$1.9 tln stimulus is unlikely to support the USD in long term

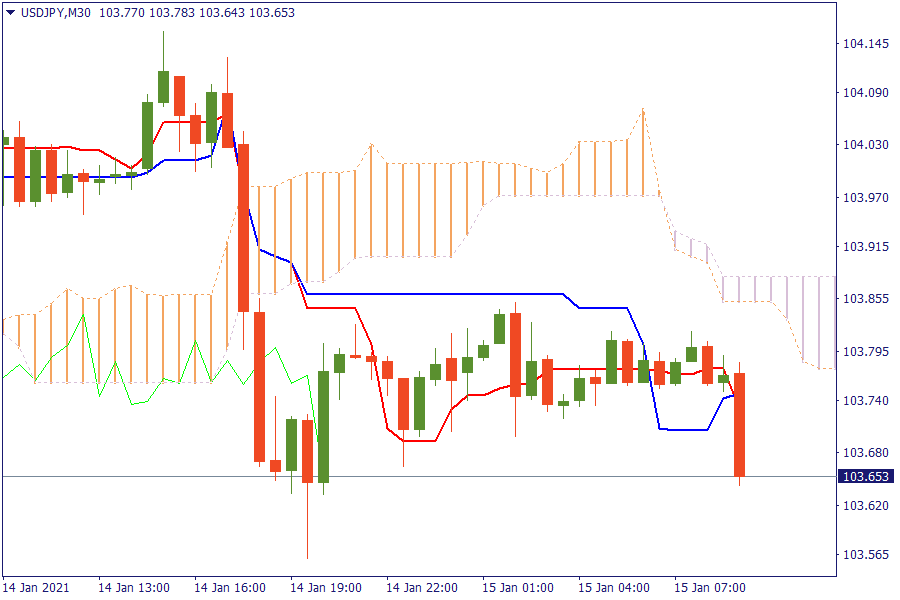

Ichimoku Kinko Hyo

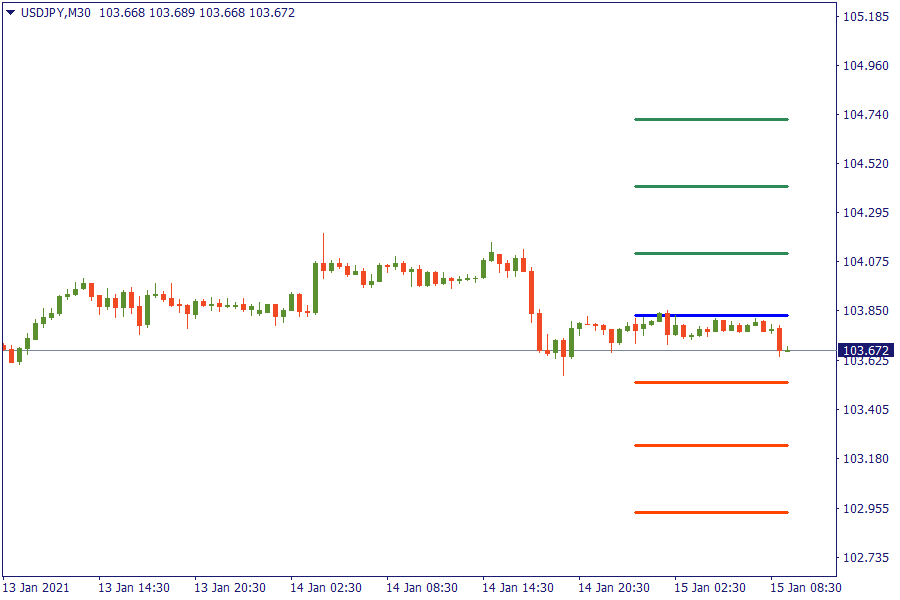

USD/JPY: The pair is trading below the cloud. Further bearish pressure will lead the currency pair to retest the previous lows.

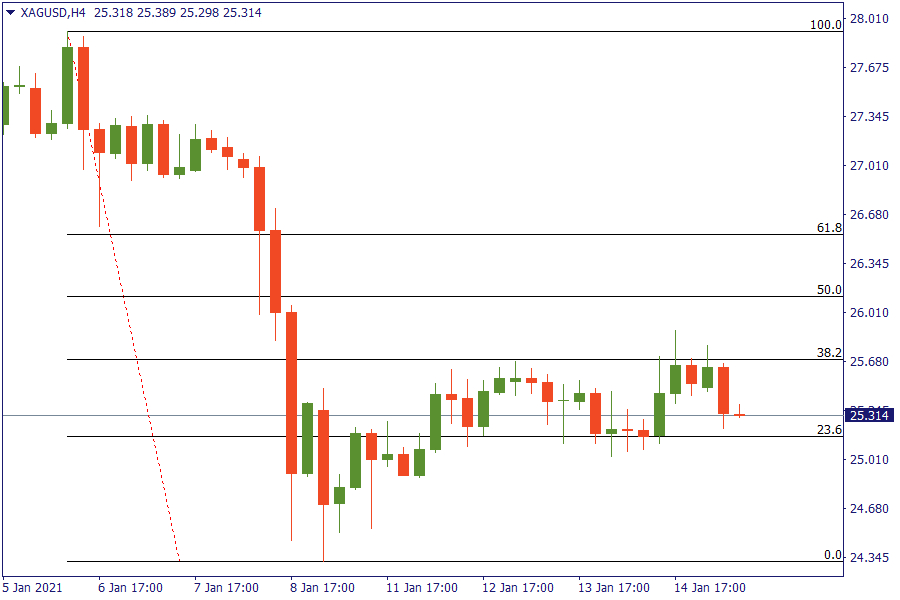

Fibonacci Levels

XAG/USD: Silver is struggling to move higher and remains below the 38.2% retracement area.

European Market View

Asian equity markets were subdued after failing to shrug-off the weak lead from the US where major indices were dragged lower. Asian shares stumbled lower in afternoon trade on Friday, reversing earlier gains as rising COVID-19 cases in China reinforced investor concerns over the prospects for a global economic recovery. Earlier on Friday, an Asian regional share index had edged near record highs after US President-elect Joe Biden proposed a $1.9 trillion stimulus plan to jump-start the world's largest economy and accelerate its response to COVID-19. Looking ahead, highlights from the macroeconomic calendar include UK GDP, US retail sales, NY Fed manufacturing, industrial production, Uni. of Michigan, earnings from JP Morgan, Wells Fargo, and Citigroup.

EU Key Point

- UK November monthly GDP -2.6% vs -4.6% m/m expected

- Germany reports 22,368 new coronavirus cases, 1,113 deaths in the latest update today

- The UK is preparing to vaccinate up to half a million people a day from next week

- Italian PM Conte is reportedly set to face a vote of confidence on Monday