australia will release the quarterly wage price index and employment figures. Another key indicator during the rest of the month will be private capital expenditure due on Aug. 29. No doubts that the RBA will take these data into account when it next time makes its decision, so the releases will have a substantial impact on the AUD.

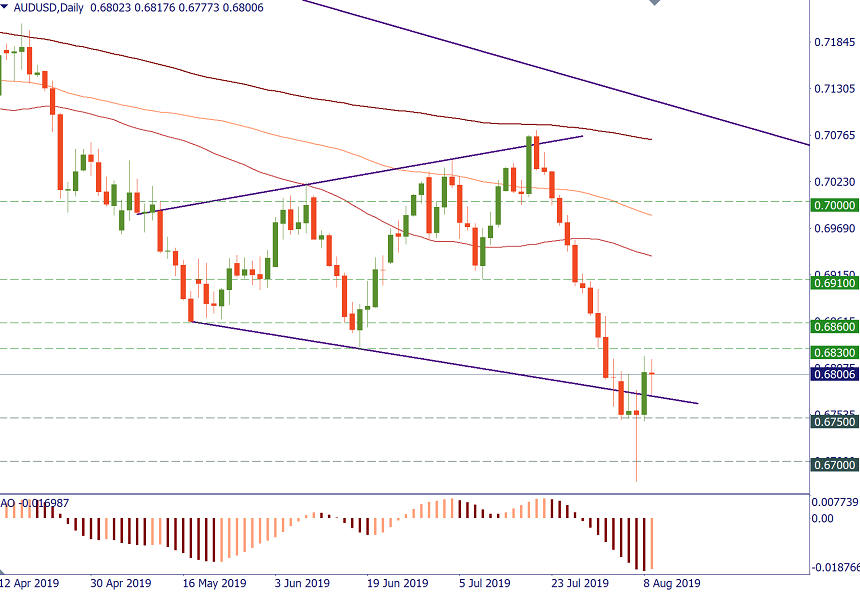

AUD/USD has room for correction

Market players now expect more rate cuts in the United States this year and this limits the ability of USD to appreciate. The fact that the RBA is more reserved than New Zealand’s regulator gives the AUD a good chance to consolidate versus the USD and even recover during the next week.

AUD/USD is currently struggling around 1.68. The pair needs to return above 1.6830 (June low) to open the way towards 0.6860 (May low) and 0.6910 (July 10 low). Bears will start regaining strength if the Aussie slides below 0.6750.